导图社区 财会第七章金融资产

- 299

- 0

- 1

- 举报

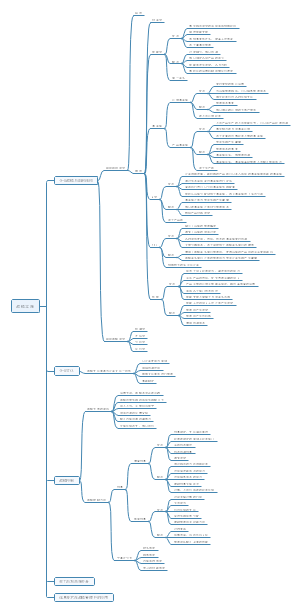

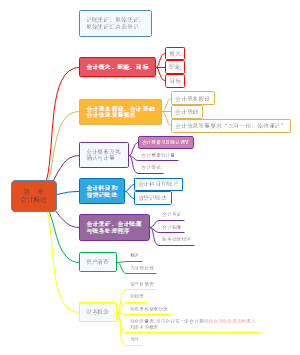

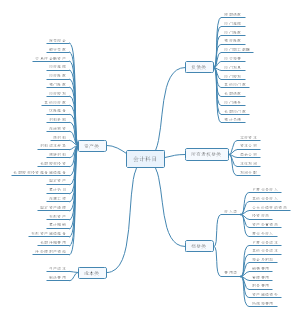

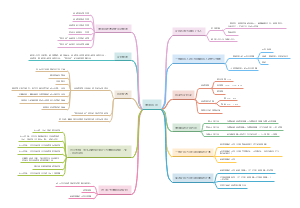

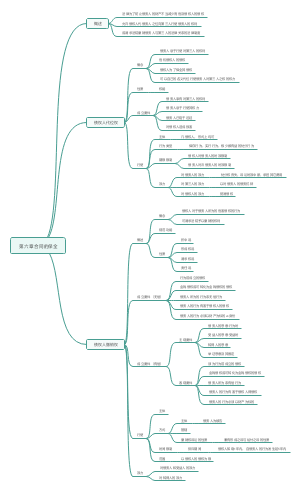

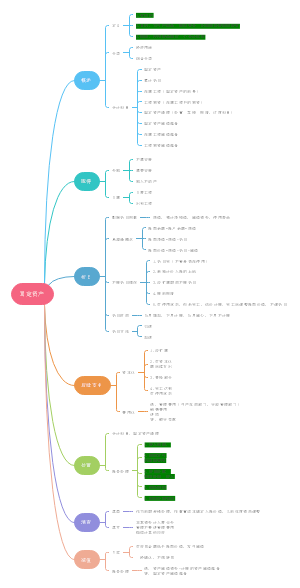

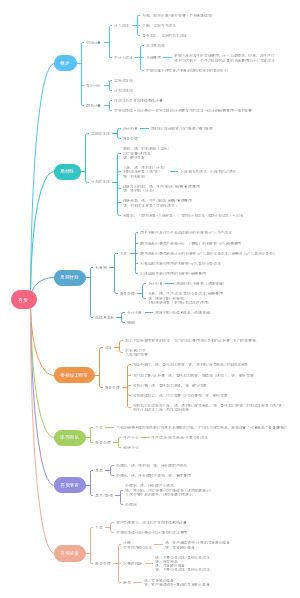

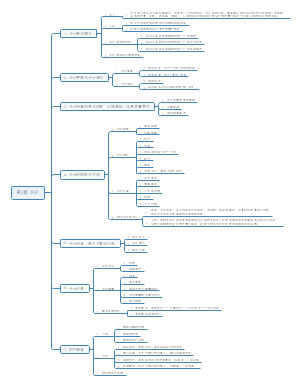

财会第七章金融资产

财会第七章金融资产的思维导图,介绍了金融资产的分类(现金和现金等价物、短期投资、证券营销会计)、估值、财务分析和决策。

编辑于2022-04-22 09:34:22- 金融资产

- 相似推荐

- 大纲

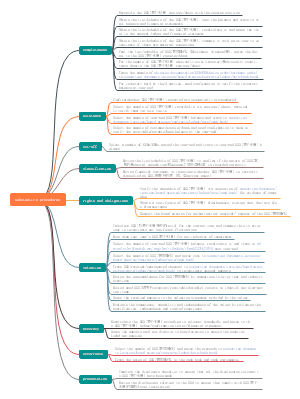

Financial Assets

Type

Cash(and cash equivalents)

Repoting cash in the balance sheet

Cash is listed first 最具流动性

Cash Equivalents

very safe

a very stable market value

mature within 90 days of the date of acquisition

Restricted Cash

Compensating balance 补偿性余额

These balances should be disclosed

Lines of Credit 信用额度

in advance

The unused portion of 信用额度

neither an asset nor a liability it increases the company's liquidity usually disclosed in notes accompanying the financial statements.

Cash management

The basic objectives: provide accurate accounting for cash receipts(现金收入),cash disbursements(现金支出),and cash balance(现金余额/现金结存) Prevent or minimize losses from theft or fraud 预测借款的需要以及assure the availability of adequate amounts of cash for conducting business operations. 防止不必要的大量金额闲置在没有产生收入的银行账户中

the management of all financial resources

Internal control over cash

The major steps: Separate the function of handling cash from the maintenance of accounting records. Prepare cash budgets(or forecasts) Prepare a control listing of cash receipts at the time and place the money is received. Require the all cash receipts be deposited daily in the bank. Make all payments by check.The only expection should be for small payments tto be made in cash from a petty cash fund(小额现金基金). Require that evey expenditure be verified before a check is issued in payment. Promptly reconcile bank statements with the accounting records(及时核对银行对账单和会计记录).

Cash over and Short 现金盈亏

To record a shortage in cash receipts for the day.

The account has a debit balance,it appears in the income statement as a miscellaneous(各种各样的)expense/...a credit balance,...shown as a miscellaneous revenue.

Bank statements

Reconciling the bank ststement

Bank reconciliation 银行往来调节表

The bank and the depositor(存款人)

Normal differences between Bank Records and Accounting Records

Outstanding checks 未兑付支票

由本公司签发并登记的,但尚未提交银行付款的支票

Deposits in transits 在途存款

存款人记录的Cash receipts不在银行近一个月的报表里

存款人记了,银行没记

Service charges 服务费

Charges for deposting NSF checks 存放NSF支票的费用

NSF(存款不足)

The customer who wrote the check did not have sufficient funds in his or her account.In such cases,the bank will reduce the depositor's account bu the amount of this uncollectible item and return the check to the depositor marked "NSF".就好比 the customer views an account receivable.

Credits for interest earned

月末,this interest is credited to the depositor's account and reported in the bank statement.

Miscellaneous bank charges and credits

Bank view each depositor's account as a liability.The bank deducts theses charges from the depositor's account and notifies the depositor by including a debit memorandum in the monthly bank statement. Debit memoranda are issued for transactions that reduce this liability,such as bank service charges. Credit memoranda are issued to recognize an increase in this liability,for example,from interest earned by the depositor.

银行记了,存款人没记

Steps in Preparing a Bank Reconciliation

Add deposits in transit to the balance

Deduct outstanding checks from the balance

在银行报表里

Add credit memoranda issued by the bank

Deduct debit memoranda issued by the bank

在存款人的报表里

Make appropriate adjustments

Determine two adjusted balance

两两调整并比对

Prepare journal entries

Illustration of a Bank Reconciliation

Updating the Accounting Records

making one journal entry to record the unrecorded cash receipts and another to record the unrecorded cash reductions.

Short-Term Investments 短期投资(有价证券)

Almost as liquid as cash itself

Accounting for Marketing Securities

会计事项

The purchase of investments

The receipt of dividends or interest revenue

involving a debit to Cash and a credit to either Interest Revenue or Dividend Revenue

The sale of investments

end-of-period adjustments

Adjusting marketable securities to market value

计价原则:fair value accounting 公允价值计量

可供出售证券在资产负债表中须按资产负债表日的现行市价列报。 将有价证券调整为现行市价时,需要使用unrealized holding gain(or loss) on investment(未实现的投资持有利得(或损失))

Unrealized holding gain(or loss) on investment在balance sheet的Stockholders' equity里面

Accounts Receivable 应收款项

Internal control over receivables

Uncollectible accounts

Reflecting uncollectible accounts in the financial statements

Uncollectible Accounts Expense

在分录里Credit Allowance for Doubtful Accounts

Closed into the Income Summary account as other expense account

Account receivable Less:Allowance for doubtful accounts

Caused by selling goods on credit to customers who fail to pay their bills

Estimated to be uncollectible

The alllowance for doubtful accounts 坏账准备账户

按估计的坏账金额贷记单独的坏账准备账户

Contra-asset account & An estimate

Writing off an uncollectible account receivable

如果确定了an account不能collectible,就不能再视作Assets而是应当be written off. To write off an account receivable is to reduce the balance of the customer's account to zero.. Dr Allowance for Doubtful Accounts Cr Accounts Receivable (Discount Stores)

Debit is made to Allowance for Doubtful Accounts and not to the Uncollectible Accounts Expensw account.

Reduce both the asset account and the contra-asset account by the same amount

Doesn't change the net realizable value of account receivable in the balance sheet

Credit losses are recognized as an expense in the period in which the sales occurs,not the period in which the account is determined to be uncollectible.

Matching principle

Monthly estimates of credit losses

eg: Balance at January 31(credit) Less:Write-off of account considered worthless (Discount Stores) Credit balance at February 28 (prior to adjustment) 下个月加5,000 Dr Uncollectible Accounts Expense 5,000 Cr Allowance for Doubtful Accounts 5,000

Estimating Credit Losses

The balance sheet approach-aging the accounts receivable 应收账款账龄分析法

拖得时间越长,越难收回

The credit manager 估计不同age的accounts receivable的credit losses百分比

more reliable

The income statement approach

The uncollectible accounts expense is estimated at some percentage of net credit sales. The adjusting entry is made in the full amount of the estimated expense.

fast and simple

Recovery of an account receivable previously written off

eg: Wilson account reinstated: Dr Accounts Receviable Cr Allowance for Doubtful Accounts To reinstate as an asset an account receivable previously written off. Wilison account previously reinstated is finally collected: Dr Cash Cr Accounts Receivable To record the collection of account receivable from Wilison.

Direct write-off method

eg: Dr Uncollectible Accounts Expense Cr Accounts Receivable To write off the account receivable from Bell Products as uncollectible.

No valuation allowance will be used

When account receivable is small in relation to other assets,using it doesn't have a material effect on the reported net income.

Allowance method is better

It enables expenses to be matched with the related reenue and thus provides a more logical measurement of net income.

Factoring accounts receivable 应收账款让售

selling its account receivable to a financial institution. These arrangements enable a business to obtain cash immediately instead of having to wait until the receivable can be collected.

Popular among small businessorganizations that don't have well-established credit.Large and liquid organization often can borrow money using unsecured lines of credit(信用额度)

Credit card sales

Bank credit cards

other credit cards

The receivable is from the credit card company: Dr Account Receivable Cr Sales To record sale to customer using XXX credit card. Redeeming the draft(赎回汇票) after deducting a X percent discount: Dr Cash Credit Card Discount Expense Cr Accounts Receivable To record collection of account receivable from XXX, less X% discount.

Notes Receivable and Interest Revenue

Maker of the note 票据的出票人:签署票据并因此承诺付款的人 Payee of the note 票据的收款人:接收款项的人 Maker:The illustrated note is a liability and is recorded by crediting the Notes Payable account. Payee:This same note is an asset and is recorded by debiting the Notes Receivable account.

Nature of interest

Computing the interest: Interest=Principal*Rate of interest*Time

Accounting for Notes Receivable

The interest collected to an Interest Revenue account,and only the face amount of the note is credited to the Notes Receivable account.

Illustrative Entries

If the maker of a Note Defaults

After the default of a note,an entry should be made by the holder to transfer the amount due from the Notes Receivable account to an Account Receivable from the debtor. eg: Dr Accounts Receivable Cr Notes Receivable Interest Receivable Interest Revenue To record default by XXX on X-month,X% note.

Valuation

Cash:Face amount

Short-Term Investments:Fair market value 公允市场价值

Accounts Receivable:Net realizable value 可实现净值

Financial analysis and decision making

Accounts receivable turnover rate

=Annual net sales/Average accounts receivable