导图社区 BankingIndustry

- 34

- 0

- 0

- 举报

BankingIndustry

BankingIndustry:fill:rgba(69,69,69,1.0);font-size:10.0px;font-family:sans_serif;font-weight:normal;

编辑于2022-09-19 13:21:35- 报刊阅读

- BankingIndustry

- 相似推荐

- 大纲

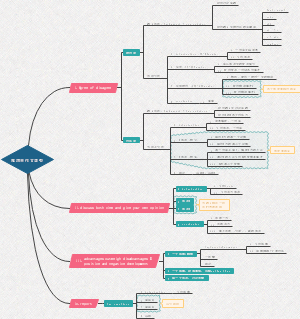

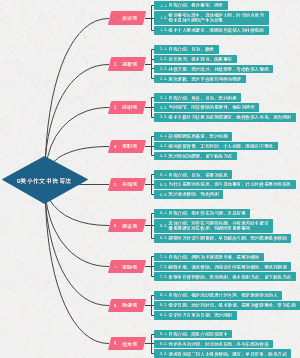

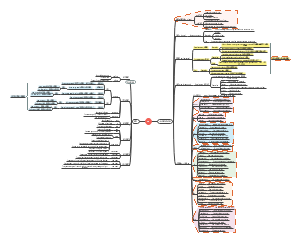

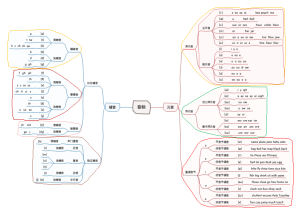

Banking Industry

The kinds of bank

Central Bank:People's Bank of China

Commercial Bank:CB AB ICBC

Policy Bank:China Department Bank

The functions of bank

Financial institution, operate currency, credit bussiness,distribute credit currency,manage flow of currency, adjust supply and demand of currency, deal with deposits and loans as well as balance of currency,as agent of borrower and lender

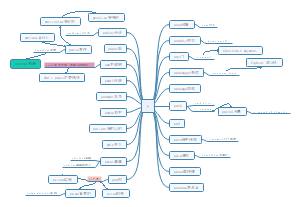

Marketing Strategies

Education

Objects

soon-to-be collage graduates

People with a history of credit problems

Means

community education sessions

publish a “Banking 101”blog

volunteers to speak

Peace of mind

offer special accounts

design a program

use an emotional appeal

Convenience

young people

direct download links from your website

offer a pick-up service

old people

help them conduct quick,friendly transactions

focus marketing materials on you convenient locations and low-effort.banking

Ease of comparison

service: the same products from different banks to decide which is better

Problems

Failed Banks

commercial real estate loans

construction loans

decreasing numbers of customers

undercapitalization

land loans

Sub prime Lending

Object

weak credit

insufficient income

an unable job situation

features

adjustable rate mortgage

increasing payment

forclosures

certain indexes

plus a margin

Foreclosures

owe a deficiency balance

Bad Loans

定义:逾期,经催收无法偿还

原因

破产

死亡

意外

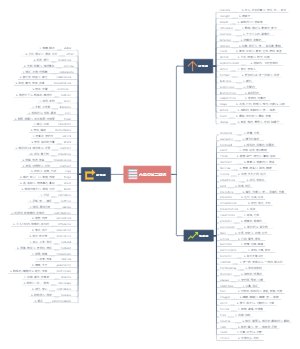

SWOT Analysis

Internal

Strengths

record-high annual returns

diversified investment portfolio offerings

decreases in transaction and trading fees

an increase in the number of ATM machines

increased market share

Weaknesses

high loan rates

low bond credit ratings

an increased number of outstanding junk bonds

an increase in loan-sharking activity

an increased number of high-risk investment options

External

Opportunities

a growing economy

banking deregulation

increased client borrowing

an increase in the number of banks

an increase in the money supply

low government-set credit rates

larger customer checking account balance

Threats

a declining economy

increased banking regulations

larger capital gains taxes

new high-risk investment vehicles

high health care costs

Design the SWOT Analysis Chart

a two-by-two chart

strengths weaknesses

opportunities threats

Banking Industry

The kinds of bank

Central Bank:People's Bank of China

Commercial Bank:CB AB ICBC

Policy Bank:China Department Bank

The functions of bank

Financial institution, operate currency, credit bussiness,distribute credit currency,manage flow of currency, adjust supply and demand of currency, deal with deposits and loans as well as balance of currency,as agent of borrower and lender

Marketing Strategies

Education

Objects

soon-to-be collage graduates

People with a history of credit problems

Means

community education sessions

publish a “Banking 101”blog

volunteers to speak

Peace of mind

offer special accounts

design a program

use an emotional appeal

Convenience

young people

direct download links from your website

offer a pick-up service

old people

help them conduct quick,friendly transactions

focus marketing materials on you convenient locations and low-effort.banking

Ease of comparison

service: the same products from different banks to decide which is better

Problems

Failed Banks

commercial real estate loans

construction loans

decreasing numbers of customers

undercapitalization

land loans

Sub prime Lending

Object

weak credit

insufficient income

an unable job situation

features

adjustable rate mortgage

increasing payment

forclosures

certain indexes

plus a margin

Foreclosures

owe a deficiency balance

Bad Loans

定义:逾期,经催收无法偿还

原因

破产

死亡

意外

SWOT Analysis

Internal

Strengths

record-high annual returns

diversified investment portfolio offerings

decreases in transaction and trading fees

an increase in the number of ATM machines

increased market share

Weaknesses

high loan rates

low bond credit ratings

an increased number of outstanding junk bonds

an increase in loan-sharking activity

an increased number of high-risk investment options

External

Opportunities

a growing economy

banking deregulation

increased client borrowing

an increase in the number of banks

an increase in the money supply

low government-set credit rates

larger customer checking account balance

Threats

a declining economy

increased banking regulations

larger capital gains taxes

new high-risk investment vehicles

high health care costs

Design the SWOT Analysis Chart

a two-by-two chart

strengths weaknesses

opportunities threats