导图社区 SBL

- 70

- 0

- 0

- 举报

SBL

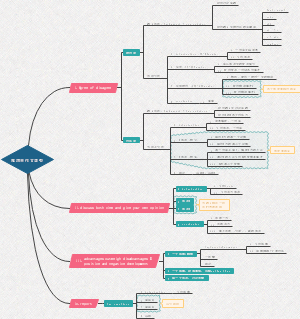

本图整理的内容有: Chapter 01 Strategy, leadership and culture Chapter 02 Stakeholders and social responsibility Chapter 03 Impact of corporate governance on strategy ...

编辑于2023-03-21 23:33:07 北京市- ACCA

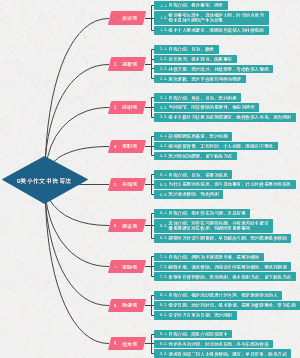

- 底层逻辑【看清这个世界的底牌】 刘润 著 《读书笔记》

底层逻辑,源于不同中的相同,变化背后的不变,让我们在千变万化的复杂世界中如鱼得水 读了这本书,启发颇多,尤其是人生三层智慧,层层递进,对电视剧、电影主人公的发展有了不一样的感知,原来就是那么回事儿;对工作的益处就不用提了。 将此书用思维导图呈现出来,时刻提醒自己,现已完成第一章《是非对错的底层逻辑》,后续持续更新中,有兴趣一起交流的朋友可加 微信号 15620587698

- SBL

本图整理的内容有: Chapter 01 Strategy, leadership and culture Chapter 02 Stakeholders and social responsibility Chapter 03 Impact of corporate governance on strategy ...

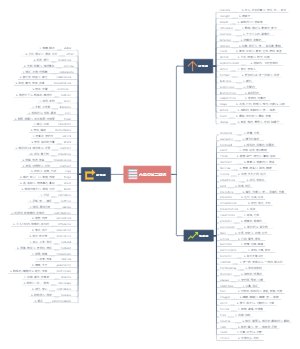

- 2022年-ACCA-SBL知识结构图

2022年ACCA SBL考试知识结构图 【知识结构 案例分析 答题套路 记忆要点】

SBL

社区模板帮助中心,点此进入>>

- 底层逻辑【看清这个世界的底牌】 刘润 著 《读书笔记》

底层逻辑,源于不同中的相同,变化背后的不变,让我们在千变万化的复杂世界中如鱼得水 读了这本书,启发颇多,尤其是人生三层智慧,层层递进,对电视剧、电影主人公的发展有了不一样的感知,原来就是那么回事儿;对工作的益处就不用提了。 将此书用思维导图呈现出来,时刻提醒自己,现已完成第一章《是非对错的底层逻辑》,后续持续更新中,有兴趣一起交流的朋友可加 微信号 15620587698

- SBL

本图整理的内容有: Chapter 01 Strategy, leadership and culture Chapter 02 Stakeholders and social responsibility Chapter 03 Impact of corporate governance on strategy ...

- 2022年-ACCA-SBL知识结构图

2022年ACCA SBL考试知识结构图 【知识结构 案例分析 答题套路 记忆要点】

- 相似推荐

- 大纲

SBL

Chapter 01 Strategy, leadership and culture

1. Leadership

1.1 什么是领导力:Leadership is the process of influencing an organization (or group within an organization) in its efforts towards achieving an aim or goal

1.4 Change and leadership (K)

2.6 Strategic management (M)

3. Culture

3.2 Culture web (M)

必备套路

开场白

[The cultural web states the combination of assumptions that make up the paradigm,]文化网络说明各种假设的组合,构成经营理念营理念营理念营理念

正文

1. symbols【符号、特征】

Symbols 含义:[Organisations are represented by symbols such as logos, offices, dress, language and titles.] 【企业由各种特征组成,像商标、着装、语言】 案例:[One of symbols at Frigate is Ron's nickname 'The Commander’ and motor cruiser is the main symbol of his success.]

2. control system

、奖励系统Control systems +2 含义:[Organisations are controlled through a number of systems including financial systems, quality systems and rewards.] 【企业由一系列系统所控制,包括财务、质量】 案例: [There are few formal process controls at Frigate, and the attempt to install such controls was heavily resisted.]

3. power structure

Power structures +1 含义:[Power structures look at who holds the real power within an organisation.] 【企业中谁真正拥有权利】 案例:At Frigate the power comes from one person, Ron, whose leadership style is based on his strong opinions and beliefs.

4. organisation structure

Organisational structures +1 含义:[The structure of the organisation often reflects the power structure. 【组织架构通常反映为权利架构】 案例:There is little formal structure at Frigate,] and the attempt to install a formal organisational structure failed.

5. routine

Routines and rituals +2 含义:[The daily behaviour and actions of staff signal what the organisation considers to be ‘acceptable’.] 案例:At Frigate, there is one rule for Ron and another for everyone else.[Flexible hours, extended holidays etc for Ron but minimum holiday, no flexibility, wage deductions for arriving late etc for employees.]

6. story

Stories +1 含义:[The stories concern past events and people talked about inside and outside the company.] 案例:Stories at Frigate relate to Ron as 'The Commander’. He is the hero of the organisation who constantly has to deal with lazy employees, poor quality suppliers, customers who delay paying, the tax authority, and society in general.

结尾

paradigm and conclusion

Paradigm and conclusion +1 含义:[The paradigm refers the basic assumptions and beliefs that an organisation‘s decision makers hold.] 案例:The paradigm at Frigate shows a company run for the personal gratification of Ron and his family. Ron believes that his lifestyle and benefits are the reward for taking risks in a hostile environment.

Chapter 02 Stakeholders and social responsibility

1 Principles and agents in governance

1.1 Agency theory (K)

1.2 Stakeholders (K)

1.3 Power and interest (M)

子主题

1/ Families of employees on the train The families clearly had a high level of interest in the activities of TGR. They were connected to the company prior to the accident and the interest is likely to have related to the job security and the working environment of their family members. After the train crash this interest will have inevitably increased, especially if TGR is found to have acted negligently in following the correct health and safety procedures. They are likely to pursue claims for damages and the press attention and the suffering of the bereaved families would increase their power. -> This group would be classified as key players.

1/ Families of employees on the train【解决关注的东西】 As key players, TGR will need to ensure that the treatment this group receives is acceptable to them. Supporting the group with access to a counsellor would be an appropriate initial step. Following the MEA's investigation, if TGR is found to have operated the train negligently, then making any compensation payments as soon as possible to this group would be highly appropriate. Offering an apology to this group and providing details of the steps to prevent similar incidents in the future would also be highly appropriate.

2/ 'Flower Power' wildflower protection group【保持联系,第一手资料】 The Flower Power group have a high level of interest in the accident. The group's interest is focused on the protection and promotion of Meeland's indigenous vegetation. This is evident as the group was quick to highlight concerns that the oil spill had affected an area of land containing a rare type of orchid. On the face of it, the group is unlikely to be in a position to exert much influence over TGR, however, they are positioned to highlight the impact of the accident, which may attract more powerful stakeholder groups, ie the national government. -> They would be classified as keep informed stakeholders.

2/ 'Flower Power' wildflower protection group As a group with high interest but low power, TGR's strategy for dealing with 'Flower Power' should be one of keeping them informed of any developments concerning the disaster. The group will be interested to hear first-hand from TGR's management of any developments concerning any subsequent clean-up operation, and the actions that TGR is taking to try to control the detrimental impact the accident has had on the wildlife around the scene.

3/ Meeland Environment Agency (MEA) The MEA would have a high level of interest and poorer over TGR. It is evident that the MEA has some delegated powers to intervene in cases concerning ecological disasters. The MEA's primary interest is likely to focus on protecting citizens and the natural habitat from environmental damage. Thus, MEA is now highly interested in the company's activities. This is evident by the Head of the MEA choosing to publicly mention TGR by name during the television news broadcast and suggested 'extensive punitive financial penalties for any wrongdoing'. -> The MEA can be regarded as being a key player.

3/ Meeland Environment Agency (MEA) TGR's board should ensure that any action the company takes in respect of the disaster is considered acceptable to the MEA. Appropriate strategies are likely to involve openly and willingly assisting MEA's investigative team in determining the cause of the incident. Paying any financial penalties imposed and assisting with the clean-up operation are likely to be deemed acceptable.

2 Social responsibility

2.1 Carroll's four levels of CSR

2.2 Corporate citizenship (K)

2.3 Ethical stances

2.4 CSR viewpoints (M)企业社会责任七层次理论模型

3 Sustainability

3.1 Environment and social issues

3.2 Integrated reporting <IR> (M) (Linkage+benifit+6C)

1. 含义

1.1. process,To demonstrate the linkage between strategy, governance and financial performance and the social, environmental and economic context within which the business operates

2. benifit

2.1. for compay

2.1.1. Decision-making

2.1.2. Reputation

2.2. for shareholders

2.2.1. Communications

2.2.2. Relationships

2.2.3. Accountability

3. elements(6C)

3.1. Financial capital

3.2. Manufactured capital

3.3. Human capital

3.4. Intellectual capital

3.5. Natural capital

3.6. Social capital

4. IR记忆要点

4.1. 目的和作用

4.1.1. 链接内外部+对所有利益相关者有益+提高信息质量

4.2. IR的好处

4.2.1. 推进与股东的关系+让客户和员工了解我们可以提供什么+加强我们对capital的使用和影响+提高透明度-企业形象

4.3. IR的组成

4.3.1. 财务聚焦资金来源+生产聚焦设备设施+智力聚焦研发与创新+人力聚焦技能与经验+自然聚焦长期稳定资源+社会聚焦内外部关系

4.4. 常用语:

4.4.1. it compaised……

4.4.2. it consist of ……

4.4.3. focus on……

3.3 Social and environment audit

Chapter 03 Impact of corporate governance on strategy

1 What is corporate governance?

1.1 Definition of corporate governance

The system by which organisations are directed and controlled

1.2 Regulatory guidance(监管原则)

2 How is corporate governance achieved across the world?

2.1 Principles vs rules(K)

2.2 Different jurisdictions(不同司法体系下,公司治理的守则)

2.2.1 Corporate governance in the UK

2.3 Board responsibilities(董事会的责任)(K)

Effectiveness

.Monitoring the chief executive officer .Overseeing strategy .Monitoring risks, control systems and governance .Monitoring the human capital aspects of the company .Managing potential conflicts of interest .Effective communication of its strategic plans

Board leadership(K)

chairman

Provide leadership to the board, ensuring its effectiveness and setting its agenda

Ensuring the board receives accurate and timely information

Ensuring effective communication with shareholders

Facilitate effective contribution from NEDs

Take the lead in the induction for new directors and in board development

Meet with the NEDs without the executives present

Facilitating board appraisal

Encouraging active engagement by all members

chief executive officer

Provide leadership to the business, ensuring the effectiveness of operations and setting strategy

Providing accurate and timely information

Communicating effectively with significant stakeholders

Facilitate the effective implementation of board decisions

Co-operate in induction and development

Co-operate by providing any necessary resources

Co-operate in board appraisal

Co-operate with all the members of the board

3 What impact does ownership have on CG?(所有权对公司治理的影响)

3.1 The role of the investor

3.2 Disclosures and reporting

3.3 Public sector and third sector governance (K)-记忆

Chapter 04 The external environment

1 The external environment

2 The macro environment (M)【宏观环境】-PESTEL模型

3 National environment【所在国和投资国环境】-钻石模型

3.2 Components of the Diamond (M)

3.2.1 Factor conditions(当地条件)

natural resources, climate, semi-skilled or unskilled labour

-infrastructure(基础设施) and communications, higher education, and skilled employees -Government policy and support

3.2.2 Demand conditions (本国需求条件)

·A tough domestic market is likely to encourage competitiveness ·As firms have to produce cost-efficient(性价比高), high-quality goods to satisfy the requirements of domestic customers ·The experience a firm gains from meeting domestic customers' needs will then allow it to compete successfully on an international scale

3.2.3 Related and supporting industries (当地配套产业)

·Industries need to be supported by a good local supply chain, which contributes to quality and cost advantages ·Clustering (聚类, 产业集群)

3.2.4 Firm strategy, structure and rivalry (公司战略, 结构和同业竞争)

·Cultural factors, social attitudes and management styles can all lead to competitive advantage in certain industries ·Intense domestic rivalry among firms means they need to perform well to survive and to look for export markets

4 Industry or sector environment(行业环境)-波特五力模型

4.1 Porter's five forces(M)

4.1.1 New entrants

Will intensify(加剧) competition in the industry

Barriers to entry

·Prevent new firms from joining on industry

·Help to sustain profits

·Such as capital requirements, economies of scale among existing firms, or patents

4.1.2 Power of suppliers

·If suppliers have strong bargaining power, the price of inputs will be driven up, thereby reducing profits

4.1.3 Power of buyers

·If buyers have strong bargaining power they can drive down prices, thereby reducing profits

·Factors such as relative size, and ability to switch to an alternative product or service affects bargaining power

4.1.4 The threat of substitute 【不在同一行业】

·A substitute is a different product or service which satisfies the same customer needs

·The availability of substitutes restricts profits

·Customers can switch to a substitute if the price of a product or service increases or quality/utility decreases

4.1.5 Competition and rivalry

·Intense competition in an industry will reduce profits

·This may result from slow growing or declining markets, excess capacity, or barriers to exit

答题套路

五力模型

1.Threat of new entrants

1.定义:A new entrant into an industry will bring extra capacity and more competition.The strength of this threat depends on two things: barriers to entry and the potential reaction of current suppliers. 2.案例体现:Barriers to entry appear to be:【规模经济+资本投入+分销渠道】 (1)Economies of scale: The five large dominant companies in the industry should be enjoying economies of scale which force any potential new entrant with large-scale production, which carries with it a high risk of failure. This is not an issue for Ling which also currently enjoys economies of scale in its manufacture. (2)Capital requirements: The manufacture of light bulbs requires new entrants to invest large financial resources into production plants. Although capital may be available, the risk associated with large-scale entry may lead to high premiums on borrowed capital. (3)Access to distribution channels: This may be very significant, as the distribution channels are very specific (supermarket groups, home improvement superstores and major electrical chains). The new entrant will have to persuade these channels to accept its products, perhaps through offering price discounts. Selling directly to the consumer seems unlikely in this industry where individual purchases are both infrequent and low value. 3威胁的结论: The reaction to new entrants of existing firms in the industry is likely to be relatively forceful as they have a history of vigorous retaliation to prospective entrants. The upsurge of nationalism in the country will also give them a powerful card to play in this retaliation.

2.Threat of substitute products

1.含义:Substitute products are products which can perform the same function as the product of the industry under consideration. 2.案例体现:It is hard to envisage any potential substitute except for candles which, in the long term, are likely to be much more expensive. Another possible way is to do without lighting. This is the approach taken by government on street lighting. It is turned off from 23:00 to 05:00. However, it seems unlikely that consumers will chose to sit in the dark. 3威胁的结论: In the short term, the threat of substitute products seems very low. However, in the long term, newer technologies may emerge.

3.Bargaining power of suppliers

1含义: If suppliers have strong bargaining power, the price of inputs will be driven up, thereby reducing profits 2案例体现:(我们对供应商的依赖程度【我们是否强大】+供应商对我们的依赖程度【供应商是否强大】+供应商产业链战略) (1)This appears to be the case in Zedland, where 90% of glass production is accounted for by 3 companies and metal production is largely concentrated in the hands of 1 very large company, OmniMetal. The customers (such as Flick) are large but they are more fragmented. Furthermore, light bulbs are largely made of glass and metal and it seems unlikely that this will change in the near future. This lack of substitutes increases the power of the supplier. (2)The light bulb industry is not an important customer for the supplier . Most glass is sold to the construction industry. Most metal is sold to the automobile industry. The light bulb manufacturers use less than 0.5% of the country’s glass production and less than 0.1% of its metal production. The relative unimportance of light bulb manufactures as customers increases the supplier group’s power. (3)Another factor increasing suppliers’ power is that the products (glass and metal) are a vital part of the customers’ light bulb business. (4)On the other hand, the supplier group’s products are largely undifferentiated and switching costs between suppliers appears to be reasonably low. 3威胁的结论:Finally, it seems unlikely that the supplier group poses a credible threat of forward integration into light bulb manufacture and this will be a factor which reduces supplier bargaining power.

4/ Bargaining power of customers

1含义【主要客户是谁】:·If buyers have strong bargaining power they can drive down prices, thereby reducing profits

The main customers of the industry’s products are large supermarket groups, home improvement superstores and large electrical chains. These customers, particularly the supermarket groups, purchase a large volume of the industry’s products (90%) and so, on the face of it, they can demand favourable prices. 2案例体现: (1) However, the products the buyer purchases from the industry represents a relatively insignificant fraction of the buyer’s costs or purchases. A recent report suggested that light bulb sales contributed less than 0.1% of a supermarket’s revenue. Light bulbs are much less important to supermarket groups which tend to be less price sensitive. (2)Customers’ bargaining power in the light bulb industry is strengthened by the product being undifferentiated, with low customer switching costs. However, the customers are extremely unlikely to move backwards in the supply chain to manufacture their own light bulbs and so this potentially limits their bargaining power. 3威胁的结论:To the end consumer, light bulbs are undifferentiated and there are no switching costs. Light bulbs are an insignificant fraction of their total spend and so they are unlikely to shop around to get the lowest price.

5/ Competitive rivalry in the industry

1.含义:Intense competition in an industry will reduce profits。 Equally balanced competitors: When an industry is dominated by a small number of firms which are relatively well balanced in terms of size, it creates potential instability because they may be prone to fight each other. 2.体现案例: (1)This appears to be the case in Zedland where five fairly similar sized firms produce 72% (20X5) of the light bulbs sold in the country and wage short-term price-cutting wars, disrupt competitors’ supply lines and react aggressively to potential new entrants. (2)Slow industry growth: Between 20X0 and 20X5 the market grew by just over 2% (from total revenues of $490m to $500m). In mature markets with little scope for overall growth, the only way a firm can increase market share is to take it from its competitors. Consequently, slow industry growth increases competitive rivalry. (3)Lack of differentiation or switching costs: Competitive rivalry is increased where the product is perceived as a commodity, as is the case for light bulbs. In such circumstances the buyer’s decision is largely based on price, and pressures for intense price competition result. (4)High exit barriers: Exit costs are high because of the investment required in plant and the fact that light bulb factories have no obvious alternative use. When exit costs are high, companies will remain in the industry and may resort to extreme tactics which weaken the profitability of the industry as a whole.

4.2 Industry life cycle

5 Customers and markets【客户和市场环境】

6 Scenario planning (情景规划)

Chapter 05 Strategic capability

1 Strategic capability【战略能力】

2 Sustainable competitive advantage

3 Organisational knowledge

4 Porter’s value chain model (M) (描述企业创造产品和服务的过程,提供框架,识别客户眼中增值活动,分为基本活动和支持活动)

Primary activities(5)

inbound logisics

Receiving, handling and storing inputs

operation

Convert inputs into products

outbound logisics

Deliver outputs to customers

marketing and sales

Informing customers of the products, persuade them to buy

servicing

installing, repairing, upgrading, providing spare parts

Support activities(4)

procurement

Acquire inputs to the primary activities

Technology development

Product design, improving processes and resource utilisation

HR management

Recruiting, training, developing and rewarding people

Firm infrastructure

General management, planning, finance, control, public affairs

5 Value network

6 SWOT analysis

结束语

In summary, the company is operating in a very competitive industry where OEMs also compete aggressively on non-price criteria. However, economic and environmental issues provide ReInk with opportunities for growth if they can properly manage their strengths and address the financial and management weaknesses of the company. 总之,企业经营处于非常激烈的竞争环境中,但是如果企业能够恰当处理威胁和劣势,在经济和环境问题上能够有增长机会

Chapter 06 Competitive advantage and strategic choice

1 Porter’s generic strategies(M)

1.1 Cost leadership【成本领先=规模经济+提升效率+使用最新技术】

1.2 Differentiation【差异化】

1.3 Focus on (niche) strategy (K)

2 Sustainable competitive advantage

2.1 Marketing mix (7Ps)

2.2 Sustainable strategies

3 Managing organisational portfolios

3.1 The BCG (Boston Consulting Group) matrix

3.2 Public sector portfolio matrix【政府投资组合矩阵】

4 Product-market strategy: direction of growth

4.1 Growth vector matrix (Ansoff matrix) (M)

5 Diversity of products and markets

5.1 The need for diversification【环境变化+分散风险+股东要求回报】

5.2 Types of diversification【多元化类型=相关多元化+复合多元化】

5.3 International diversification【国际多元化】

6 Methods of development【多元化开发方式】

6.1 Internal development【内部发展】

6.2 Business combinations【企业合并】(K)

6.3 Partnering【强强联合】

7 Suitability, acceptability and feasibility【适合+利益相关者接受+能力】 (M)

7.1 Suitability (M)【SWOT】 (非财务因素)

The group needs to consider whether the acquisition makes sense given its current strategic position.

a/ Synergies The proposed acquisition may potentially offer the group the scope to realise synergies in its operations. This is backed up by the comments made by Sir John Watt, who considers road, rail and air to be complementary to one another. Whether such synergies can be achieved seems dubious though, given that the anticipated synergies between road haulage and rail have not been fully realised. b/ Wide spread of locations The wide dispersion of airport locations makes it unlikely that air freighting goods would be close enough to the end destination, eg out-of-town supermarket stores. The suitability would partially rest on the ability of the mini-container system to be integrated. c/ Environmentally friendly The supermarkets' support for more environmentally friendly modes of transport make it unlikely that they would be interested in using an airfreight service. d/ Experience and expertise The current proposal is to purchase an airport and not an airline. This raises considerations about the suitability of the proposal, namely that the group does not have any experience in operating an airport. e/ Demand for 'low cost’ Sir John Watt's proposal highlights an intention to attract a 'low-cost airline'; at the current time it is unknown whether such an airline would be interested. The report by the aviation consultant raises doubts over the proposal as Marston airport is surrounded by a relatively small local population.

7.2 Acceptability (M) (财务因素)

The acceptability of the strategy is concerned with expected outcomes in terms of return, risk and shareholder reaction.

a/ Financial performance In 20X5 the airport site was valued at $6m. This valuation suggests that the $7m to be paid by the group represents a reasonable price. Marston airport occupies a site of 450 hectares; based on the market rate ($20,000/hectares) the land alone is worth $9m. As the airport is located near the motorway, purchasing the site is highly acceptable in consideration of the increasing lack of land available for warehousing. b/ Profitability Marston airport is a profitable entity; it generated a profit after tax of $40,000 in 20X5. The airport achieved a gross profit margin of 28.21% and on operating profit margin of 15.38% in the year (compared to the industry average of 17.5%). Interestingly, Marston airport achieved a higher operating profit margin than all of the group companies in 20X5. By contrast Marston airport's ROCE of 2.19% is far lower than the industry average of 8.5%. This indicates that the airport has required a significant level of investment to generate very low returns. c/ Liquidity and gearing Marston airport has a positive liquidity position with a current ratio of 2.50 compared to the industry average of 2.25. However, it appears to have a very high inventory balance. When this is stripped out from current assets, Marston airport's acid test ratio of 1.125 is lower than the national average of 1.50. The airport is more highly geared (59.12%) than the industry average (40%), and this reflects the airport's level of long-term borrowings, of just over $4m. d/ Receivables and payables The standard payment terms in Meetand require payment within 30 days of the invoice date. In 20X5, Marston airport was receiving payment from trade receivables in 30 days; however, it was only paying its own suppliers after 60 days on average. This is likely to raise some concern over the airport's cash flow. Marston airport's performance is mixed. Although it is profitable, the company is hindered by a significant long-term debt which has resulted in a relatively low ROCE. e/ Financial risk From the group‘s perspective the initial purchase cost is likely to be a small investment. Despite this, consideration needs to be given to the potential impact on other group entities. TGR and TGW are likely to require significant levels of investment to improve their performance. Acquiring Marston airport will lead to a reduction in funds available. f/ Shareholders The Green family have a strong interest in road haulage particularly given the close connection with TGRT. The majority of shareholders may regard the acquisition as straying too far from the group's original direction.

7.3 Feasibility (M)

Feasibility is concerned with whether an organisation has the resources and competencies to deliver a strategy.

The group clearly has built up a high level of expertise in the provision of road haulage services through the operation of TGRT and has extended its operations into warehousing. However, it has been unable to deploy these competencies as effectively at TGR. There is a danger that the acquisition of Marston airport could lead to a similar situation - as the competencies required to run an airport do not exist within the group.

结论

As the analysis indicates, the purchase of Marston airport represents a poor investment for the group at the current time. Even though the group could fund the acquisition, it does not possess the necessary competencies. Shareholders and the other SBUs might increases the undesirability of the proposal. Despite these reservations the acquisition would provide the group with much land at a price below the market rate, which could potentially be developed into sites for warehousing. Regardless of this, the viability of obtaining the required planning permissions and the associated costs for such a development would need to be fully considered before this scheme could progress.

Chapter 07 Assessing and managing risk

1 Organisational strategy and risk management

1.1 Understanding stakeholder responses to risk

1.2 Embedding risk in an organisation’s culture and values (K)

2 Risk management process

2.1 Set responsibilities

2.2 Risk appetite (K)【态度和能力】

risk-seking business

risk-averse business

2.3 Identify risks

strategic-risk

failure to fulfil client demond+impact company survive

operational-risk

failure to internal business and control+impact day to day operation

key person

competition

data

reputation

2.4 Assess risks【风险评估=技术+地图+主观判断】

2.5 Respond to risks【TARA+ALARP+Diversification】

TARA

2.6 Monitoring

Chapter 08 Internal control systems Governance, control and risk · Risk management · Internal control · Corporate governance

1 Internal control【定义+目标+要素+分类+程序+报告】

1.1 Definitions of internal control

1.2 Objectives of internal control: RORCS (K)【风险控制+运营有效+财报可靠+合规+资产安全】

1.3 Elements of internal control

1.4 Categories of control

1.5 Control procedures 【控制程序】

1.6 Control over financial reporting

2 Monitoring

2.1 Information

2.2 Reviewing internal controls

2.3 Audit committees

2.4 Internal audit【内审的作用+内审的质量(4)+持续评价内审成立的必要性】

Chapter 09 Applying ethical principles

1 Doing the wrong thing

1.1 Fraud【方式+{舞弊三角:压力(动机)+机会+合理化}】

1.2 Responding to fraud risks【prevention+detection】

1.3 Bribery and corruption

1.4 Measures to combat bribery and corruption

2 Doing the right thing【企业的道德(5个问题)+道德守则+对专业人士的要求+会计的职业道德(5个原则)+对会计师的威胁和防范】

2.1 Tucker’s 5 questions (M)道德决策模型

2.2 Corporate codes of ethics

2.3 Professions and the public interest

2.4 The code of ethics for accountants

2.5 Threats and safeguards for accountants

Chapter 10 Financial analysis

1 Financial objectives and business strategy【财务目标和企业战略的关系】

2 The finance function

3 Financial analysis and decision-making techniques

3.1 Financing requirements

3.2 Sources of finance

3.3 Investment appraisal

3.4 Dealing with risk and uncertainty 【如何解决在投资评价过程中的风险和不确定性】

3.5 Financial reporting and tax implications

3.6 Organisation performance and position

4 Cost and management accounting

5 Standard costing and variance analysis

6 Evaluating strategic options using marginal costing techniques

Chapter 11 Applications of IT

1 Applications of IT (K)

2 Mobile technologies and cloud computing

2.1 Mobile technology

2.2 Benefits and risks of mobile technology(K)

2.3 Cloud computing

2.4 Benefits and risks of cloud computing (K)

2.5 Cloud computing v owned technology

3 Information technology and data analysis

4 Big data

5 Data for decision making

5.1 New product development decisions

5.2 Marketing decision

5.3 Pricing decision

5.4 Sources of data-Market research

6 Information system controls from a strategic perspective

6.1 Need for IS controls from a strategic perspective (K)【IS是资源+成功关键+影响多级管理+影响客户服务+高成本+结果性改变 】

7 IT and systems security controls

8 Cybersecurity【网络安全】

8.1 Promoting cyber security in organisations (K)【企业内控、风险管理、网络安全=套路】

9 Improving IT/IS controls

Chapter 12 E-business

1 Delivering e-business

2 Strategy models for e-business

3 Applications of technology to support e-business

4 Characteristics of e-marketing: the 6 Is model (M)网络营销的6个模式

5 Comparison of traditional and online branding【线上和传统品牌管理】

6 Acquiring and managing suppliers and customers using technology【用信息技术管理客户和供应商】

7 New developments and innovation【新的开发和创新】

Chapter 13 Enabling success and managing changes 【实现成功和企业变革】

确保成功

1 Organisational structure and internal relationship

1.1 Organisational structure

1.2 Internal relationship【与决策相关的职责和权限=集权程度】

2 Collaborative working

2.1 Boundary-less organisations

2.2 Outsourcing

3 Performance excellence 【高绩效的7个标准】

3.1 The Baldrige Excellence Framework(M) 【实现7个高绩效标准的6个关键因素】

3.1.1 Elements of the Baldrige assessment (M)

4 Empowering organisations

4.1 Empowerment

5 Talent management【人力管理】

5.1 The benefits of talent management (K

5.2 Talent management activities (K)

变革模型

6 Strategic change

6.1 Type of change(M)

7 Contextual features of change【变革考虑因素】 (时间范围两能力,权利意愿要保留)

time

是否充裕

scope

流程?企业?

preservation

哪些保留下来

diversity

员工经验能够承受

capability

管理者的能力

capacity

企业的能力:资源和人力

readiness

主观上是否准备好

power

足够多的power推动变革

8 The four-view (POPIT) model

8.1 Usefulness of POPIT

9 Lewin's three-stage model

9.1 Unfreeze

9.2 Change (or 'move’)

9.3 Refreeze

Chapter 14 Process redesign

1.1 Drivers of process redesign

2 Harmon's process-strategy matrix (M) (哈蒙的过程-战略矩阵)

3 Process redesign options

3.1 Re-engineering (business process re-engineering

3.2 Simplification

3.3 Value-added analysis

3.4 Gaps and disconnects

4 Feasibility

4.1 Areas of feasibility (K)

5 Harmon‘s process redesign methodology

5.1 Planning

5.2 Analysing the existing process

5.3 Designing the new process

5.4 Development

5.5 Transition

Chapter 15 Project management

1 Project management

1.1 What is a project

1.2 What is project management

1.3 Project and strategy

2 Project initiation

2.1 Pre-initiating tasks

2.2 The project manager (K)

2.3 Project sponsor

2.4 Initiating tasks

3 Project costs and benefits

3.1 Identifying the benefits

3.2 Measuring benefits (K)

3.3 Identifying the costs (K)

4 Project planning

4.1 Work breakdown structure (WBS) 任务分解结构

4.2 The project budget

4.3 Gantt charts 甘特图

4.4 Network analysis 关键路径分析

5 Project execution and control

5.1 Controlling projects

5.2 Project slippage

5.3 Project change procedure

5.4 Responding to project risk

6 Project completion

6.1 The completion report

6.3 The post-implementation review

culture-web案例

案例一

案例二

必备套路

开场白

[The cultural web states the combination of assumptions that make up the paradigm,]文化网络说明各种假设的组合,构成经营理念

正文

1. symbols【符号、特征】

Symbols 含义:[Organisations are represented by symbols such as logos, offices, dress, language and titles.] 【企业由各种特征组成,像商标、着装、语言】 案例:[One of symbols at Frigate is Ron's nickname 'The Commander’ and motor cruiser is the main symbol of his success.]

2. control system

、奖励系统Control systems +2 含义:[Organisations are controlled through a number of systems including financial systems, quality systems and rewards.] 【企业由一系列系统所控制,包括财务、质量】 案例: [There are few formal process controls at Frigate, and the attempt to install such controls was heavily resisted.]

3. power structure

Power structures +1 含义:[Power structures look at who holds the real power within an organisation.] 【企业中谁真正拥有权利】 案例:At Frigate the power comes from one person, Ron, whose leadership style is based on his strong opinions and beliefs.

4. organisation structure

Organisational structures +1 含义:[The structure of the organisation often reflects the power structure. 【组织架构通常反映为权利架构】 案例:There is little formal structure at Frigate,] and the attempt to install a formal organisational structure failed.

5. routine

Routines and rituals +2 含义:[The daily behaviour and actions of staff signal what the organisation considers to be ‘acceptable’.] 案例:At Frigate, there is one rule for Ron and another for everyone else.[Flexible hours, extended holidays etc for Ron but minimum holiday, no flexibility, wage deductions for arriving late etc for employees.]

6. story

Stories +1 含义:[The stories concern past events and people talked about inside and outside the company.] 案例:Stories at Frigate relate to Ron as 'The Commander’. He is the hero of the organisation who constantly has to deal with lazy employees, poor quality suppliers, customers who delay paying, the tax authority, and society in general.

结尾

paradigm and conclusion

Paradigm and conclusion +1 含义:[The paradigm refers the basic assumptions and beliefs that an organisation‘s decision makers hold.] 案例:The paradigm at Frigate shows a company run for the personal gratification of Ron and his family. Ron believes that his lifestyle and benefits are the reward for taking risks in a hostile environment.

浮动主题

IR综合治理报告

案例一

案例二

答题套路

1. 目的和作用

1.1. [we should to demonstrate the linkage between strategy, governance and financial performance and the social, environmental and economic context within which the business operates.]

1.2. [HiLite’s integrated report should be designed to benefit all of our stakeholders who are interested in how we create value over time, including our hotel staff, the hotel customers, local communities, suppliers and investors.]

1.3. [The primary role of an integrated report is to improve the quality of information available to our stakeholders, by communicating broader and more relevant information which can assist them in effective decision making,]

2. IR的好处

2.1. improved relationship between HiLite and our investors,

2.2. a greater insight for our hotel customers and our hotel staff into our organisation’s business model and the benefits we can offer them

2.3. greater understanding of our use and dependence on different resources and ‘capitals’ and our access to and effect on them

2.4. Reputation. The greater transparency and disclosure of <IR> would increase the corporate reputation, which in turn result in a lower cost of, and easier access to, sources of finance.

3. IR的组成

3.1. Financial capital. 含义:It comprises the pool of funds available to Plantex, which includes both debt and equity finance. It focuses on the source of funds, rather than its application 案例:for example in funding production of drugs or the purchase of equipment).

3.2. Manufactured capital. 含义:This is the human-created, production-oriented equipment and tools used in production or service provision, such as buildings, equipment and infrastructure. 案例:This would include the specialist equipment used by Plantex for the development of new drugs. Manufactured capital draws a distinction is between inventory and plant and equipment.

3.3. Intellectual capital. 含义:This is a key element in future earning potential, with a close link between investment in R&D, innovation, human resources and external relationships, as these can determine the organisation’s competitive advantage. 案例:For Plantex developed pharmaceuticals become patented products which ultimately derive value to the firm.

3.4. Human capital. 含义:It consist of the knowledge, skills and experience of the company’s employees and managers, as they are relevant to improving operational performance. 案例:Plantex are knowledge-intensive businesses which rely heavily on the innovation and creativity of the talented scientists.

3.5. Natural capital. 含义:This is any stock of natural resources or environmental assets which provide a flow of useful goods or services. 案例:Plantex will require access to refined, pure chemicals in order to create its pharmaceutical solutions.

3.6. Social and relationships capital. 含义:Comprises the relationships within an organisation, as well as those between an organisation and its external stakeholders. 案例:These relationships should enhance both social and collective wellbeing.

4. 总结

4.1. [Using a broader set of information can also benefit them by providing a greater understanding of the drivers of our performance and value creation. With this information, they can be more confident of our long-term outlook and our ability to create value over time.]

IR记忆要点

目的和作用

链接内外部+对所有利益相关者有益+提高信息质量

IR的好处

推进与股东的关系+让客户和员工了解我们可以提供什么+加强我们对capital的使用和影响+提高透明度-企业形象

IR的组成

财务聚焦资金来源+生产聚焦设备设施+智力聚焦研发与创新+人力聚焦技能与经验+自然聚焦长期稳定资源+社会聚焦内外部关系

常用语:

it compaised……

it consist of ……

focus on……

流程复杂VS对于战略重要 的关系案例

波特五力模型

要求

(b) An evaluation of the attractiveness of the Zedland light bulb industry, using an appropriate framework.. (15 marks) Professional skills marks are available for demonstrating evaluation skills relating to the attractiveness of the light bulb industry in Zedland for Ling Co. (2 marks)

答题套路

开场白

五力模型

1.Threat of new entrants

1.定义:A new entrant into an industry will bring extra capacity and more competition.The strength of this threat depends on two things: barriers to entry and the potential reaction of current suppliers. 2.案例体现:Barriers to entry appear to be:【规模经济+资本投入+分销渠道】 (1)Economies of scale: The five large dominant companies in the industry should be enjoying economies of scale which force any potential new entrant with large-scale production, which carries with it a high risk of failure. This is not an issue for Ling which also currently enjoys economies of scale in its manufacture. (2)Capital requirements: The manufacture of light bulbs requires new entrants to invest large financial resources into production plants. Although capital may be available, the risk associated with large-scale entry may lead to high premiums on borrowed capital. (3)Access to distribution channels: This may be very significant, as the distribution channels are very specific (supermarket groups, home improvement superstores and major electrical chains). The new entrant will have to persuade these channels to accept its products, perhaps through offering price discounts. Selling directly to the consumer seems unlikely in this industry where individual purchases are both infrequent and low value. 3威胁的结论: The reaction to new entrants of existing firms in the industry is likely to be relatively forceful as they have a history of vigorous retaliation to prospective entrants. The upsurge of nationalism in the country will also give them a powerful card to play in this retaliation.

2.Threat of substitute products

1.含义:Substitute products are products which can perform the same function as the product of the industry under consideration. 2.案例体现:It is hard to envisage any potential substitute except for candles which, in the long term, are likely to be much more expensive. Another possible way is to do without lighting. This is the approach taken by government on street lighting. It is turned off from 23:00 to 05:00. However, it seems unlikely that consumers will chose to sit in the dark. 3威胁的结论: In the short term, the threat of substitute products seems very low. However, in the long term, newer technologies may emerge.

3.Bargaining power of suppliers

1含义: A supplier group is more powerful if it is dominated by a few companies and is more concentrated than the industry it sells to. 2案例体现:(我们对供应商的依赖程度【我们是否抢答】+供应商对我们的依赖程度【供应商是否强大】+供应商产业链战略) (1)This appears to be the case in Zedland, where 90% of glass production is accounted for by 3 companies and metal production is largely concentrated in the hands of 1 very large company, OmniMetal. The customers (such as Flick) are large but they are more fragmented. Furthermore, light bulbs are largely made of glass and metal and it seems unlikely that this will change in the near future. This lack of substitutes increases the power of the supplier. (2)The light bulb industry is not an important customer for the supplier . Most glass is sold to the construction industry. Most metal is sold to the automobile industry. The light bulb manufacturers use less than 0.5% of the country’s glass production and less than 0.1% of its metal production. The relative unimportance of light bulb manufactures as customers increases the supplier group’s power. (3)Another factor increasing suppliers’ power is that the products (glass and metal) are a vital part of the customers’ light bulb business. (4)On the other hand, the supplier group’s products are largely undifferentiated and switching costs between suppliers appears to be reasonably low. 3威胁的结论:Finally, it seems unlikely that the supplier group poses a credible threat of forward integration into light bulb manufacture and this will be a factor which reduces supplier bargaining power.

4/ Bargaining power of customers

1含义【主要客户是谁】:The main customers of the industry’s products are large supermarket groups, home improvement superstores and large electrical chains. These customers, particularly the supermarket groups, purchase a large volume of the industry’s products (90%) and so, on the face of it, they can demand favourable prices. 2案例体现: (1) However, the products the buyer purchases from the industry represents a relatively insignificant fraction of the buyer’s costs or purchases. A recent report suggested that light bulb sales contributed less than 0.1% of a supermarket’s revenue. Light bulbs are much less important to supermarket groups which tend to be less price sensitive. (2)Customers’ bargaining power in the light bulb industry is strengthened by the product being undifferentiated, with low customer switching costs. However, the customers are extremely unlikely to move backwards in the supply chain to manufacture their own light bulbs and so this potentially limits their bargaining power. 3威胁的结论:To the end consumer, light bulbs are undifferentiated and there are no switching costs. Light bulbs are an insignificant fraction of their total spend and so they are unlikely to shop around to get the lowest price.

5/ Competitive rivalry in the industry

1.含义: Equally balanced competitors: When an industry is dominated by a small number of firms which are relatively well balanced in terms of size, it creates potential instability because they may be prone to fight each other. 2.体现案例: (1)This appears to be the case in Zedland where five fairly similar sized firms produce 72% (20X5) of the light bulbs sold in the country and wage short-term price-cutting wars, disrupt competitors’ supply lines and react aggressively to potential new entrants. (2)Slow industry growth: Between 20X0 and 20X5 the market grew by just over 2% (from total revenues of $490m to $500m). In mature markets with little scope for overall growth, the only way a firm can increase market share is to take it from its competitors. Consequently, slow industry growth increases competitive rivalry. (3)Lack of differentiation or switching costs: Competitive rivalry is increased where the product is perceived as a commodity, as is the case for light bulbs. In such circumstances the buyer’s decision is largely based on price, and pressures for intense price competition result. (4)High exit barriers: Exit costs are high because of the investment required in plant and the fact that light bulb factories have no obvious alternative use. When exit costs are high, companies will remain in the industry and may resort to extreme tactics which weaken the profitability of the industry as a whole.

波特钻石模型

案例一

要求

Preparing THREE slides, with supporting notes, to be presented to Dave Deen that explain the principles of Porter’s ‘diamond’, and use those principles to describe the relative attractiveness of Ceeland and Arboria as environments in which MachineShop’s growth ambitions could be achieved. (10 marks) Professional skills marks are available for demonstrating communication skills in clarifying the principles of Porter’s diamond and presenting them in the required format. (2 marks)

答案

Slide 1: Porter’s diamond model ·Four elements of the ‘diamond’: - Factor conditions - Demand conditions - Related and supporting industries - Firm strategy, structure and rivalry ·Understanding national competitiveness Slide 2: Factor conditions ·Basic factors ·Advanced factors ·Developments in Ceeland Demand conditions ·Level of demand ·Consumer characteristics and product preferences ·Demand conditions in Ceeland Notes Factor conditions Factor conditions can be classified as being either basic or advanced. Basic factor conditions include unskilled labour and the natural environment, whereas skilled labour and the transport infrastructure are regarded as being advanced factors as these offer sustained advantages. Both types of conditions are deemed necessary if an organisation wishes to compete successfully in a particular industry. In relation to Ceeland, the government has built up an effective road transport system which is cheap to use. The ability to easily distribute goods around the country is an attractive factor for MachineShop in considering whether to enter the market. MachineShop’s interest has also been supported by the recent developments to Ceeland’s digital communication network, since the ability to accept orders over the internet is a key part of its business model. Demand conditions Demand conditions are concerned with the level of demand by consumers for a particular product or service in a company’s home market. The ability of an organisation to supply products and services to demanding consumers in its home market may help when anticipating and satisfying buyer requirements in comparable overseas markets. This would appear to be a critical issue for MachineShop. MachineShop has benefited in this regard by serving consumers in Arboria, where buyers are demanding and assertive. Dave Deen has suggested that a similar consumer society to Arboria is emerging in Ceeland. The decision by the government of Ceeland to lift restrictions on the type of machines permitted for use by citizens is likely to increase the demand for such machinery, thereby strengthening demand conditions. Prior to any venture into Ceeland. MachineShop would need to conduct full market research to ensure that the predicted social trends do occur. Slide 3: Related and supporting industries ·Competitive success in one industry is linked to success in related industries ·Co-operation and co-ordination ·Already using a Ceeland supplier Firm strategy, structure and rivalry ·Rivalry encourages market participants to continually develop ·Few competitor in Arboria ·Ceeland market still developing Notes Related and supporting industries Related and supporting industries within a country are those which help to underpin the performance of other organisations, by co-operating with each other and co-ordinating their activities to achieve joint success. Domestic suppliers are preferable to foreign suppliers. MachineShop currently stocks products made by a supplier in Ceeland. The ability for a foreign entity such as MachineShop to source products of sufficient quality for sale in Arboria serves to make Ceeland even more appealing. Firm strategy, structure and rivalry The final component of the ‘diamond’ model concerns firm strategy, structure and rivalry. Porter identified that significant rivalry in a given market encourages competitors to continually develop their own products and services in order to maintain competitive advantage. MachineShop’s success to date in Arboria has not been influenced by this factor due to a lack of competitors. As Ceeland’s economy is still developing, domestic rivalry will also be lacking. (This is seen as a disadvantage in the ‘diamond’, because the lack of rivalry means companies don’t have to continually develop products to remain competitive.)

案例二

要求

Using Porter's Diamond, analyse why the US, and Silicon Valley in particular, has a competitive advantage as a location for technology companies.

答案

Solution Factor conditions ·Stanford University has always had a strong focus on technology and research, and so provides a good supply of highly skilled workers Demand conditions ·As the world's richest and most sophisticated economy, the US is the largest market for high-technology products Related and supporting industries ·External economies of scale due to the presence of similar firms-e.g. local support firms, such as lawyers, used to dealing with high-tech firms and start-ups ·Silicon Valley has a strong network of venture capitalists who are used to investing in promising technology companies Firm structure, strategy and rivalry ·The direct competition between so many successful companies encourages high standards ·Firms are constantly competing for the best IT staff and attracts skilled staff from all over the world

流程复杂VS对于战略重要 的关系案例

流程复杂VS对于战略重要 的关系案例

要求

(b)iCompute is currently re-considering three high level processes: (i)Advice on legal issues (currently outsourced) (ii)Software support (currently outsourced) (iii)Time recording (in-house, bespoke software development) Evaluate, using an appropriate framework or model, the suitability of iCompute’s current approach to EACH of these high level processes. (10 marks)

答案

1/ Advice on legal issues a/ This could be classified as a process of high complexity and low strategic importance on the process/strategy matrix. b/ Consequently, it seems that continuing the outsourcing arrangement should be the preferred option. Bespoke systems development is risky. c/ There is evidence in the scenario of litigation between iCompute and two of its customers. Although iCompute is considering moving this process in-house, it seems unlikely that it will be able to afford, attract or motivate an internal legal team. 2/ Software support a/ Service is one of the primary activities of Porter’s value chain and directly influences the customer’s perception. Not only is support relatively complex (as acknowledged by the manager who made the outsourcing decision)but it is also of strategic importance. b/ This suggests that iCompute should bring support back in-house, perhaps by the use of an automated systems. c/ This used to be organised in-house, but was outsourced a year ago. Subsequent customer feedback has been poor, but even without this feedback, it could be argued that outsourcing was a poor decision. 3/ Time recording a/ It could be argued that the application is a relatively simple low-value process which only shows hours employees have worked on certain tasks. b/ According to Harmon, it should be automated or outsourced. c/ Within iCompute, some contracts are on a time and materials basis, but most contracts are on a fixed price basis. Meanwhile, as accurate time recording is a key requirement in many professions, it seems highly likely that a range of off-the-shelf packages would be available to fulfill their needs. Consequently, an ERP or outsourcing would release resources which could be employed on external fee-earning contracts.

Baldrige model,

要求

4. Prepare THREE slides for a presentation to the board of directors of Ling Co that explains the Baldrige model, and how it might be used to help Ling Co achieve continuing corporate success. (6 marks) Professional skills marks are available for demonstrating communication skills in highlighting the key points to include in the slides. (2 marks) (Total = 8 marks)

答案

Slide: 1 The Baldrige model of performance excellence【目的和怎么用】 1.What does it aim to do? (1)Provide a framework for assessing performance (2)Help organisations to achieve excellence 2.How does it do this? (1)Helps an organisation to identify its strengths (2)Highlights areas for improvement Slide: 2 What are the criteria that are used to assess an organisation?【标准是什么】 Six key criteria shape an organisation’s ability to perform, and help to achieve the seventh criteria. 1 Leadership 2 Strategy 3 Customers 4 Measurement, analysis and knowledge management 5 Workforce 6 Operations 7 Results (see supporting notes) Slide: 3 How are the criteria evaluated and applied?【如何评价标准】 Criteria 1-6 are evaluated in relation to four dimensions: √ Approach:怎么去完成 √ Deployment:怎么去部署核心流程 √ Learning:怎么学习和改进流程 √ Integration:怎么整合流程,满足现在和未来目标 Results (Criterion 7) are evaluated against four (different) dimensions: √ Levels:现在业绩是什么水平 √ Trends:未来趋势是什么 √ Comparisons:与同业比的差距 √ Integration:目前的结果是否符合利益相关者预期

中心主题

主题

主题

主题

中心主题

主题

主题

主题

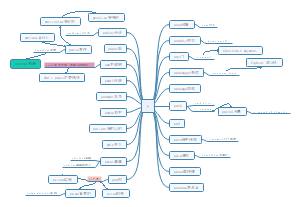

Chapter 04 The external environment

1 The external environment

2 The macro environment (M)【宏观环境】-PESTEL模型

3 National environment【所在国和投资国环境】-钻石模型

3.2 Components of the Diamond (M)

3.2.1 Factor conditions

natural resources, climate, semi-skilled or unskilled labour

-infrastructure(基础设施) and communications, higher education, and skilled employees -Government policy and support

3.2.2 Demand conditions (需求条件)

·A tough domestic market is likely to encourage competitiveness ·As firms have to produce cost-efficient(性价比高), high-quality goods to satisfy the requirements of domestic customers ·The experience a firm gains from meeting domestic customers' needs will then allow it to compete successfully on an international scale

3.2.3 Related and supporting industries (配套产业)

·Industries need to be supported by a good local supply chain, which contributes to quality and cost advantages ·Clustering (聚类, 产业集群)

3.2.4 Firm strategy, structure and rivalry (战略, 结构和同业竞争)

·Cultural factors, social attitudes and management styles can all lead to competitive advantage in certain industries ·Intense domestic rivalry among firms means they need to perform well to survive and to look for export markets

4 Industry or sector environment(行业环境)-波特五力模型

4.1 Porter's five forces(M)

4.1.1 New entrants

Will intensify(加剧) competition in the industry

Barriers to entry

·Prevent new firms from joining on industry

·Help to sustain profits

·Such as capital requirements, economies of scale among existing firms, or patents

4.1.2 Power of suppliers

·If suppliers have strong bargaining power, the price of inputs will be driven up, thereby reducing profits

4.1.3 Power of buyers

·If buyers have strong bargaining power they can drive down prices, thereby reducing profits

·Factors such as relative size, and ability to switch to an alternative product or service affects bargaining power

4.1.4 The threat of substitute 【不在同一行业】

·A substitute is a different product or service which satisfies the same customer needs

·The availability of substitutes restricts profits

·Customers can switch to a substitute if the price of a product or service increases or quality/utility decreases

4.1.5 Competition and rivalry

·Intense competition in an industry will reduce profits

·This may result from slow growing or declining markets, excess capacity, or barriers to exit

4.2 Industry life cycle

5 Customers and markets【客户和市场环境】

6 Scenario planning (情景规划)

中心主题

主题

主题

主题