导图社区 3 Financial Statement Analysis

- 87

- 0

- 1

- 举报

3 Financial Statement Analysis

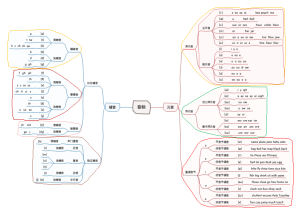

2023年最新考纲CFA二级财报科目,部分内容与一级重合,其中Financial statement modeling从Equity valuation中抽出

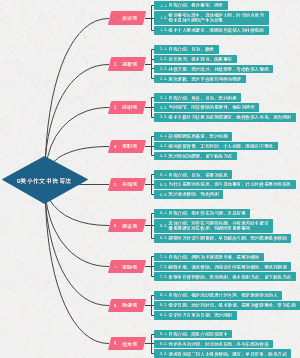

编辑于2023-05-18 11:39:14 上海- 2024cpa会计科目第17章收入、费用和利润

2024cpa会计科目第17章,本章属于非常重要的章节,其内容知识点多、综合性强,可以各种题型进行考核。既可以单独进行考核客观题和主观题,也可以与前期差错更正、资产负债表日后事项等内容相结合在主观题中进行考核。2018年、2020年、2021年、2022年均在主观题中进行考核,近几年平均分值 11分左右。

- 2024cpa会计科目第十二章或有事项

2024cpa会计科目第十二章,本章内容可以各种题型进行考核。客观题主要考核或有资产和或有负债的相关概念、亏损合同的处理原则、预计负债最佳估计数的确定、与产品质量保证相关的预计负债的确认、与重组有关的直接支出的判断等;同时,本章内容(如:未决诉讼)可与资产负债表日后事项、差错更正等内容相结合、产品质量保证与收入相结合在主观题中进行考核。近几年考试平均分值为2分左右。

- 2024cpa会计科目第十一章借款费用

2024cpa会计科目第十一章,本章属于比较重要的章节,考试时多以单选题和多选题等客观题形式进行考核,也可以与应付债券(包括可转换公司债券)、外币业务等相关知识结合在主观题中进行考核。重点掌握借款费用的范围、资本化的条件及借款费用资本化金额的计量,近几年考试分值为3分左右。

3 Financial Statement Analysis

社区模板帮助中心,点此进入>>

- 2024cpa会计科目第17章收入、费用和利润

2024cpa会计科目第17章,本章属于非常重要的章节,其内容知识点多、综合性强,可以各种题型进行考核。既可以单独进行考核客观题和主观题,也可以与前期差错更正、资产负债表日后事项等内容相结合在主观题中进行考核。2018年、2020年、2021年、2022年均在主观题中进行考核,近几年平均分值 11分左右。

- 2024cpa会计科目第十二章或有事项

2024cpa会计科目第十二章,本章内容可以各种题型进行考核。客观题主要考核或有资产和或有负债的相关概念、亏损合同的处理原则、预计负债最佳估计数的确定、与产品质量保证相关的预计负债的确认、与重组有关的直接支出的判断等;同时,本章内容(如:未决诉讼)可与资产负债表日后事项、差错更正等内容相结合、产品质量保证与收入相结合在主观题中进行考核。近几年考试平均分值为2分左右。

- 2024cpa会计科目第十一章借款费用

2024cpa会计科目第十一章,本章属于比较重要的章节,考试时多以单选题和多选题等客观题形式进行考核,也可以与应付债券(包括可转换公司债券)、外币业务等相关知识结合在主观题中进行考核。重点掌握借款费用的范围、资本化的条件及借款费用资本化金额的计量,近几年考试分值为3分左右。

- 相似推荐

- 大纲

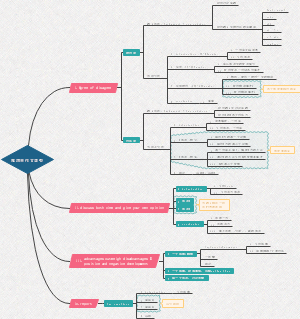

Financial Statement Analysis

Intercorporate Investments

Overview

Financial assets(<20%): IFRS 9

The relationship between coupon rate and YTM

IFRS 9

Classification of Financial Assets

Impairment

The new standard moves the recognition criteria from an "incurred loss" model to an "expected loss" model

Reclassification

Equity instruments: not permitted

Debt instruments: is only permitted if the business model for the financial assets (objective for holding the financial assets) has changed in a way that significantly affects operations

AMC → FVPL: fair value with any gain or loss immediately recognized in profit or loss

FVPL → AMC: fair value at the reclassification date becomes the carrying amount

Associate(20%-50%)

特点

20% to 50% of the voting rights of an associate

Less than 20% but have significant influence

Equity method

The equity investment is initially recorded on the investor's balance sheet at cost

The carrying amount of the investment is adjusted to recognize the investor's proportionate share of the investee's earnings or losses and are reported in income

Dividends or other distributions received from the investee: return of capital

reduce the carrying amount of the investment

not reported in the investor's profit or loss

公式

Income Statement: A gain is recognized = current year’s net profit of the investee *percentage of interest owned

Balance sheet: The carrying amount of investment = cost of investment + (accumulated net profit of the investee –accumulated dividends declared by the investee) * percentage of interest owned

Losses from Associates

If the investment value is reduced to zero ,the investor usually discontinues the equity method and does not record further losses

If the investee subsequently reports profits, the equity method is resumed after the investor’s share of the profit equals the share of losses not recognized during the suspension of the equity method

Purchase price

Excess of Purchase Price Over Book Value Acquired

长期股权投资的初始投资成本大于取得投资时应享有被投资单位可辨认净资产公允价值份额的,两者之间的差额不要求对长期股权投资的初始投资成本进行调整

长期股权投资的初始投资成本小于取得投资时应享有被投资单位可辨认净资产公允价值份额的,两者之间的差额应计入取得投资当期的营业外收入,同时调整增加长期股权投资的账面价值

Amortization of Excess Purchase Price

The investor must directly record these adjustment effects by reducing the carrying amount of the investment on its balance sheet and by reducing the investee's profit recognized on its income statement

Transactions

方式

Upstream sale: the profit on the intercompany transaction is recorded on the associate's income (profit or loss) statement

Downstream sale: the profit is recorded on the investor's income statement

The investor company's share of any unrealized profit must be deferred by reducing the amount recorded under the equity method

Both IFRS and US GAAP require that the unearned profits be eliminated

Impairment

IFRS

The test of the entire carrying amount of investment is by comparing its recoverable amount with its carrying amount

确认

The impairment loss: on the income statement

The carrying amount

Reduce directly

Allowance account

US GAAP

The decline of fair value below its carrying value is permanent

An impairment loss is recognized on the income statement and the carrying value of the investment on the balance sheet is reduced to its fair value

Both IFRS and US GAAP prohibit the reversal of impairment losses

Fair value option

The election to use the fair value option occur at the time of initial recognition and is irrevocable

Subsequent to initial recognition, the investment is reported at fair value with

Unrealized gains and losses arising from changes in fair value

Interest and dividends received included in the investor's profit or loss (income)

是否有选择权

US GAAP: available to all entities

IFRS: restricted to venture capital organizations, mutual funds, unit trusts, and similar entities, including investmentlinked insurance funds

Joint ventures(50%)

Equity method: Both IFRS and US GAAP require this method

Proportionate consolidation: Only under rare circumstances will joint ventures be allowed to use this. The venturer's share of the assets, liabilities, income, and expenses of the joint venture to be combined or shown on a line-by-line basis

Combination(>50%)

Acquisition Method

Business Combinations

Merger (吸收合并) • Company A+ Company B = Company A

Acquisition (控股合并): Company A+ Company B = (Company A + Company B)

Consolidation (新设合并): Company A+ Company B = Company C

合并报表编制的基本流程

Balance sheet

基于公允价值调整子公司个别资产负债表

母公司的账面价值与子公司全部的公允价值逐项相加,合并报表层面确认“少数股东权益”(<100%)

将母公司长期股权投资的账面价值与子公司所有者权益的公允价值抵消,合并报表层面确认“商誉"(若有)

Income statement

自购买日起,将子公司全部的收入、成本费用逐项与母公司相加

对于母公司与子公司、子公司相互之间发生的经济业务,视同一会计主体内部业务处理,全额抵消;调整子公司公允价值与账面价值差额的摊销额

在“企业合并净利润”中,扣除“少数股东损益”,计算得出“归属于母公司净利润”

Goodwill

Partial(IFRS, US GAAP)

goodwill = Purchase Price − X% × FV of subsidiary's NIA

minority interest = (1-X%) × FV of subsidiary's NIA

Full (IFRS)

goodwill = (Purchase Price /X%) − FV of subsidiary's NIA = (Partial)goodwill /X%

minority interest =(1 − X%) × (Assumed 100% Purchase Price ) =(1 − X%) × (Purchase Price /X%)

Goodwill impairment

IFRS

企业合并所形成的商誉,至少应当在每年年终进行减值测试

对于因企业合并形成的商誉的账面价值,应当自购买日起按照合理的方法分摊至相关的资产组;商誉应当结合与其相关的资产组或者资产组组合进行测试

比较这些相关资产组或者资产组组合的账面价值(包括所分摊的商誉的账面价值部分)与其可收回金额,如相关资产组或者资产组组合的可收回金额低于其账面价值的,应当就其差额确认减值损失

减值损失金额应当首先抵减分摊至资产组或者资产组组合中商誉的账面价值;再根据资产组或者资产组组合中除商誉之外的其他各项资产的账面价值所占比重按比例抵减其他各项资产的账面价值

US GAAP (two-step approach)

Compare the carrying amount of the reporting unit (including goodwill) to its fair value. If the carrying value of the reporting unit exceeds its fair value, potential impairment has been identified

Measure the amount of the impairment loss: The amount is the difference between the implied fair value of the reporting unit's goodwill and its carrying amount

SPE and VIE

SPE (Special purpose entities) can be a legitimate financing mechanism for a company to segregate certain activities and thereby reduce risk; consolidated on financial statements

VIE(variable interest entity): An entity that is financially controlled by one or more parties that do not hold a majority voting interest

Effect of methods

Other issues

Contingent Consideration

Contingent consideration may be negotiated as part of the acquisition price. For example, the acquiring company (parent) may agree to pay additional money to the acquiree's (subsidiary's) former shareholders if certain agreed upon events occur

会计处理 (IFRS and US GAAP)

Initially: measured at fair value

In subsequent periods

Changes in the fair value of liabilities: recognized in the consolidated income statement

Do not remeasure equity classified contingent consideration

Contingent Assets and Liability

In-Process R&D

Initial:as a separate intangible asset and measure it at fair value (if it can be measured reliably)

In subsequent periods

Amortization if successfully completed (a marketable product results)

Impairment if no product results or if the product is not technically and/or financially viable

Restructuring Costs: Do not recognize restructuring costs that are associated with the business combination as part of the cost of the acquisition. Instead, they are recognized as an expense in the periods the restructuring costs are incurred

Employee Compensation: Post-Employment and Share-Based

Overview

Measuring DB

PBO: the actuarial present value of all future pension benefits earned to date, based on expected future salary increases

Estimated annual payment after retirement = estimated final salary *benefit formula * estimated years of service

过程

Actuarial Assumptions to Estimate PBO

Future compensation increase and levels: salary growth rate, length of service, employee turnover

Life expectancy for post-employment

Expected vesting: If the employee leaves the company before meeting the vesting criteria, he may be entitled to none or a portion of the benefits earned up until that point

Discount rate is the interest rate used to calculate the present value of future benefits

Pension obligation (PBO)

Current service cost

Definition: the amount by which a company's pension obligation increases as a result of employees' service in the current period

Projected unit credit method: Annual unit credit = value at retirement date / years of service

Presentation of financial statements

Balance sheet presentation

Funded status (required by both IFRS and US GAAP) = Fair value of plan assets – PBO

Offset disclosure (net reporting)

Plan assets (PA)>PBO: overfunded; net assets

PA<PBO(FS<0): underfunded; net liabilities

Asset ceiling: When a company has a surplus in a defined benefit plan, the amount of reported asset cannot be larger than this level

计算

Plan Assets

Fair value at the beginning of the year +Contributions+Actual return-Benefits paid =Fair value at the end of the year

PBO

PBO at the beginning of the year +Service cost+Interest cost+Past service cost (+/- )Actuarial losses/gains Benefits paid =PBO at the end of the year

Income statement presentation

Periodic Pension Cost (PPC)

IFRS

Reported in P&L

Current service cost

Past service cost

Interest expense (PBO*r)

Interest income (PA*r)

Reported in OCI

Actuarial gains and losses

Actual return on plan assets -the amount included in the net interest expense/income calculation

概要

US GAAP

Reported in P&L

Current service cost

Interest expense (PBO*r)

Expected return on plan asset (PA*re)

The amortization of past service costs: over the remaining service life of the affected employees

The amortization of actuarial gains and losses (Corridor approach)

max (the beginning PBO, plan assets)*10%

The excess amount over the "corridor" is amortized as a component of periodic pension cost in P&L

Reported in OCI

Unamortized of the past service costs

Unamortized of the actuarial gains and losses

Changes in assumptions (retirement age, mortality) result in gains or losses in PBO

expected return - the actual return on plan assets

概要

Total Periodic Pension Cost (TPPC)

TPPC = PPC in I/S + PPC in OCI

TPPC = employer contributions − (ending funded status − beginning funded status) (考试常用)

Impact of assumptions

If the discount rate increases

PBO ↓

Current service cost ↓

Interest expenses =PBO*r

Int ↓, if the employee is young

Int ↑, if the plan is mature

Pension costs in I/S ↓

Funded status ↑

Plan asset no effect

TPPC ↓

If compensation growth rate decreases

PBO ↓

Current service cost ↓

Interest expenses ↓

Pension costs in I/S ↓

Plan asset no effect

Funded status ↑

TPPC ↓

If expected return on assets increases

Pension costs in I/S ↓

Others: no effect

Other post employment benefits (OPB)

作用

Used to substitute the compensation growth rate

Inflation will decrease gradually and become constant to ultimate healthcare trend rate

Holding all else equal, each of the following assumptions would result in a lower benefit obligation and a lower periodic cost

A lower assumed near-term increase in health care costs

A lower assumed ultimate health care cost trend rate

An earlier year in which the ultimate health care cost trend rate is assumed to be reached

Disclosures

Periodic Pension Cost

IFRS: the components can be included in various line items

US GAAP

The entire periodic pension cost in P&L (including interest) is shown as an operating expense

Analysts adjust GAAP-reported income

+

the periodic pension cost in P&L

Interest cost → interest expense

Actual return on plan assets → nonoperating income

- only service cost in determining operating income

Cash Flow

Over contribution (repayment): contribution > total periodic pension costs

CFO +(Contribution - TPPC)*(1-t),

CFF - (Contribution - TPPC)*(1-t)

Under contribution (borrowing): contribution < total periodic pension costs

CFO -(Contribution - TPPC)*(1-t),

CFF + (Contribution - TPPC)*(1-t)

Total cash flow: remain constant

Share-based compensation

Equity settled

Stock options

一些概念

Grant date: the date that the compensation approved

Service period: the period between grant date and vesting date

Vesting date: the date that employees can first exercise the stock option

Exercise date: employees receive the stocks

Stock grants

特点: Based on market value of the stock on the grant date

Types

Stock without conditions

Restricted stock

Performance stock

Weakness

The receivers have limited influence over the companys market value(market declines)

Lead managers to be risk averse or excess risk seeking

May dilute the shareholders' interests

Cash settled

Stock appreciation rights

Employees have the right to receive the profit of price increase at a predetermined quantity

Have limited downside risk, a right not obligation, however, require an cash outlay now

Phantom stock

特点

Based on the performance of hypothetical stock

Suitable for illiquid stock or privately held firm

Strengths: No shares are issued, no dilution to existing shareholders

Multinational Operations

Foreign currency transactions

使用情况

Makes an import purchase or export sale.

Borrows or lends funds where the amount to be repaid or received is dominated in a foreign currency

计算

Settlement before balance sheet date

Settlement intervening balance sheet date

Transaction gain or loss →I/S→RE

Gain or loss

Translation of foreign currency FS

Analytical Issues and Disclosure

The two most common treatments

other operating income/expense

non-operating income/expense

Disclosure of the line item

IFRS: amount of exchange rate differences recognized in profit or loss

U.S.GAAP: the aggregate transaction gain or loss included in determining net income for the period

Currency

Presentation currency: (reporting currency) the currency in which financial statement amounts are presented

Functional currency: the currency of the primary economic environment in which an entity operates

Local currency: the currency where the company operates

定义: translate the entity's financial statements to presentation currency (reporting currency)

Translation

选择标准

Different exchange rate

Current rate: the exchange rate on the balance sheet date

The average rate is the average exchange rate over the reporting period

The historical rate is the actual rate that was in effect when the original transaction occurred

方法

Current rate method

图解

I/S

B/S

科目关系

Nl − Dividend = △RE

A (NI× Average Rate) − Div × Historical Rate I = B

Temporal method

图解

B/S

I/S

关系

RE1 − RE0 = △RE A − RE0 = B

△RE + Dividend = Nl B + Div × Historical Rate = C

Inventory and COGS

Exposure (local currency)

Current method

Temporal method

Ratios analysis after translation

Current method

Pure means from the same source of financial report, B/S or I/S

Pure B/S ratios

Pure I/S ratios

Mixed B/S and I/S ratios

假设

Foreign currency appreciates

Only for end of time figures to calculate the ratios

关系

比较(假设H<A<C)

Translation of entity's FS in a hyperinflationary economy

定义: Cumulative three-year inflation rate exceeds 100%, requires an average of approximately 26% per year

会计处理

IFRS

Principles

Restate the foreign currency financial statements for inflation

Translate the financial statements using the current exchange rate

Procedures of IAS 29

B/S

Monetary assets and liabilities: not restated

Non-monetary assets and liabilities* ending price index/beginning price index

Equity (other than retained earnings)* ending price index/beginning price index

I/S

Revenue*ending price index/average price index

Expense*ending price index/average price index

Purchasing power gain/loss

I/S, a plug for NI to be the right number

Based on net monetary assets or liability(e.g., an inflationary environment for net monetary asset, a loss)

Adjust PPGL with current exchange rate

US GAAP: Do not allow restatement for inflation ,but instead require using temporal rate method

Tax Implications of Multinational Operations

Revenue Growth Issue and Foreign Exchange Risks

Disclosures about foreign currency effect on sales growth in the MD&A

Growth in sales that comes from changes in volume or price is more sustainable than from changes in exchange rates

Analysts will consider the foreign currency effect on sales growth both for forecasting future performance and for evaluating a management team's historical performance

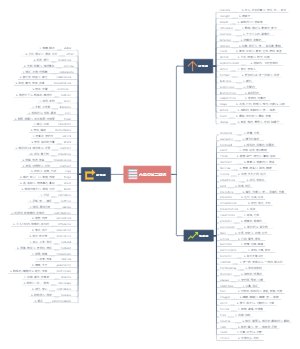

Analysis of Financial Institutions

The difference between financial institutions and non-financial institutions

Difference with other companies

Systematic risk

A risk of disruption to financial services

Financial contagion

Regulated

Mainly financial assets

Global Organizations for regulations

Basel Committee on Banking Supervision

The purposes of the measures contained in Basel III

Improve the banking sector's ability to absorb shocks arising from financial and economic stress, whatever the source

Improve risk management and governance

Strengthen banks' transparency and disclosures

Basel III framework

Minimum required capital

Minimum liquidity: banks must hold enough high-quality liquid assets to cover its liquidity needs in a 30-day liquidity stress scenario

Have a minimum amount of stable funding relative to the bank's liquidity needs over a one-year horizon

International Association Insurance Supervisors(IAIS)

International Organization of Securities Commissions (IOSCO)

Financial Stability Board(FSB)

Individual jurisdictions' Regulatory Authorities

US National Association of Insurance Commissioners (NAIC)

CAMELS model

CAMELS

Capital adequacy

Calculation

Risk-weighted assets: more risky assets require higher level of capital

Risk-weighting is specified by individual regulators

资本类型

Tier 1 capital

Common Equity Tier 1 capital (the most important component): Common stock, additional paid-in capital, retained earnings, OCI, certain adjustments including the deduction of intangibles and deferred tax assets

Other Tier 1 capital: subordinated instruments with no specified maturity and no contractual dividends (e.g., preferred stock with discretionary dividends)

Tier 2 capital: Subordinated instruments with original (i.e., when issued) maturity of more than five years

Requirements of Basel III (a bank must meet all of them)

Common Equity Tier 1 Capital must be at least 4.5% of risk-weighted assets

Total Tier 1 Capital must be at least 6.0% of risk-weighted assets

Total Capital (Tier 1 Capital plus Tier 2 Capital) must be at least 8.0% of risk-weighted assets

Asset quality

Loans (largest portion)

Depend on the creditworthiness of the borrowers and the corresponding adequacy of adjustments for expected loan losses

Investments in securities issued by other entities

At amortized cost (net of allowances)

Management capabilities: successfully identifying and exploiting appropriate profit opportunities while simultaneously managing risk

Earnings sufficiency

Ideally be high quality and trending upward

Accounting estimates are unbiased

The earnings are derived from sustainable

Composition of banks' earnings

Net interest

Service income

Great portion of net interest income and service income is more sustainable

Trading income

Fair value hierarchy

Level 1: inputs are quoted prices for identical financial assets or liabilities inactive markets

Level 2: inputs are observable but are not the quoted prices for identical financial instruments in active markets

Level 3: inputs are unobservable. The fair value of a financial instrument is based on a model (or models) and unobservable inputs

Liquidity position

Liquidity coverage ratio (LCR)

Calculation

Requirements of Basel III

Expected cash flows are the estimated one-month liquidity needs in a stress scenario

The standards recommend a minimum LCR of 100%

Net stable funding ratio (NSFR)

Calculation

Requirements of Basel III: The standards recommend a minimum NSFR of 100%

Others

Concentration of funding: the proportion of funding that is obtained from a single source

Contractual maturity mismatch

Sensitivity to market risk

The sources of market risk: interest rates; exchange rates; equity prices; commodity prices

Mismatches in the maturity of banks' loans and deposits, repricing frequency, reference rates, or currency of banks' loans and deposits create exposure to market movements

Calculation: Value -at -risk (VaR)

Purposes

Evaluate the bank on a CAMELS basis

Equity or debt investment analysis of banks

Analytical Considerations Not Addressed by CAMELS

Government support

Size of the bank

Status of the country’s banking system

Government Ownership

Mission of banking entity

Corporate culture

Competitive environment

Off-balance-sheet items

Segment information

Currency exposure

Risk factors

Basel III disclosures

Insurance company

Property and casualty (P&C)

Distribution

Direct: have their own sales and marketing staff

Agency writers use independent agents, exclusive agents, and insurance brokers

ratios in analyzing companies' profitability

Loss and loss adjustment expense ratio = (Loss expense + Loss adjustment expense)/Net premiums earned

Underwriting expense ratio = Underwriting expense/Net premiums written

Combined ratio = Loss and loss adjustment expense ratio + Underwriting expense ratio

Dividends to policyholders (shareholders) ratio = Dividends to policyholders (shareholders)/Net premiums earned

Combined ratio after dividends = Combined ratio + Dividends to policyholders (shareholders) ratio

Life and health (L&H)

Evaluating Quality of Financial Reports

The quality of financial reports

Reporting quality

Earning quality

Potential problems

Amounts and Timing of Recognition

Classification

Mergers and Acquisitions Issues

Financial Reporting that Diverges from Economic Reality

Evaluating the quality

Beneish Model

公式: M-score = −4.84 + 0.920 (DSR) + 0.528 (GMI) + 0.404 (AQI) + 0.892 (SGI) +0.115 (DEPI) − 0.172 (SGAI) + 4.679 (Accruals) − 0.327 (LEVI)

评价

A higher M-score indicate higher level of earning manipulation

Beneish considered that the likely relevant cutoff for investors is a probability of earnings manipulation of 3.8% (an M-score exceeding −1.78)

各部分计算

LImitations

Relies on accounting data, which may not reflect economic reality

The predictive power is decreasing because it is known by people

Altman Model

公式: Z-score=1.2A+1.4B+3.3C+0.6D+1.0E

各部分计算

A = Net working capital/Total assets

B = Retained earnings/Total assets

C = EBIT/Total assets

D = Market value of equity/Book value of liabilities

E = Sales/Total assets

评价: Higher Z-score, lower probability of bankruptcy

Z<1.81: a high probability of bankruptcy

Z>3.00: a low probability of bankruptcy

1.81<Z<3.00: not clear indicators

LImitations

One-period static model

Depends on accounting data, not market data

Quantitative tools to evaluating earning quality

High-quality earnings:

Sustainable

Adequate

Gauge earnings persistence

Higher accruals mean less reliability

Mean reversion in earnings

Earnings at extreme levels tend to revert back to normal levels over time

Earnings are largely comprised of accruals, mean reversion will occur faster

Evaluating the quality of the financial statements

Cash flow statement

Indicators of Cash Flow Quality (typically on OCF): charactristics of high-quality cash flow)

Positive OCF

OCF derived from sustainable sources

OCF adequate to cover capital expenditures, dividends, and debt repayments

OCF with relatively low volatility (relative to industry participants)

Manipulation cash flow

Large differences between earnings and OCF or increases in such differences can be an indication of earnings manipulation

Timing issues

Selling receivables to a third party

Delaying paying account payables

Classification issues: Shifting positive cash flow items from investing or financing activities to operating activities to inflate OCF

Balance sheet

Completeness

Off-balance-sheet obligations

Take-or-pay contracts

Operating lease

Intercorporate investment methods

Unbiased Measurement

Value of the pension liability (actuarial assumptions)

Value of investment in debt or equity of other companies for which a market value is not readily available

Goodwill value (subjectivity in impairment testing)

Inventory valuation (subjectivity in testing for impairment).

Impairment of PP&E and other assets

Clear Presentation

Sources of information about risk

Financial statements

Auditor's report

Notes to financial statements

Management Discussion and Analysis (MD&A)

SEC Form 'NT' (unable to file required reports timely)

Financial press

Researchers' report

Integration of Financial Statement Analysis Techniques

Framework

DuPont analysis

Three steps

Five steps

NI: not include equity income

Asset turnover: 总资产中无长期股权投资

Leverage: 长期股权投资加回总资产

Capital Allocation Decisions: If ratio of proportional capex to proportional assets is greater(less) than 1, firm is allocating more (less) resources to the segment

Accrual ratio

Balance sheet approach

Operating assets = total assets – cash, cash equivalents and marketable securities

Operating liabilities = total liabilities – total debt

NOA(net operating assets) =Operating assets – operating liabilities

Cash flow statement approach

Accruals of cash flow=NI–CFO-CFI

Cash Flow Analysis

Operating cash flow deducts interest and taxes while operating income does not, so adding-back cash interest and cash taxes to CFO. If the company is reporting under IFRS and choses to classify interest expense as a financing cash flow, the only necessary adjustment is for taxes

Cash basis ratios

Cash flow to operating income = CFO before interest and taxes/EBIT

Cash return on total assets = CFO before interest and taxes/average total assets

Cash flow interest coverage = CFO before interest and taxes/cash interest paid

Cash flow to total debt = CFO before interest and taxes/total debt

Cash flow to reinvestment = CFO before interest and taxes/capital expenditures

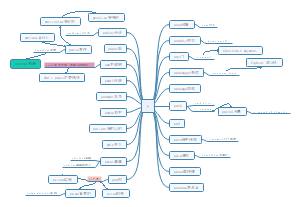

Financial Statement Modeling

Process

Income Statement Modeling

Revenue Forecast Approaches

Top-down approach

Growth relative to GDP growth

First forecasts the growth rate of nominal GDP

Then considers how the growth rate of the specific company being examined will compare with nominal GDP growth

Market growth and market share

First forecasts growth in a particular market

Then considers the company's current market share, and how it is likely to change over time

Bottom-up approach

Time series

Returns-based measure: forecasts based on balance sheet accounts

Capacity-based measure: forecasts based on same-store sales growth (for stores that have been open for at least 12 months) and sales related to new stores

Hybrid approach

利润表科目关系: 见CFA一级 Financial statement analysis

Economies of Scale

Characteristics

Average costs per unit of a good or service produced fall as volume rises

Gross and operating margins tend to be positively correlated with sales levels

出现情况: include high fixed costs, higher levels of production, greater bargaining power with suppliers, and lower per unit advertising expenses

Evidence

Lower proportion of COGs

Lower proportion of SG&A

预测项目

COGs

公式

Forecast COGS = (historical COGS/ revenue) (estimate of future revenue)

Forecast COGS = (1-gross margin) (estimate of future revenue)

Competitors' gross margins

Gross margin differences among companies within a sector should logically relate to differences in their business operations

Differences in competitors' gross margins could simply reflect differences in business models

Analysts' consideration

A small error in this item can have a material impact on the forecasted operating profit

Whether an analysis of these costs can improve forecasting accuracy

The impact of hedging strategy

SG&A expenses

Selling and distribution expenses often have a large variable component and can be estimated as a percentage of sales

Other general and administrative expenses are less variable

Financing expenses

Net debt: gross debt Less cash, cash equivalents, and shortterm deposits

Net interest expense: Interest expense minus interest income

Income tax expense

Types of tax rates

The statutory tax rate

The statutory tax rate: =income tax expense/EBT

The cash tax rate: tax actually paid (cash tax)/EBT

Tax expense = Tax payable + changes in deferred tax liabilities - changes in deferred tax assets

Reasons for differences between the statutory tax rate and the effective tax rate: Tax credits, withholding tax on dividends, adjustments to previous years, and expenses not deductible for tax purposes

Balance Sheet Modeling

Working capital items

Inventories= (inventory days on hand)×(COGS/365)

Accounts receivable=(days sales outstanding)×(revenues/365)

Accounts payable=(days payable outstanding)×(COGS/365)

PP&E

Depreciation and amortization forecasts are usually based on historical depreciation, management's disclosures, and levels of long-term assets

Capital expenditures can be thought of as including both maintenance capital expenditures and growth capital expenditures

Cash Flow Statement Modeling

Net income (I/S)

Share based compensation

Working capital

Depreciation & amortization

CFO

Capital Expenditure (CapEx)

CFI

Share repurchase and issurance

Dividends

Debt issurance and repayment

CFF

Building a Financial Statement Model

Pro forma income statement estimation

Revenue (growth and future revenue)

COGS: % of sales (consider: business strategies or regions)

SG&A: Fixed or % of sales

Financing costs: Debt * interest rates (consider: anticipated changes in capital expenditures or financial structure)

Income tax expense and cash taxes

Effective rates and trends (changes in deferred tax segments)

Segment information (growth in high- and low-tax segments)

Pro forma balance sheet estimation

Working capital (i.e. A/R, A/P, and inventory): Based on estimation of the pro forma income statement

Depreciation and capital expenditures: % of sales (consider: align with company's growing assumption)

Pro forma cash flow statement estimation: Based on pro forma income statement and balance sheet

Behavioral Financial and Analyst Forecasts

Overconfidence in Forecasting

Illusion of Control

Conservatism Bias

Representativeness Bias

Confirmation Bias

The Impact of Competitive Factors in Price and Costs

Porter's Five Forces

The companies have limited pricing power

The companies face downward pressure on profitability

ROIC&ROCE

Return on invested capital (ROIC)

ROIC=EBIT(1-T)/Invested capital

Invested capital=operating assets - operating liabilities

Return on capital employed (ROCE)

ROCE=EBIT/captial employed

ROCE can be useful with different tax structures

Inflation and Deflation

Industry sales

Most increases in the cost of inputs: Commodities or labor

Result in higher prices for end products

Company sales: The impact of higher prices on volume depends on the price elasticity of demand

Industry costs

Company costs: it is often helpful to segment the cost structure by category and geography

Technological Developments

Impacts on demand curve

Scenario and/or sensitivity analysis

Long-Term Forecasting

The investment strategy for which the stock is being considered

Cyclicality of the industry

Company specific factors

The analyst's employer's preferences