导图社区 2 Economics

- 53

- 1

- 0

- 举报

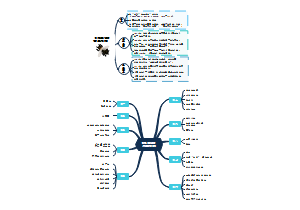

2 Economics

2023年CFA二级大纲经济学科目,共有3个module,重要部分(如公式,结论等)已标记

编辑于2023-04-17 10:25:52 上海- 2024cpa会计科目第17章收入、费用和利润

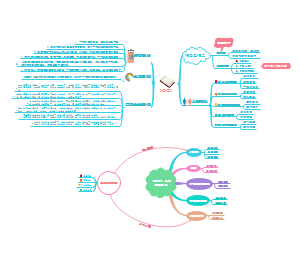

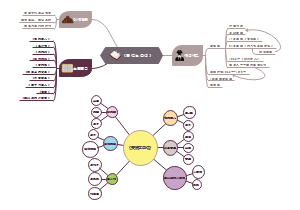

2024cpa会计科目第17章,本章属于非常重要的章节,其内容知识点多、综合性强,可以各种题型进行考核。既可以单独进行考核客观题和主观题,也可以与前期差错更正、资产负债表日后事项等内容相结合在主观题中进行考核。2018年、2020年、2021年、2022年均在主观题中进行考核,近几年平均分值 11分左右。

- 2024cpa会计科目第十二章或有事项

2024cpa会计科目第十二章,本章内容可以各种题型进行考核。客观题主要考核或有资产和或有负债的相关概念、亏损合同的处理原则、预计负债最佳估计数的确定、与产品质量保证相关的预计负债的确认、与重组有关的直接支出的判断等;同时,本章内容(如:未决诉讼)可与资产负债表日后事项、差错更正等内容相结合、产品质量保证与收入相结合在主观题中进行考核。近几年考试平均分值为2分左右。

- 2024cpa会计科目第十一章借款费用

2024cpa会计科目第十一章,本章属于比较重要的章节,考试时多以单选题和多选题等客观题形式进行考核,也可以与应付债券(包括可转换公司债券)、外币业务等相关知识结合在主观题中进行考核。重点掌握借款费用的范围、资本化的条件及借款费用资本化金额的计量,近几年考试分值为3分左右。

2 Economics

社区模板帮助中心,点此进入>>

- 2024cpa会计科目第17章收入、费用和利润

2024cpa会计科目第17章,本章属于非常重要的章节,其内容知识点多、综合性强,可以各种题型进行考核。既可以单独进行考核客观题和主观题,也可以与前期差错更正、资产负债表日后事项等内容相结合在主观题中进行考核。2018年、2020年、2021年、2022年均在主观题中进行考核,近几年平均分值 11分左右。

- 2024cpa会计科目第十二章或有事项

2024cpa会计科目第十二章,本章内容可以各种题型进行考核。客观题主要考核或有资产和或有负债的相关概念、亏损合同的处理原则、预计负债最佳估计数的确定、与产品质量保证相关的预计负债的确认、与重组有关的直接支出的判断等;同时,本章内容(如:未决诉讼)可与资产负债表日后事项、差错更正等内容相结合、产品质量保证与收入相结合在主观题中进行考核。近几年考试平均分值为2分左右。

- 2024cpa会计科目第十一章借款费用

2024cpa会计科目第十一章,本章属于比较重要的章节,考试时多以单选题和多选题等客观题形式进行考核,也可以与应付债券(包括可转换公司债券)、外币业务等相关知识结合在主观题中进行考核。重点掌握借款费用的范围、资本化的条件及借款费用资本化金额的计量,近几年考试分值为3分左右。

- 相似推荐

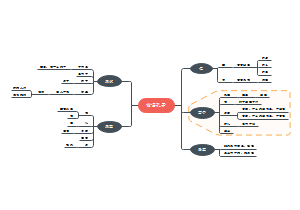

- 大纲

Economics

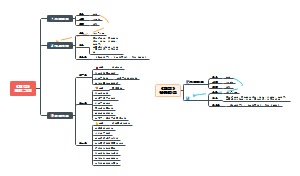

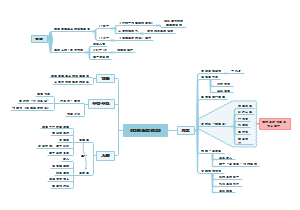

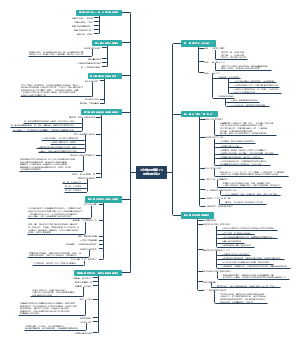

Currency exchange rates: Understanding Equilibrium Value

Bid-Ask Spread

表示方法:A/B, price currency/base currency

实例:CNY/USD=6.9-7.0

bid price: 6.9

ask(offer) price: 7.0

spread = ask price - bid price

The factors that influence the size of the bid–offer spread quoted

In the interbank market: liquidity

The currency pair

The time of day

Market volatility

To dealers' clients in the FX market

The bid–offer spread in the interbank foreign exchange market

The size of the transaction: 委托金额越大,spread越大

The relationship between the dealer and the client: VIP客户较小

Cross Rate and Triangular Arbitrage

Cross rate

A,B两个货币都有跟C的标价,计算A/B

步骤

判断乘除

相乘同边,相除对角,乘小除大

Triangular arbitrage

三种货币相互有市场标价,A换B B换C C换A,判断盈亏

步骤

画三角图,标方向

分析乘除

使用实践法,划出路线,找到套利回报

Forward contract

Spot and forward rate

Spot rate: 两日内进行兑换的汇率

Forward rate: 约定在未来某一天按照某一固定价格兑换的汇率

Forward premium and discount

Forward premium 远期升水,F-S>0,

Forward discount 远期贴水, F-S<0,

Forward rate=spot rate+0.01%*bp; 1bp(basic points) = 0.01%

Mark-to-market value

定义: reflects the profit (or loss) that would be realized from closing out the position at current market prices

公式

FP t = forward price (to sell base currency) at time t

FP 0= forward price specified in the contract (to buy the base currency)

days = number of days remaining to maturity of the forward contract (T − t)

r = interest rate of price currency

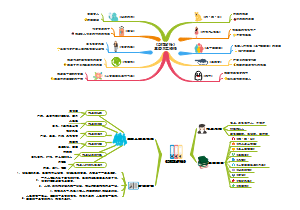

The International Parity Relationships

Interest Rate Parity(IRP)

Covered Interest Rate Parity

Uncovered Interest Rate Parity

Forward Rate Parity

Forward rate = expected future spot rate (F=E(S1))

注: Over the longer term, uncovered IRP and forward rate parity have more empirical support

International Fisher Relation

The Fisher Effect

International Fisher effect

Purchasing Power Parity (PPP)

Absolute PPP (law of one price)

Relative PPP

ex-post PPP

ex-ante PPP

关系

FX Carry Trade

表示方法: X/Y,X currency high-yield,Y currency low-yield

Risks of the carry trade

The carry trade is profitable only if uncovered interest rate parity does not hold over the investment horizon

The return distribution of the carry trade is not normal, and it is characterized by negative skewness and excess kurtosis

Risk management in carry trade

Volatility filter: If FX volatility were to rise above a higher threshold, then a signal would be generated that those positions should be closed

Balance-of-Payments Accounts

BOP

经常项目(账户):对实际资源在国际间流动的行为进行记录

贸易收支(有形贸易收支)

劳务收支(无形贸易收支)

经常性转移收支

资本和金融项目(账户):对资产所有权在国际间流动行为进行记录

资本项目:资本性质的无偿转移,如债务减免、移民转移

金融项目

概念:记录因国际资本流动所形成的所有交易,涉及到对外资产和债务的变动

分类

长期资本(long-term capital):期限在一年以上或未规定期限的资本(如股票所代表的股权资本)

短期资本(short-term capital):期限为一年或一年以下(包括见票即付)的资本

平衡项目(账户)

分配的特别提款权(Allocation of Special Drawing Right)

官方储备(Official Reserves),又称国际储备资产

错误与遗漏(Errors and Omissions),又称“统计误差”(Statistical discrepancy)

Mechanisms influence the path of exchange

In current account

The flow supply/demand channel (J-curve)

The portfolio balance channel

The debt sustainability channel

In capital account

Capital flows into a country→demand for that country's currency increases →appreciation

Excessive capital inflows into emerging markets will lead to currency crisis

长、短期实际汇率关系

Exchange Rate Determination Models

Mundell-Fleming model

Flexible exchange rate+High capital mobility

Flexible exchange rate+Low capital mobility

Fixed exchange rate+High capital mobility

Impossible triangle

Expansionary monetary polic:y ineffective

Expansionary fiscal policy: lead to economic overheating

The monetary approach: only take into account the effect of monetary policy onexchange rates

Pure monetary model

Dornbusch overshooting model

The asset market (portfolio balance) approach

Exchange Rate Management

Capital flow surges can be both a blessing and a curse

The objectives of capital controls or central bank intervention in FX markets

Ensure that the domestic currency does not appreciate excessively

Allow the pursuit of independent monetary policies without being hindered by their impact on currency values

Reduce the aggregate volume of inflow of foreign capital

Effectiveness: central banks in developed market countries are relatively ineffective at intervening in the foreign exchange markets due to lack of sufficient resources

Currency crisis

Economic Growth

Preconditions for Growth

Savings and investment

Financial markets and intermediaries

Political stability, rule of law, and property rights

Education and health care systems

Tax and regulatory systems

Free trade and unrestricted capital flows

Economy Sustainable Growth, Stock Market, fixed income

potential GDP

Stock market

P = GDP*(E/GDP)*(P/E)

P: the aggregate value (price) of equities

E: aggregate earnings

%∆P = %∆ GDP + %∆(E/GDP) + %∆(P/E)

Over short to immediate horizons: all three of these factors contribute to appreciation or depreciation of the stock market

Over the long run

%∆(E/GDP)=0

%∆(P/E)=0

%∆P=%∆GDP

Higher rates of potential GDP growth

Higher real interest rates

Higher expected real asset returns

Fixed income analysis

A higher rate of potential GDP growth improves the general credit quality of fixed income securities

Monetary policy decisions

Credit rating agencies use it to evaluate the credit risk of sovereign debt or government-issued debt

Government budget

Cobb-Douglas production function

形式

Y: the level of aggregate output

L: the quantity of labor/ number of workers/hours worked

K: an estimate of the capital services

α: the shares of output (factor shares) paid by companies to capital (0≤α≤1)

1-α: the shares of output (factor shares) paid by companies to labor

A: a multiplicative scale factor referred to as total factor productivity (TFP)

特点

Constant returns to scale

Diminishing marginal productivity

α close to zero: diminishing marginal returns to capital are very significant

α close to one: the impact of diminishing marginal is relatively small

变形

各部分说明

y = Y/L; the output per worker or (average) labor productivity

k = K/L; the capital- to- labor ratio

影响因素

Output per worker (labor productivity)

A: Technology or TFP

k: Amount of capital available for each worker (capital-to-labor ratio)or capital deepening

Capital deepening: an increase in the capital-to-labor ratio, reflected by a move along the production function. However, once it becomes very high, further additions to capital have relatively little impact on per capita output

Developed countries: gain little from capital deepening and must rely on technological progress for growth in productivity

Developing nations: capital deepening can lead to at least a short-term increase in productivity

Technological progress: causes a proportional upward shift in the entire production function

Other factors affect the economy growth

Natural resources

Resource curse

Dutch disease: currency appreciation driven by strong export demand for resources makes other segments of the economy, in particular manufacturing, globally uncompetitive

Labor Supply

Population growth

Net migration

Average hours worked: The long-term trend in average hours worked has been toward a shorter workweek in the advanced countries

Human capital: increased through investment in education and on- the- job training

Physical capital

ICT investment: physical capital spending on information, computers, and telecommunications equipment ,making a significant contribution to increasing the rate of economic and productivity growth

Non- ICT capital spending: capital deepening; have less impact on potential GDP growth

Public Infrastructure

Technological development

Economic Growth Theories

Classical growth theory

Developed by: Thomas Malthus(1798)

主要观点: Population explosion with limited resources will stop economic growth

结论: In the long run, even with technological progress the standard of living is constant over time, there is no growth in per capita output

The reasons why the model failed

The link between per capita income and population broke down

Technological progress has been rapid enough to more than offset the impact of diminishing marginal returns

Neoclassical growth theory

主要观点

The economy is at equilibrium when the output-to-capital ratio is constant

∆k/k=∆y/y

公式(θ: growth rate in technology)

Sustainable growth of output per capita (or output per worker)(g*)

Sustainable growth rate of output (G*)

Endogenous growth theory

Self-sustaining growth, which is generated by saving and investment decisions, emerges as a natural consequence of the model and the economy does not necessarily converge to a steady state rate of growth

No diminishing marginal returns to capital and permanently increases the rate of economic growth

The developed countries can continue to grow as fast as or faster than the developing countries, so there is no reason to expect convergence of income over time

Convergence debate

Absolute convergence: developing countries, regardless of their particular characteristics, will eventually catch up with the developed countries and match them in per capita output

Conditional convergence:convergence is conditional on the countries having the same saving rate, population growth rate, and production function

Club convergence

Only rich and middle-income countries that are members of the club are converging to the income level of the richest countries in the world

Poor countries can join the club if they make appropriate institutional changes

Economics of Regulation

Economic Rational for Regulation

Economic Rational for Regulation

Informational frictions: adverse selection; moral hazard

Externalities

Weak competition

Regulation of Financial Markets

Disclosures

Prudential supervision

Regulation of Commerce

Consumer protection

Commercial law

Antitrust

Antitrust Regulation

Promote competition

Typically required for mergers and acquisition

Classification of Regulations and Regulators

Classification of Regulations and Regulators

Regulators

Legislative bodies

Government agencies

Statutes: reflecting laws enacted by legislative bodies

Administrative regulations or administrative law: rules issued by government agencies or other regulators

Judicial law: interpretations of courts

Independent regulators: do not rely on government funding and are often given a degree of autonomy in terms of decision making

Courts

Industry self-regulatory bodies

特点

May be subject to pressure from their members

Derive authority from their members

Have the power to exclude or expel parties from being members

Certain entry requirements (such as training or ethical standards) may be imposed

类型

Self-regulating organizations (SROs)

SROs differ from standard industry self-regulatory bodies in that they are given recognition and authority

SROs are funded independently

Non-self regulating organizations

Outside bodies

Regulatory Interdependencies

Regulatory capture theory: regulation can sometimes enhance and work to the benefit of the interests of the regulated

Regulatory competition: Regulators may compete to provide a regulatory environment designed to attract certain entities

Regulatory arbitrage: Entities may identify and use some aspect of regulations that allows them to exploit differences in economic substance and regulatory interpretation or in foreign and domestic regulatory regimes to their benefit

Regulatory Tools

Price mechanisms

Restricting some activities

Mandating some activities

Providing public goods

Financing private projects

Analysis of Regulation

Costs

Implementation costs that were unanticipated (e.g., if it turns out more compliance lawyers need to be hired than originally thought)

Indirect costs because of unintended consequences

Assessment of the likelihood of regulatory change

Assessment of the impact of regulatory change on a sector

Impact on revenues

Cost impact

Business risk