导图社区 BUS 400

- 23

- 0

- 0

- 举报

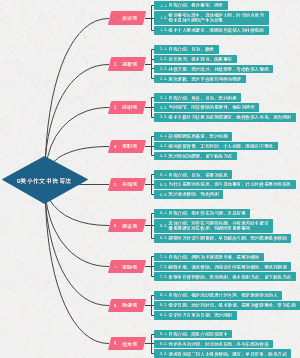

BUS 400

这是一篇关于BUS 400的思维导图,战略可以提高决策质量、 促进协调、 使组织专注于追求长期目标等。

编辑于2024-05-07 18:31:32- 战略

- 英文版

- 相似推荐

- 大纲

BUS 400

Chapter 1: What is Strategy?

Business/military forces need strategy to

give direction and purpose

deploy resources in the most effective manner

coordinate the decisions made by different individuals

Distnguishing strategy from tactics

Strategy is the overall plan for deploying resources to establish a favorable position

Tactic is a scheme for a specific maneuver

Characteristics of strategic decisions

important

involve a significant commitment of resource

Not easily reversible

What make a succesful strategy

long-term simple and agreed objective

Profound understanding of the competitive environment

Objective appraisal of resources

Strategy framework

Clear, consistent, long-term goal

Profound understanding of business environment

Appreciation of resource and capabilities

Effective implementation`

Strategy analysis: Framework

What's wrong with SWOT

enternal factor → Oppotunity & threats

internal factor →Strenth & Weakness

Arbitrary

identify impact the firm

analyze their implications

Strategic fit

The firm

Goal & Value

Resources & Capabilitie

Structure & System

Strategy

Competitors

Customers

Suppliers

What is Strategy

enhancing the quality of decision making

facilitating coordination

foucusing organizaions on the pursuit for long-term goals

Strategic choices

Corporate strategy

Top management

industries and markets

Business strategy

Senior managers of divisions and subsidiaries

particular industy or market

Realized Strategy

Inteeded Strategy (10-15%)

desige: planning and rational choice

top management team

Emergent Strategy

process: responding to multitude of external and internal forces

individal managers

How is strategy made?

identify the current strategy

appraise performance

diagnose performance

industry analysis

analysis of resources and capabiliries

formulate strategy

implement strategy

Chapter 2: Goals, values & performance

Purpose of the firm

Create value to shareholder

Value =profit

Production

less valued →physically transfering→more value

Commerce

transfer space and time from less valued to more value

Measure Value

Cash flow

Profit

equity financed firms (start-up)

Disaggregating the financial performance

Maximizing enterprise value and profirability

Dilemma of performance

long-term preformance goal

short-term monitoring of performance targets

Values and corporate social responsibility (CSR)

shaping an organization's character an identity

motivating employees

reinforcing unity and direction

long term profit

adaptability

reputation

legitimary

Chapter 3/4: Industry analysis: The fundamentals

Core of the firm's business environment

customers

suppliers

competiters

analysis of industries WITHIN industries >BETWEEN industries

Porter 5 force

Threat of new entrants

Buyer Bargain Power

Threat of Substitution

Supplier Bargain Power

Competitive Rivalries

Game theory

Understanding the dynamics/interactivity of competition

Make sence of the nature of interactions

able to explain past competitive behavior

Prisoner's dilemma: best for individually but wrose for collectively

Competitive intelligence

Objective: market shares v.s profitability

Current strategy

Assumption about the industry

Resources & Capabilities: Price war is useless

Segmentation Analysis: Stage

identify key variable and categories

identify segmantation variable

reduce to 2 or 3 variables

identify discrete categories for each variable

Construct a segmentation matrix

Analyze segment attractiveness

Identify KSFs in each segment

Analyze benefits of borad v.s narrow scope

Potential for economies of scope across segments

Similarity of KSFs

Differentiation benefits of segments focus

Chapter 5: Analysing Resources and Capabilities

Role

When the industty environment is volatile, offer a more stable basis

primary sources of competitive advantage and profitability

Strategtic fit

Competition

challenging

cooperation

Resource on their own do not cofer a competitive advantage

Survival through time: leveraging on existing resources & capabilities to develop organizational

Importance

extend

scarcity

relevance

sustainability

durability

transferability

replicability

approriability

property rights

relative bargaining power

embeddedness

Recimmendations

exploiting key strengths

target market/customer segments where core strenths have biggest impact

replicate in new location

exploit key strengths by diversifying into new market

key weakness

invest in long-term investment & not effective in cultural factors

outsource

partner with complementary firm

taget market/customer have smallest impact

Chapter 7: The nature and soures of competitive advantage

Cost advantage

higher rate of profit

maket share

technology

customer

differentiation advantage

create barriers to sustain

prevent identification

prevent incentive

prevent diagnosis of the sources

limit acquisition of Resources & Capabilities necessary for imitation

higher rate of profit

Cost analysis

Economies of scale

Economies of learning

Production techniques

Product design

Input costs

Capacity utilization

Residual efficiency

Chapter 8: Industry evolution and strategic change

industry evolution

Demand growth

Knowledge (product innovation)

Life cycle

Intro

Battle for technological leadership

Growth

market demand>industry capacity

Maturity

standardization and excess capacity→price competition

Decline

stronger price competition (price war)

challenge

organization intertia

prolitical and social structure

complementarity between strategy, structure and systerms

adaptation strategic change

Competence enhancing v.s Competence Destroying

new technology requires different resources and capabilities from those they already possess

Architectural v.s Component Innovation

involve a new product architecture

Sustaining v.s Disruptive Technologies

managing strategic change

creating perceptions of crisis

establisihing stretch targets

organizational initiative

reorganizing company structure

new leadership

scenario analysis

Chapter 11. Vertical Integration and the scope of the firm

Business Strategy

Purpose

Strategic fit

Objective

achieve a competitive advance and satisfy strategic objective

Means

understand the enternal environment

economic

regulatory

culture

teconological

demographics

understand the competitive environment

understand the internal environment

Resources & Capabilities

Performance

Corporate Strategy

Purpose

make a decisions over the scope of the firm's activities

Objective

Product scope

Geographic scope

Vertical scope

make or buy

Transactional Costs

Vertical relationships

short/long term contracts

supplier-customer relation

franchise

benifits of vertical integration

technical economies from integrating process

avoids transactions costs of market contracts

small numbers of firms

transaction-specific investment

opportunism and strategic misrepresenation

tax and regulations on market transactions

superior coodination

Cost of vertical integration

differences in optimal scale of operation between different stages of production prevent balanced vertical integration

inhibits development of distinctive capabilities

difficulties of managing strategically different business

incentive problems: lack of "high powered" incentives

limits flexibility

demand fluctuation

change in technology,coustomer preference...

compounding of risk

desiging vertical relationship

long-term contracts and quasi-vertical integration

key issue

No generic solution

resources

capabilities

strategy

risk allocated between the parties

incentives appropriate