导图社区 商银2-financial statements for bank

- 30

- 0

- 0

- 举报

商银2-financial statements for bank

这是一篇关于商银2-financial statements for bank的思维导图,主要内容有overview、report of condition—balance sheet、direct relationship、report of income—-income statement。

编辑于2022-12-08 20:30:08- 财务会计

- 金融生

- 衍生10-property(性质) of stock option

这是一篇关于衍生10-property(性质) of stock option的思维导图

- 衍生9-mechanics of option markets

这是一篇关于衍生9-mechanics of option markets的思维导图

- 商银8-manage liquidity legal reserve risk2

这是一篇关于商银8-manage liquidity legal reserve risk2的思维导图,negative gap when interest rates rise, while call options can be used to offset a positive gap when interest rates fall. 8-* 8-* 8-* Speculation vs. Hedging With financi...

商银2-financial statements for bank

社区模板帮助中心,点此进入>>

- 衍生10-property(性质) of stock option

这是一篇关于衍生10-property(性质) of stock option的思维导图

- 衍生9-mechanics of option markets

这是一篇关于衍生9-mechanics of option markets的思维导图

- 商银8-manage liquidity legal reserve risk2

这是一篇关于商银8-manage liquidity legal reserve risk2的思维导图,negative gap when interest rates rise, while call options can be used to offset a positive gap when interest rates fall. 8-* 8-* 8-* Speculation vs. Hedging With financi...

- 相似推荐

- 大纲

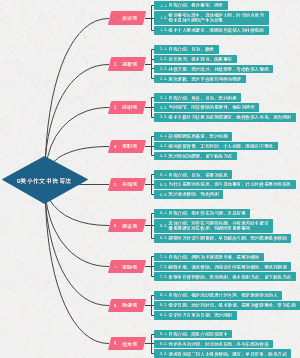

2-financial statements for bank

overview

difference between CB & nonfinancial firm

CB: major asset-loan major liability-deposit

nonfinancial: major asset: tangible asset (building & machinery)

balance sheet

stock(存量)

income statement

flow(流量)

submit

financial statement must be submitted to regulators & stockholders quarterly

report of condition——balance sheet

asset

cash assets

作用:designed to meet the financial firm's need for liquidity

地位:called primary reserves

sort

vault cash (库存现金)

the currency and coin needed to meet customer withdrawal (一时持有,用于临时支付的现金)

deposit at federal reserve

to meet legal reserve requirement

deposit at other financial institution

to purchase service from correspondent bank

cash item in process of collection (收款过程中的现金项目)

investment security

作用:a backup source of liquidity & provide a source of income

sort1

security(both short/long-term investment security)

S: easily sold to obtain cash (T-bill,municipal security,money market instrument)

L: municipal bond/government bonds¬es/government agency security/corporate bond¬e

federal funds sold & reverse repurchase agreement

RP: short-term uncollateralized loan made by one bank to another,usually extended overnight,with funds returned the next day.

the next day, the purchsing bank returns the fed funds+one day's interest,reflecting the fed fund rate

repo: collateralized federal fund transaction

other trading account asset

sort2

held-to-maturity security (income-generating portion)

available-for-sale security (the liquid portion)

called secondary reserves

trading account asset/security

principally speculate on interest rate movements and profit on price changes,typically held for brief period. (从事自营而短期持有,并旨在日后出售或计划从买卖的实际或预期价差中获利的金融工具头寸)

loan

principally to supply income and the major source of credit&liquidity risk

commercial & industrial/business loan

finance a firm's capital need/equipment purchase/plant expansion

real estate/property-based loan

地位:primarily mortgage loan

residential mortgage are the largest component of the real estate loan portfolio

very long-term loan with an average maturity of approximately 20 years

individual/consumer loan

personal & auto loan(车贷)

other loan:foreign/agricultrual/security loan...

lease(租赁)

记账公式: net loan = gross loan - unearned income - ALL

contra-asset account (资产对销账户) 基本作用是用于抵消某一账户的余额

unearned/discount income (预收收入)

allowance for possible loan loss(ALL)

specific reserve: set aside to cover a particular/problem/above-average risk loan

general reserve: remaining ALL

nonperforming loan: 90 days or more past due or are not accruing interest

earning asset:investment security + net loan&lease (generate interest income & some of the noninterest income)

other/miscellaneous asset

fixed asset/intangible asset(goodwill&mortgage sevicing right/deferred tax/prepaid expense)

liability

deposit

地位:main source of funding

sort

demand deposit

held by individual/corporation/partnership/government pay no explicit interest

corporation is the major holder corporation can only use demand deposit for transaction account purpose

NOW account(negotiable order of withdrawal account) (可转让支付命令账户)

depositor can maintain a minimum account balance to earn interest

MMDA account(money market deposit account)

higher rate than NOW,but less liquid than demand&NOW

saving deposit account

time deposit

retail certificate of deposit(CDs) (零售存款证)

就是我们常见的 有到期日有利息的存款

wholesale CDs (批发存款证)

negotiate instrument(ownership can be transferred in the secondary market)

nondeposit borrowing

federal funds purchased&repo

major source of borrowed fund

fed fund rate can be variable——driven by market demand & supply

other borrowed fund

banker's acceptance/issuing commercial paper/medium-term note/discount window loan

subordinated debt (次级债券)

attractive,no reserve requirement&deposit insurance premium

other liability

accrued interest/deferred tax/dividend payable/minority interest

related concept

transaction account: checkable deposit(demand deposit or NOW account)

brokered deposit: wholesale CD obtained through brokerage house

eurodollar deposit

core deposit: stable over short period,thus provide a long-term funding source to a bank 是最稳定的资产,但可以随时提取

cheapest & most frequently used source of funding

include demand deposit/NOW account/MMDA/retailing CD

purchased fund

rate-sensitive funding source

immediately withdrawn or replaced as rate on competitive instrument change

wholesale CD+nondeposit borrowing

equity

required to hold a minimum level of equity

preferred stock

common stock(at par value)

surplus & additional paid-in capital (实收资本)

retained earning/undivided profit

off-balance-sheet activity(OBS)

a supplement to income & help bank reduce its exposure to interest-rate and other type of risk

sort

loan commitment (贷款承诺)

letter of credit (信用证)

loan sold

derivative security

direct relationship

influence factor

the amount and mix of assets and liability held by bank

interest rate of each them

leverage

financial leverage

往往是由于负债融资引起的,一旦财务杠杆变高了,这也就意味着企业利用债务融资的可能性降低了

operating leverage

由于固定成本的存在,导致利润变动率大于销售变动率的一种经济现象,它反映了企业经营风险的大小

report of income——income statement

interest income & expense

interest from asset & liability

net interest income=total interest income - total interest expense

provision for loan losses

a noncash,tax deductible(免税的) expense

与ALL关系: PLL is the current period's allocation to the ALL ALL(end) = ALL(begin) + PLL - actual loss + recovery on loan previously charged off

记账过程中报表的变化

认为可能会发生坏账→net loan减少,ALL增加/retained earning减少  发现确实坏账收不回来了→write the loan off its book  在这个过程中,total asset&liability是没变的,只是具体分录有变化。可以看出坏账准备账户的意义

noninterest income & expense

income

fee earned from fiduciary(信托的) activity

service charge on deposit account

trading account gain&fee

additional noninterest income fee from investment banking/fee from insurance

total operating income/revenue = interest income + noninterest income

expense

情况介绍: mainly of personnel expense(人事费) it's a burden(for almost all bank,non-income < non-expense)

sort

wage,salary,employee benefit

premise(房屋费用) & equipment fee utility & depreciation,rental fee on office space

other operating expense deposit insurance premium

net income(total revenue-total expense)

pretax net operating income =total operating revenue - total operating expense =(interest income+noninterest income) - (interest expense+noninterest expense + PLL)

others

security gain/loss (证券盈余)

bank purchase/sell/redeem security during the year, and often results in gains/losses above or below the book value

applicable income taxes: all federal,state,local and foreign income taxes due from bank

extraordinary item: transaction or event that are both unusual and infrequent