导图社区 Nine Lectures on China's Macroeconomy

- 10

- 0

- 0

- 举报

Nine Lectures on China's Macroeconomy

这是一篇关于Nine Lectures on China's Macroeconomy的思维导图,《中国宏观经济九讲》从制度、土地、全球化、杠杆、房地产、金融、货币政策、高质量发展和共同富裕九个方面,深入剖析了中国经济发展的历程和内在逻辑。该书不仅还原和再现了中国经济发展的现实,还为未来中国经济的发展提出了有益的启示。

编辑于2025-09-10 15:10:18- 经济

- Nine Lectures on China's Macroeconomy

这是一篇关于Nine Lectures on China's Macroeconomy的思维导图,《中国宏观经济九讲》从制度、土地、全球化、杠杆、房地产、金融、货币政策、高质量发展和共同富裕九个方面,深入剖析了中国经济发展的历程和内在逻辑。该书不仅还原和再现了中国经济发展的现实,还为未来中国经济的发展提出了有益的启示。

- 中国宏观经济九讲

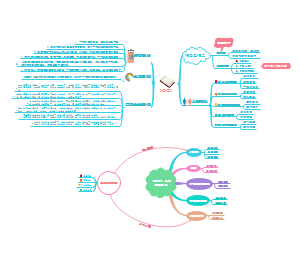

了解中国宏观经济很好的一本书,该书聚焦中国改革开放以来经济增长的动因与挑战,基于1979-2019年的经济数据与政策实践,从制度、土地、全球化、杠杆、房地产、金融、货币政策、高质量发展和共同富裕九大主题切入,系统性剖析中国经济年均增长9.4%的驱动机制,并针对土地财政依赖、债务杠杆高企、人口老龄化等衍生问题提出转型思考。

- 宏观经济学二十五讲中国视角

宏观经济学二十五讲中国视角,北大国发院硕士课程,B站有免费视频,此为本人学习过程中所梳理,启发良多,供参考。

Nine Lectures on China's Macroeconomy

社区模板帮助中心,点此进入>>

- Nine Lectures on China's Macroeconomy

这是一篇关于Nine Lectures on China's Macroeconomy的思维导图,《中国宏观经济九讲》从制度、土地、全球化、杠杆、房地产、金融、货币政策、高质量发展和共同富裕九个方面,深入剖析了中国经济发展的历程和内在逻辑。该书不仅还原和再现了中国经济发展的现实,还为未来中国经济的发展提出了有益的启示。

- 中国宏观经济九讲

了解中国宏观经济很好的一本书,该书聚焦中国改革开放以来经济增长的动因与挑战,基于1979-2019年的经济数据与政策实践,从制度、土地、全球化、杠杆、房地产、金融、货币政策、高质量发展和共同富裕九大主题切入,系统性剖析中国经济年均增长9.4%的驱动机制,并针对土地财政依赖、债务杠杆高企、人口老龄化等衍生问题提出转型思考。

- 宏观经济学二十五讲中国视角

宏观经济学二十五讲中国视角,北大国发院硕士课程,B站有免费视频,此为本人学习过程中所梳理,启发良多,供参考。

- 相似推荐

- 大纲

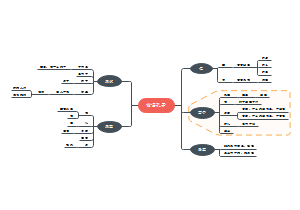

Nine Lectures on China's Macroeconomy

Lecture One: System

1.1 Realities about economic growth

· Since Reform and Opening up, China's economy has achieved remarkable success, what created this miracle?

· China's economic development model has strong characteristics of government leadership and top-down driven.

Market-oriented reform? The failure of Eastern Europe.

Globalization? Emerging economies would get locked in at the low end (低端锁定)

Mainstream Western economic theory frameworks cannot explain the miracle created by China's economic growth

Neoliberal theoretical system, a response plan to the 1970s stagflation

· SOE privatization.

· Weakening government intervention, economic system "liberalization"

· Opening up financial markets and achieving "financial liberalization"

1.2 Competing for growth

Assessment model centered on economic construction, with GDP at the core

1.2.1 Compounding demands (层层加码)

Progressively setting increasingly higher growth targets layer by layer

1.2.2 Decentralized Competitive Landscape

Local decentralization, localities initiate homogeneous competition

1.2.3 Clear Assessment Mechanism

The particularity of China's economic growth lies in introducing a competition-for-growth incentive mechanism, making official behavior "entrepreneurial"

1.3 Problems and reforms

In the early stages of Reform and Opening up, the main contradiction was under-rreleased productive forces. The single goal system with GDP at core could well solve the problem of shortage of daily goods.

With continuous development of China's economy, the single goal system with GDP as KPI can no longer meet all the needs of the people

Summary

1.3.1 The fiscal construction that prioritize infrastructure

Insfastructure projects have significant effect on boosting economy and are more favored by local authorities

In contrast, livelihood expenditures such as healthcare are insufficient. With the gradual improvement of public living standards, public demends are also rising gradually, which led to the emergence of new contradictions.

The 19th CPC National Congress report pointed out: Socialism with Chinese Characteristics has entered a new era, and the principal contradiction facing Chinese society has evolved into the contradiction between unbalanced and inadequate development and the people's ever-growing needs for a better life.

Introduce an assessment system that includes public services, establish a more comprehensive assessment mechanism

1.3.2 Market Segmentation and Overcapacity

Break local protectionism and build a unified national market

Market segmentation directly hinders the high-end development of manufacturing

Disorderly competition will cause overcapacity

Introduce diversified performance assessment mechanism, formulate local assessment standards based on local conditions (因地制宜); accelerate promoting coordinated regional economic development; continue advancing supply-side reform to drive high-quality development

1.3.3 Scale Orientation and High Debt Leverage

The enterprise sector is large in size but weak in strength.

The local implicit debts have rapidly increased.

Strengthen the constraints on assets and liabilities, implement accountability for implicit debts, and develop the capital market.

1.3.4 Reliance on External Demand

China's intergratio into the world trade system provided an outlet for excess capacity

With the advent of de-globalization, external demand declines, it is necessary to rely more on domestic demand to drive economic growth, but issues like uneven income distribution exist

Activate domestic demand, increase income for the urban bottom and migrant workers, improve social security mechanism to resolve their worries.

1.3.5 Environmental Issues

In early stages of modern economic development, the model of sacrificing environment for economic growth is common

The assessment method with GDP as sole KPI also easily ignores environmental impact

As economy gradually develops, environmental issues gradually gain more attention

Lucid waters and lush mountains are invaluable assets

Eliminate excess capacity but prevent one-size -fits-all approach(一刀切);reshape energy structure and develop green economy; multi-faceted layout (多方面布局) and strengthen supporting facilities construction to gradually achieve low-carbon transformation.

1.3.6 Regional Divergence

Eastern coastal regions stand out

· Undertook overseas industrial chain transfer with absolute geographical advantages

· Formed "industry + talent agglomeration" effect (集聚效应)

New Concept of Regional Development,“Belt and Road”Initiative、Sea-Land Coordinated Development

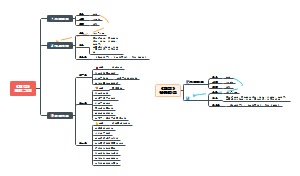

Lecture Two: Land

2.1 The transition from the fiscal contract system (财政包干制)to the tax-sharing system(分税制)

The period of Planned Economy:

All economic activities are uniformly managed by the state.

Unified purchase and marketing of products.

Unified revenue and expenditure.

Unified import and export.

The state concentrated all surplus and redistributed surplus products through planning directives.

Advantages: Concentrate all human, financial, material resources to rapidly achieve industrialization.

Disadvantages: Slow response speed to the material needs of the masses.

The main contradiction in the primary stage of socialism: The growing material and cultural needs of the people versus the backward social production.

Insufficient enthusiasm from local authorities and enterprises

Reform focus: Stimulate the enthusiasm of local governments and enterprises to meet the material life needs of the masses.

On one hand: Decentralize power and concede profits to mobilize enterprise enthusiasm.

The key is tax reform

· Replacing profit delivery with taxes (利改税): Change from handing over profits to paying income tax.

· Price reform: Price breakthrough (价格闯关 )combined with different tax rates for different products to control prices.

· The tax-sharing reform in 1994

Price breakthrough completed, gradually abolished product tax, returned to tax neutrality.

· Better institutional provisions, with foreign enterprises and private enterprises being the main players.

Unification of three taxes (三税合一): unified enterprise income tax rate

On the other hand, the local and central governments "operate separately"(分灶吃饭), granting local governments the autonomy in fiscal expenditure.

Combined with the GDP-oriented assessment,mobilize(调动 ) the enthusiasm of local economic development

Original unified revenue and expenditure fiscal management model: Local governments handed over all fiscal surpluses to the central government at year-end, which was allocated uniformly by the central government.

The drawbacks are obvious: it is too rigid and inflexible, and there is a lack of local motivation for generating revenue.

Switching from unified revenue and expenditure to the contract system (包干制)

Local governments hand over fiscal revenue based on the contract ratio, which was generally fixed for five years.

Local fiscal expenditure were no longer directed by the central government, local authorities can decide expenditure purposes themselves.

Localities balance the fiscal revenue and expenditure themselves

Advantages and disadvantages are both significant

Advantages: Strong incentives, encouraging localities to generate revenue , expand the tax base and develop the economy.

Disadvantages: The central government's fiscal proportion declined, the central government's ability to regulate local governments was weakened.

Rigid expenditure pressures, such as large subsidies for agricultural product prices.

The economy was growing rapidly, the purchasing power of the central government's fixed share income declines with increasing inflation

Taxation is based on territorial principles, with local governments obtaining majority. The local authorities avoid paying the taxes by means such as "accumulating wealth within enterprises".

The central government's ability to adjust regional disparities through transfer payments weakened.

Tax-sharing reform

· Divide taxes into central taxes, local taxes, and central-local shared taxes: Central government takes the majority.

· Local governments concede profits to the central government.

· After centralizing financial resources, the central government establishes an effective and fair transfer payment system.

The financial resources are gradually concentrating at the central level, while the financial expenditure pressure of local governments is constantly increasing.

Forced local governments to generate revenue through other channels: The emergence of land finance.

The existence of the GDP assessment mechanism has compelled local authorities to find various ways to develop the economy and generate income through other means.

2.2 Transferable land use rights

The historical evolution of land use rights

In ancient and modern times, for the most part, land was privately owned by farmers, and the economy was characterized by small-scale farming with self-sufficient farmers and tenant farmers.

After the founding of the PRC, in order to rapidly achieve industrialization and accumulate surplus for industrialization, a model of the price gap between industrial products and agricultural products was adopted. Agricultural products were uniformly purchased and sold by the state. To reduce transaction costs, the following measures were taken:

· The land changed from private ownership to collective ownership, and was used for the requisition of grain by the People's Commune.

· The production of agricultural products was based on fulfilling national tasks.

· Farmers' migration was restricted, and rural surplus resources were utilized in line with the national industrialization strategy.

After the reform and opening up, urban land ownership belongs to the state, while rural land ownership belongs to the collective.

China remained a socialist country with public ownership as the mainstay.

Changes of land use rights.

· Changes in the usage rights of rural collective land

The ownership remained with the collective, but the usage rights were given to the families. The families took the place of the former production teams to manage the land.

Household responsibility system (包产到户), enhancing farmers' enthusiasm, the greatest institutional innovation in 1978 (from bottom to top)

The problem of food supply were solved, but there exist shortcomings in large-scale operation.

The contradiction between collective ownership and population changes

As the population increases, farmers expect to be allocated more land upon the expiration of their contracting rights. However, the central government emphasized that "adding personnel does not increase land area". The factors influencing population growth and decline were uncontrolled and there was no long-term expectation.

Fragmentation of land management

The collective land was constantly being divided as the population grew, and thus it failed to achieve the scale advantages.

The issue of separating contracting rights and operating rights

As more and more farmers moved to cities for work, the ownership of the contracted land and the management rights became separated, making it difficult to clarify the land ownership. Moreover, short-term tenants of the land had no motivation to carry out large-scale development and mechanized operations.

In some areas, the reform of collective production materials into shareholding had been initiated.

Concentrated settlement verified all the production materials of the entire village, and handed over the collective assets to the collective economic cooperative for management.

Overall, the collective agricultural land has gone through the process of collective cooperation - household responsibility system - land management rights transfer - re-collectivization through land shareholding system.

· The issue of rural residential land(aka homestead, 农村宅基地)

Rural housing is provided by the collective, which allocates the land free of charge to the farmers. The farmers then build their own houses to solve their housing problems.

Rural residental land is collectively owned

Theoretically, individuals have no right to use their homestead land for trading, mortgaging, leasing or pledging.

The allocation of homesteads is exclusive, and non-collective members are not allowed to participate in the allocation. Therefore, urban residents cannot purchase homesteads or build houses on collective land.

Two problems have arisen.

(1)Although the homestead is free, it still provides value to farmers, which leads to an increase in management difficulty.

Firstly, farmland in the village is occupied

Secondly, in some areas, rural residential plots have spread to the suburbs and urban villages, which is not conducive to urban management.

(2)A large number of migrant workers go to cities to work, resulting in a lot of idle homesteads. Since the homesteads belong to the collective, they cannot be sold to people outside the collective. Therefore, people from outside the village are unable to enter and revitalize the abandoned homesteads, causing waste of resources.

· The land system reform in cities

The attempt of the Shenzhen Special Economic Zone

In 1981, the "Interim Regulations on Land Management" was promulgated, stipulating that land use rights could be transferred (but ownership could not).

In 1987, the state-owned land use rights were first transferred through the bidding, auction and listing process.

Promoted the constitutional amendment of 1988,which specified that "land use rights can be transferred in accordance with the provisions of the law."

In 1990, the State Council issued the "Interim Regulations on the Allocation and Transfer of State-owned Land Use Rights in Urban Areas", officially establishing that state-owned land use rights could be allocated and transferred through methods such as agreement, bidding, and auction, and promoting it nationwide.

Conversion of land use purposes

How can the agricultural collective land in rural areas and suburban areas be transformed into non-agricultural construction land?

The two channels during the initial stage of Reform and Opening up

One approach is to transfer agricultural collective land to township enterprises(乡镇企业), and directly convert agricultural land in rural areas into construction land.

Farmers' income has been increased, but also caused serious problems.

· Large amount of farmland were occupied by rural industries.

· The existance of problems such as environmental pollution and scattered industrial layout.

The second approach is to convert the agricultural collective land into state-owned land, and then convert it into construction land.

In the "Land Management Law" of 1988, it was clearly stipulated that in order to convert agricultural collective land into construction land, it must first be transformed into state-owned land.

That is: Farmers cannot transfer the collective land use rights by themselves, nor can they convert the collective land into construction land on their own. Only the local government can transform the collective land into construction land. The local government is the sole buyer of rural collective land.

In 1988, the "Land Management Law" affirmed the right of local governments to profit from the transfer of land use rights.

After 1994, the revenue from land sales in all regions was officially recognized as fully belonging to local governments.

力After the implementation of the tax-sharing system reform, the discretionary income available to local governments has significantly decreased. Therefore, there is a strong desire to increase their discretionary financial resources by boosting land sale revenues.

Housing commodification reform in the townships

In the era of planned economy: Housing was provided free of charge by the units. The expenses were covered by government allocation and self-funding by the units. The ownership of the houses was entirely owned by the government or the units, while the supply was severely insufficient.

The three documents

· "Implementation Plan for the Phased and Gradual Implementation of the Housing System Reform in Urban Areas Nationwide" issued in 1988.

The purpose of the housing system reform has been clarified.

· To address the problems of severe shortage of housing supply and unreasonable housing allocation system.

· By promoting the development of the real estate industry, the construction industry and the building materials industry can also be stimulated.

· "The Decision on Deepening the Reform of Urban Housing System" issued in 1994

”Three Changes and Four Establishments“

Three Changes:

· The allocation of housing, which was previously done by the state units for free, has been changed to a more reasonable sharing among the state, units and individuals.

· The systems for construction, allocation, maintenance and management of housing in each unit have been changed to a socialized and professionalized approach (construction of houses is handled by professional developers)

· The distribution of housing benefits has been changed to a monetary wage system (previously, housing was provided as a benefit; from now on, one will have to pay for it themselves)

Four Establishments:

· Establishing commercial housing system and affordable housing system

Rich people purchase commercial housing. Then, the government acquires land surplus and builds affordable housing for those who are financially disadvantaged.

· Establishing the Housing Provident Fund system

· Establishing the housing credit system

· Establishing a real estate trading market

Since then, the concept of "housing being provided by the government or the units" has changed. Public housing, as a product of the planned economy era, has gradually vanished. Normal people began to save money to buy houses, or take out loans to purchase houses, and they started to find their own ways to meet their basic and improvement needs.

· "Notice on Further Deepening the Urban Housing System Reform and Accelerating Housing Construction" issued in 1998

In 1998, the Asian financial crisis broke out. To stabilize the economy, strengthen domestic demand and stimulate consumption, the central government decided to completely open the floodgates of the housing market.

· Residential Allocation System Reform: Starting from the second half of 1998, the physical allocation of housing was officially halted and the monetary allocation of housing was gradually implemented. Welfare housing distribution by units became a thing of the past.

· Supply system reform: High-income families purchase or lease market-priced commercial housing; middle and low-income families purchase affordable housing; the lowest-income families rent low-cost housing provided by the government or units.

· Housing finance support: All commercial banks can issue personal housing loans in all towns. The direction of HPF loans has been adjusted to be used for individuals' purchase of self-occupied housing. The combined housing loan business of combining housing provident fund loans with commercial bank loans has been developed.

Since 1998, the development of China's real estate market has entered a "fast lane".

Real estate sales have driven various industrial chains such as real estate brokerage, property management, furniture and appliances. Meanwhile, real estate investment, construction and completion have also driven various cycle industrial chains including building materials, steel and cement, glass, non-ferrous metals, and coal.

In the "Notice on Promoting the Sustainable and Healthy Development of the Real Estate Market" issued in 2003, it was clearly stated that the real estate industry has a high degree of interconnection and strong driving force, and has become a pillar industry of the national economy.

All the necessary conditions for the emergence of land finance are now in place.

· After the implementation of the tax-sharing system reform, local governments' discretionary financial resources decreased, but the pressure of GDP assessment did not abate.

· The local authorities monopolized the land market, thereby monopolizing the price difference in land transactions. As the right to profit from the transfer of land use rights gradually gained recognition from the central government, the portion of the local benefits derived from the land could be freely allocated and used for the development of the local economy.

· Commoditized housing market and the overall society's demand for improving housing living conditions has raised the value of land. The soaring land value has made it possible for land finance to boom.

2.3 From land conveyance income to land mortgage financing

Why do local governments have such a strong interest in establishing development zones and building new cities?

There are generally two ways for local governments to acquire land:

· Revitalizing the existing urban land, such as through the demolition of old urban areas and the renovation of shantytowns, which contains relatively high transaction costs.

· Expropriating land in suburban or rural areas, under the original land system, compensation is given based on the original use of the land being expropriated, so the expropriation cost is relatively low.

Why is it necessary to strictly adhere to the farmland protection line?

The government's motivation for acquiring and selling land is simply too strong.

Out of concerns for food security, the central government has repeatedly issued instructions, demanding that local authorities strictly adhere to the red line for cultivated land.

Before the reform and opening up, the planned economy accumulated surpluses through the price gap between industrial and agricultural products (by adopting the collective agricultural management model to reduce the transaction costs for the state to purchase grain). After the reform and opening up, it accumulated a large amount of surpluses through the price gap between urban and rural land.

(1)Local governments obtain the remaining funds by levying agricultural collective land and changing the land use.

(2)Local officials have KPI targets related to GDP, and they also have the desire to compete with other regions in attracting investment.

(3)By using the surplus funds obtained from residential land, the local government can offer large tracts of land to industries at a low price

Land transaction prices in the top 100 major cities in 2021: The average floor price of residential land was 5,663 yuan per square meter; the average floor price of commercial and service land was 2,421 yuan per square meter; the average floor price of industrial land was 291 yuan per square meter.

The government accumulated funds for industrialization through the price difference between urban and rural land, creating a miracle in China's industrial development speed. However, there are also some problems.

The rapid industrialization overly relies on the low-cost input of factors (land and labor), with the low-cost industrial land coming at the expense of high-priced housing and commercial land in the city center, which restricts the transformation of high-end service industries.

Widening gap between the rich and the poor, restricting further expansion of the market scale and leading to industrial overcapacity.

Land capitalization: land transfer fees + land mortgage financing

Before the revision of the "Budget Law" in 2014, local governments were not allowed to borrow money. How could they obtain financing through land mortgage?

Local governments established LGFVs, injected land funds into these companies, and then had the LGFVs mortgage the land to banks for financing.

After obtaining the money, the LGFVs carried out infrastructure investment in accordance with the requirements of the local government.

Since 2009, the model where local governments used LGFVs to conduct land mortgage financing began to expand rapidly.

As farmers' awareness of their rights has increased and cities have begun to support rural areas, the surplus of land transfer fees that local governments can freely allocate has begun to decline.

To counter the global financial crisis, it was necessary to boost domestic demand and thus the "4 trillion" stimulus policy was adopted.

The rapid growth of credit reflects the change in China's economic growth model: when the surplus from land sales declined, local governments began to drive local economic growth through the model of financing by land mortgage.

2.4 The issues and reforms of land finance

2.4.1 The gap between urban and rural areas has widened.

Normal sources of income: property income, wage income

For rural workers who have moved to cities for employment:

property income

The agricultural land in rural areas, as idle land resources, has seen a separation of the contracting rights and the operating rights. This has made the process of confirming ownership more difficult and has also resulted in a lack of the ability for collateral or guarantee.

Rural construction land, especially residential land, basically only has residential functions and no market trading functions. As a result, farmers' property income is restricted.

wage income

Compared with the urban registered population, the welfare benefits of migrant workers have a certain gap. Therefore, they will minimize current consumption expenditures and increase precautionary savings.

Farmers, with meager land acquisition subsidies, find it difficult to afford houses in cities, resulting in a slow process of the migrant workers' integration into urban society.

On the one hand, it has hindered the expansion of domestic demand; on the other hand, it has widened the gap between urban and rural areas.

In the future, local governments need to transfer more of their financial or land surpluses to the migrant worker population.

rural revitalization strategy

common prosperity for all

In essence, it is the cities that are benefiting the countryside.

The revision of the "Land Management Law" in 2019 has significant implications for the improvement of the land expropriation system.

Breaking away from the "expropriate-then-allocate" model, eligible collectively-owned construction land and state-owned construction land can now directly enter the market on an equal footing with the same rights and prices.

The efficiency of land supply from rural areas to cities is further enhanced through reducing administrative procedures.

Breaking the monopoly of local governments in the primary land market and transfering some of the benefits to farmers.

More fully leveraging the decisive role of the market in the allocation of land resources, and promoting the rationality of land distribution between urban and rural areas.

When collective land is put into the market, it is necessary to determine the share of farmers in the collective land. The collective land will be leased to merchants for operation, and farmers will receive dividends annually.

2.4.2 Boosting economic growth through debt

The "closed-loop" model of current economic growth

S1: Turn the wasteland into developable land and use land mortgage financing to develop infrastructure.

S2:Using infrastructure projects as a bargaining chip to attract investment

S3:Successful investment promotion has led to the introduction of excellent enterprises.

S4:The entry of the core enterprise leads to the entry of the upstream and downstream industrial chains.

S5:Talents are continuously flowing in.

S6:After talents move in and purchase properties in the local area, it further boosts the land value.

S7:Sell the land as collateral to continue developing infrastructure.

The infrastructure projects funded by land mortgage financing lack effective sources of repayment. How can repayment be guaranteed?

(1) With the entry of core enterprises and the establishment of the industrial chain, the economic scale expands and tax revenue increases.

(2) As long as the land appreciates in value, the repayment issue won't be a problem.

(3) Even if the project has no cash flow, as long as refinancing continues, new funds can be borrowed to replace the old ones.

This growth model is overly dependent on the real estate sector.

The stability of the financial system is not based on the projected cash flow of infrastructure projects, but rather on land.

As the most important collateral for the credit expansion of financial institutions, land prices are highly correlated with the stability of the financial system.

As long as the land prices are expected to remain stable, even if the loans issued turn bad, financial institutions can still deal with the situation by auctioning off the land. In this way, the financial risks can be relatively easily managed.

Therefore, the most ideal outcome of implementing the "housing for residence, not for speculation" (房住不炒)policy is to ensure the stability of the real estate market and prevent the disruption of the expectation of stable land prices. The most desirable regulatory result is to make the return rate of real estate and the return rate of the real economy match.

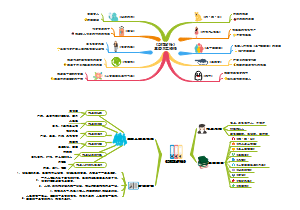

Lecture Three: Globalization

3.1 The background and origin of globalization

After the end of World War II, various countries took a series of measures to rebuild production and restore the economy. Trade activities began to become increasingly frequent.

Carrying out internationalized specialized production based on comparative advantages is conducive to maximizing the interests of all countries - this is the fundamental driving force for the development of economic globalization.

David Ricardo's theory of comparative advantage

Since the 1970s, the process of globalization accelerated.

Food crisis: During the period from 1972 to 1974, due to natural disasters, global grain production decreased significantly.

Countries like the Soviet Union entered the international market and made large-scale purchases of grain, causing global food prices to rise.

Oil Crisis: The 1973 Middle East War and the 1978 domestic unrest in Iran led to two global oil crises.

Developed countries were in a stage of rapid industrial development. The increase in oil prices led to a significant increase in the cost pressure on enterprises, prompting capital to be transferred to locations with lower costs.

The fundamental reason for globalization: The rising wage costs in developed countries have led to an acceleration of capital flowing to developing countries with large labor forces and low costs.

The issue of rising labor costs in the United States

In the early stage of the Cold War, the Soviet Union, through its planned economic system, vigorously developed industry and agriculture, attracting a large amount of capital, scientists, and labor from the United States.

Under external pressure, the United States was forced to enhance labor welfare (by increasing taxes on the wealthy class)

The workers' benefits have seen an unprecedented increase, reaching their peak in the 1970s.

High labor costs and insufficient real returns, but as long as the macroeconomy continues to grow, there is still profit potential and it can persist. However, the arrival of the food crisis and the oil crisis has disrupted this balance.

Wages and prices were spiraling upwards, making it extremely difficult for factories to operate.

The inflation rate and unemployment rate soared, while corporate profits declined significantly .

The development of technology had reached a bottleneck stage, and there were no new growth points.

Entrepreneurs had to look for places with lower costs, especially lower labor costs, and relocate their industries there.

Path of industrial transfer:United States--Japan、Germany--The Four Asian Tigers--Mainland China--South East Asia, South Asia

The manufacturing industry was shifting outward, and the industrial sector of the United States is gradually becoming "hollowed out"(空心化).

The government's tax policies returned to normal, with the tax burden for the wealthy reduced. However, the good times for American workers had gone forever.

JD Vance:Hillybilly Elegy

3.2 First element of globalization: The demographic dividend

Starting from the 1990s, especially after joining the WTO, China took on the majority of low-tech and labor-intensive industrial transfers from overseas, thus becoming the "world factory".

On the one hand, the external demand obtained through joining the WTO contributed to the release of domestic production capacity potential.

On the other hand, China's abundant and highly productive labor force has become the most powerful driving force for the rapid improvement of the entire manufacturing industry supply chain system.

There were three waves baby booms after the founding of PRC.

(1)In the early 1950s, right after liberation

(2)After the end of the three-year difficult period in 1962

(3)The 1980s and 1990s

During this period when China took on overseas production tasks, the overall population structure became younger, and the abundant labor force provided a large number of fresh forces for the development of domestic manufacturing industries.

Why not India, Bangladesh and Africa?

After the founding of PRC, basic education was rapidly extended across the country, enhancing the human capital level. Therefore, China had both "quality" and "quantity" advantages in participating in the globalization process.

The planned economy era laid a solid industrial foundation, and a large number of workers were familiar with and knowledgeable about industry.

China emerged successfully at the end of the 20th century and took the lead in taking over the industrial transfer from the "Four Asian Tigers", developing a complete manufacturing industrial system and becoming one of the world's three major manufacturing centers.

3.3 Second element of globalization: Investment attraction

After the Reform and Opening up, under the guidance of a series of documents issued by the central government to attract foreign investment, local governments competed to introduce policies that were more favorable and more generous in attracting foreign investment.

Under the assessment system based on GDP, local governments were in a competitive relationship. In terms of attracting foreign investment, in order to gain a comparative advantage, the competition among local governments was extremely intense.

The demographic dividend combined with policy incentives had jointly driven the rapid growth of FDI. Especially after China's accession to the WTO, the import and export trade channels between China and the international market became more smooth, and the capital aggregation effect of China in the global market became more prominent. The pace of opening up to the outside world had also accelerated.

3.4 What problems have been brought about by globalization?

Initially, China engaged in international division of labor mainly in low-end production stages. By taking advantage of the relatively low prices of production factors such as labor and land, China achieved rapid expansion of exports, but this led to overcapacity and the problem of low-end duplication.

Insufficient innovation and inadequate protection of property rights

The root cause: Under the assessment system based on GDP, China's industrial structure is overly fragmented. This has affected the mode of enterprise development and expansion, forcing enterprises to expand production capacity, compete on price and resources, and drive competitors out of the market, thereby seizing market share.

Each region has a complete industrial structure, but it is difficult to achieve effective resource integration, and it is also difficult to carry out large-scale innovation. As a result, they can only maintain a low-end position.

With the changes in the international situation and the development of China's economy and society, this kind of overcapacity and low-end repetitive industrial structure has become unable to meet the actual conditions of the country.

(1)The overarching logic of globalization has undergone a change.

As the high welfare benefits for workers in developed countries have disappeared, the gap between the rich and the poor has gradually widened. To narrow this gap and maintain social stability, a rebalancing of the production sector is needed.

Trump's plan for manufacturing reversion?

(2)China has gradually established an export-oriented economic growth model, which has made the domestic economy overly sensitive to changes in the international market situation.

e.g. The 2008 crisis and the "4 Trillion Yuan" plan; 2020-2022 period of the COVID-19 pandemic

In the long run, "anti-globalization" is accelerating the reconfiguration of the global industrial chain, and the industrial chain strategies of multinational enterprises are shifting from "prioritizing efficiency" to "prioritizing security".

Under the process of industrial chain restructuring, some countries will promote the localization of their industrial chains, thereby reducing their trade demands with other countries.

External demand gradually shifted towards domestic demand. China should accelerate the establishment of a new development pattern where the domestic circulation plays a leading role and the domestic and international circulations reinforce each other.

At the import end, with the intensification of trade protectionism, the "choking" problem of high-end components has emerged. China need to accelerate the strengthening of domestic substitution and enhance the independent control capabilities in core areas.

With the weakening of the demographic dividend and the increase in labor costs, the low-end and low-priced export model will no longer be sustainable.

3.5 How to resolve the problem?

3.5.1 Make full use of the advantages of the demographic quality dividend

The coverage of basic education in China has reached or exceeded the average level of middle- and high-income countries.

How to effectively leverage the quality advantage of the population to promote economic growth?

Forming a high-end industrial chain and attracting high-quality job seekers

Currently, there are not enough positions available for high-quality talents.

Further strengthen the advantage of China's demographic quality dividend and enhance the overall educational level of the nation

Industrial upgrading and the demographic quality dividend are mutually reinforcing and mutually promoting.

3.5.2 Disposal of low-end production capacity and substitution with high-end imports

Continuously deepen the supply-side reform of low-end production capacity, and promote independent innovation and import substitution in high-end industries

Supply-side structural reform should be carried out in a gradual and orderly manner. If the efforts are too intense, it will lead to a large number of unemployed workers.

Industrial policies should support the healthy and sustainable development of core manufacturing industries.

3.5.3 Utilize the pricing function of the capital market

Chinese enterprises mainly obtain financing through indirect financing methods such as bank loans.

Bank credit provides insufficient support for the strategically important emerging industries that are under the focus of national development.

The capital market focuses on the long-term growth potential and stability expectations, which is more beneficial for the development of emerging industries.

The continuous accumulation of residents' wealth in our country has created a significant demand for investment, thus providing ample room for the development of the capital market.

Lecture Four: Leverage

4.1 Leverage of public sector

Government leverage ratio = Total government debt (central + local)/GDP

The reasons for the government to increase its leverage

On one hand, central government could regulate economic development through fiscal policies.

On the other hand, local governments use debt to promote local economic development and meet the strict GDP targets set by the government.

After 2008, the proportion of local government fiscal revenue was only about half, but the proportion of fiscal expenditures it undertook accounted for 85%.

The changes in the government's leverage ratio in our country have mainly gone through two phases.

(1)Before 2009, the central government's practice of issuing bonds and increasing leverage was the main factor contributing to the rise in the leverage ratio.

Affected by the Asian financial crisis in 1997, the Ministry of Finance proposed in June 1998 to increase 100 billion yuan in construction bonds to help restore the economy.

In 1998, the central government issued 270 billion yuan of special government bonds to replenish the capital of the four major banks.

Successfully promoted the recovery of domestic economy

(2) Since 2009, local governments have replaced the central government as the main department involved in increasing leverage.

From 2008 to 2015, the leverage ratio of local governments continued to rise, while that of the central government decreased.

The main body responsible for the task of supporting the economy through proactive fiscal policies shifted from the central government to local governments.

The issue of invisible debts of local governments deserves attention.

Local governments were not the direct borrower, so they didn't have the direct responsibility for repayment and it is not directly reflected in their accounts.

Causes?

After the implementation of the tax-sharing system reform, there was an imbalance in local fiscal revenue and expenditure, and the revenue pressure was relatively high.

The old budget law imposed restrictions on local governments' ability to issue bonds independently.

Therefore, they had to turn to other platforms, usually LGFV, to raise the funds needed for development.

Local governments establish LGFVs, inject land into these platform companies. LGFVs use the land as collateral for financing, and invest in infrastructure in accordance with government instructions, thereby driving economic growth.

Local governments provide implicit guarantees and bear final responsibilities for repayment.

There is a positive feedback relationship between land financing and urban infrastructure investment.

Local governments rely on a combination of land sale revenue and land mortgage loans to ease their budget constraints, thereby providing a large amount of financial support for urban infrastructure expansion.

The improvement of infrastructure enhanced the quality of life for residents, stimulated population aggregation and urbanization development, and subsequently drove economic growth.

The local economic development and the increase in population further drove up land prices, enabling the government to obtain more funds for infrastructure development.

Infrastructure projects usually have relatively low economic returns and slow cash flow recovery, which cannot cover the financing costs.

Relying on government guarantees and land appreciation, the leverage ratio increased steadily.

Since the "4 trillion" era, urban infrastructure construction expanded rapidly, and the amount of credit funds mobilized also increased significantly.

As the scale of generalized debt expanded, the debt pressure was acceleratingly accumulating in local government. Since 2014, the central government began to gradually standardize the borrowing methods of local governments.

In the long run, government deficits are merely one way to regulate the economy and should not become the dominant force driving economic growth.

In August 2014, the new "Budget Law" was promulgated, for the first time allowing local governments to exercise greater autonomy in borrowing and integrating local government debt management into the budget system.

In September 2014, the State Council issued Document No. 43, officially kicking off the process of regulating local government borrowing activities.

(1)Clearly define the boundaries between government and enterprises, explicitly separate the government financing functions of LGFVs, and financing platforms must not undertake any new government debt.

(2)Grant local governments the authority to undertake moderate borrowing. Clearly define that local government bonds are the sole financing channel for local governments. Within the approved amount determined by the State Council and approved by the National People's Congress, local governments can issue bonds and incorporate them into budget management.

(3)The existing debts borrowed by the LGFVs should be carefully identified. Those for which the local government is responsible for repayment can be replaced by issuing local bonds.

(4)Promote the PPP model to mobilize social capital to participate in infrastructure and public service provision

As the pressure to maintain stable growth increased in 2015, the newly introduced policies were slightly relaxed without violating the major premise of "clearly demarcating the boundaries between government and enterprises".

Regarding the PPP model

Previously, the regulations stipulated that the social capital partner should not include the LGFVs affiliated with the current level of government and their wholly-owned SOEs.

As the pressure to maintain stable growth intensified, the document No.42 issued in 2015 relaxed the criteria for identifying the private sector partners in PPP projects.

For those enterprises that have established a modern enterprise system and achieved market-oriented operation, provided that the local government debts they are undertaking have been included in the government's fiscal budget, properly handled, and it has been clearly announced that they will no longer undertake the function of local government debt financing in the future, they can participate as social capital in local government and social capital cooperation projects. Through signing contracts with the government, the relationship of responsibilities, rights and interests can be clearly defined.

This loosening has provided local governments with an opportunity to expand their debts by leveraging financing platforms, using PPP projects that are ostensibly equity but actually debt-based, with large amounts of equity and small amounts of debt as the vehicle.

The local debt problem has not been resolved; instead, it has become even more complex in structure, with more concealed leverage and less transparency in the debt.

After 2016Q4, the effect of stabilizing growth became apparent. The central government began to correct the behavior of local governments frequently exceeding the bottom line of Document No. 43 and providing illegal guarantees, which increased the debt burden of local governments.

4.1.1 Regulation of local governments and LGFVs

In 2017, six ministries and commissions jointly issued Document No. 50, which explicitly reaffirmed that local government bonds are the only legitimate means for local governments to incur debt. It prohibited local governments from providing various forms of implicit guarantees to urban investment companies and banned projects involving fake equity but real debt (明股实债)

In 2017, the Ministry of Finance issued Document No. 87 to regulate government procurement of services (政府购买服务) through a negative list approach (supplementing Document No. 50). It clarified three fundamental principles for government procurement of services: 'basic services,' 'budget approval before procurement,' and 'inclusion in the guidance catalog.' Additionally, it outlined a negative list specifying what must not fall within the scope of government procurement of services

Compelling local governments to promote standardized PPP models in these sectors.

The CSRC's Document No. 89 of 2018 clearly stated that it supports local governments in piloting the issuance of project income special bonds within the scope of special bond quotas, in areas where the project income and financing can achieve self-sufficiency.

Open the main entrance, block the side entrances, promote the separation of the LGFVs from its role as a government financing agency, transform them into a public welfare or commercial enterprises, rely on the company's own operating income to repay debts, and strive for a balance between project returns and financing.

4.1.2 Regulation of financial institutions

The intensified financial regulatory measures implemented since 2017 (including the new interbank business regulations and asset management rules) have established standards for practices such as implicit guarantees, pooled fund operations, and non-standard asset investments.

In 2021, the CBIRC issued Document No. 15, which reiterated the prohibition against incurring local government implicit debt in any form. It specifically restricted banks' working capital loans (流动资金贷款)by prohibiting them from providing such loans to clients carrying local implicit debt, nor allowing them to offer supporting financing for these clients' participation in local government special bond projects

Gradual replacement of existing debts

The ultimate goal of local governments' borrowing is to promote economic growth. In the past, due to loose budget constraints, the sole focus on GDP, and the lack of supervision, a large amount of implicit debt was accumulated. On one hand, this led to heavy debt-reduction pressure on local governments. On the other hand, the risks hidden behind the debt and the insufficient efficiency of government investment deterred private capital, all of which hindered the formation of effective social investment.

4.2 Leverage of enterprises

The macro corporate leverage ratio = Non-financial corporate debt balance / GDP = (Corporate debt / Corporate total assets) * (Corporate total assets / GDP) = Microscopic debt ratio * 1 / Total asset output rate

Therefore, if an enterprise can increase its total asset output ratio through borrowing (for example, by implementing technological upgrades and equipment innovations to enhance output), then the increase in the macro leverage ratio will be lower than that of the micro leverage ratio. On the contrary, if a company has a low debt-raising efficiency and the funds raised fail to enhance the output efficiency of the enterprise, this will lead to a deterioration in the total asset output rate, and further increase the macro leverage ratio.

The changes in the macro leverage ratio of the non-financial enterprise sector in our country

Phase 1: Before the 2008 crisis, the leverage ratios of enterprises fluctuated upward, but the increase was relatively small.

During this period, China's economic performance was excellent, and after joining the WTO, it experienced a period of rapid development.

During the economic upswing period, the demand and ability of enterprises to borrow money increased, while the capacity utilization rate and input-output ratio of enterprises also remained at a relatively high level.

Phase Two: From 2009 to 2016, the leverage ratio of enterprises rose significantly, and when compared horizontally, it was notably higher than that of other countries.

Usually, when the production and operation environment deteriorates, enterprises will start to reduce their production capacity, actively reduce debts and deleverage.

However, the Chinese enterprise sector is mainly composed of SOEs, which largely undertake social responsibilities and serve as an important vehicle for local governments' macroeconomic regulation.

After the crisis, under the "4 trillion" policy, although private enterprises began to deleverage, SOEs started to increase leverage. However, at this time, expanding production not only failed to improve the production efficiency of enterprises, but also led to an overcapacity in the market, causing a further decline in the production efficiency of SOEs and further increasing the macro leverage ratio.

The increase in debt scale combined with the decline in production efficiency jointly drove the rapid rise in the leverage ratio of non-financial enterprises during this period, and also brought huge potential risks to the real economy.

In 2015, the Chinese central government first proposed the supply-side structural reform(供给侧结构性改革), advocating the 'Five Priority Tasks' of cutting overcapacity, reducing excess inventory, deleveraging, lowering costs, and strengthening areas of weakness(三去一降一补) .

Phase Three: After 2017, encouraging enterprises to gradually enter the stage of deleveraging.

The central government strengthened the regulation of local governments' borrowing activities and issued a series of supervisory regulations for LGFVs.

Improve the production efficiency of state-owned enterprises (through supply-side structural reform), reduce ineffective supply and expand effective supply, and strive to enhance the quality of the entire supply system.

The reform of SOEs was accelerating. Through means such as mergers and reorganizations, mixed-ownership reforms of state-owned enterprises, and elimination of outdated production capacity, the efficiency of SOEs was enhanced.

Reduce the debt of SOEs

4.2 Leverage of household sector

Resident leverage = Debt of the resident sector / GDP

The increase in housing prices has driven up the leverage ratio of the household sector.

Before 2008, the leverage ratio of the household sector remained on a slow upward trend overall.

After 2008, the household leverage ratio showed a significant increase.

Since 2015, the central government initiated supply-side reform and adjusted the economic structure. The upward trend of the leverage ratio of non-financial enterprises was significantly curbed, but the leverage ratio of the household sector continued to rise and even accelerated.

The increase in the household leverage ratio was largely due to the continuous growth of the mortgage loan scale of residents.

The leverage ratio of the resident sector in China is at a relatively high level and its growth rate is also among the highest globally.

The debt burden of the household sector can be analyzed through the ratio of household sector debt to disposable income to assess the debt repayment pressure of the household sector.

After the financial crisis, the debt-to-disposable-income ratio of the household sectors in Europe and the United States remained stable or even declined.

However, the debt repayment burden of Chinese residents has seen a rapid increase (as the growth of residents' income failed to keep up with the increase in housing prices)

At present, the overall debt burden of Chinese residents has surpassed that of several developed economies such as the United States. The hidden risks involved require attention.

On one hand, the principle of "housing for residence only" should be adhered to and the stable development of the real estate market should be maintained. On the other hand, through supply-side reform, the ability of technological innovation should be enhanced to accelerate economic transformation.

Lecture Five: Real Estate

5.1 The externality of land finance

5.1.1 Positive externalities of land finance

Although the cash flow from infrastructure projects is relatively slow, in the long run, it is beneficial for reducing enterprise costs and facilitating the geographical connection of the national market.

The reduction in costs contributes to the improvement of enterprises' profitability, enabling to achieve better development.

The subway project has stimulated economic development along the line, facilitated residents' lives, and enabled the rise in property prices in the surrounding areas, thereby facilitating the mobilization of a larger scale of credit.

The well-developed logistics system and network infrastructure have enabled the rapid development of the e-commerce industry.

5.1.2 The crowding-out effect of high housing prices

Local governments have provided low-priced industrial land for attracting investment. To obtain land revenue, they usually sell residential and commercial land at high prices.

Essentially, it is the commercial and residential sectors as well as high-end service industries that are continuously subsidizing capital-intensive industries such as large-scale projects and local large SOEs.

Firstly, it curbed household consumption

During the period of rapid economic development, the land finance policy has driven the rapid growth of various sectors such as manufacturing and infrastructure. The residents' income has increased significantly. Coupled with the wealth effect brought about by the rising housing prices, it can thus promote residents' consumption.

As the economic growth rate slows down, the growth of residents' income also slows, but housing prices continue to rise. The increase in residents' income fails to keep up with the increase in housing prices, and the impact of rising housing prices on residents' consumption has gradually shifted from the previous wealth effect to the crowding-out effect.

Secondly, it crowded out high-end service industries

On demand side: High housing prices have squeezed out residents' consumption, restricting consumption upgrading and resulting in insufficient demand for high-end services.

On supply-side: High housing prices have increased the operating costs of high-end service industries.

If the costs of production factors in the manufacturing sector increase, they can relocate to other areas. However, the service industry is highly dependent on commercial centers. Therefore, it can only be located in areas with dense populations and high housing prices.

Thirdly, it crowded out the space for the survival and development of manufacturing industry

On demand side: High housing prices squeeze out residents' consumption, making it difficult for manufacturing enterprises to open up the domestic market. The slowdown in global economic growth, coupled with the "anti-globalization" trend, has led to a double decline in both domestic and external demand, which is not conducive to the expansion of manufacturing enterprises.

On supply-side: With the development of the economy, the original competitive advantage of China's manufacturing industry, which had a low cost of production factors in the international division of labor, has gradually weakened.

The increase in housing prices has led to a rise in living costs, and has also pushed up wage levels by hindering labor mobility and reducing the growth rate of labor supply, thereby shrinking the profit margins of the manufacturing industry.

Furthermore, high housing prices will also lead to a misallocation of resources, causing more resources to be excessively concentrated in the real estate sector and its related industries.

The pursuit of high returns in the real estate sector by the manufacturing industry has led to the suppression of enterprise innovation and research and development expenditures, resulting in a decline in the long-term competitiveness of enterprises.

How to effectively control the rise in housing prices, maintain their stability, and thereby stimulate domestic demand and achieve economic transformation and upgrading has become an issue that must be addressed in the process of economic development.

Solution: Establishing a long-term mechanism for the real estate sector

Long-term mechanism: Through structural adjustments in supply and demand, promote long-term balance in the supply and demand of the real estate market. Adhere to stabilizing land prices, stabilizing housing prices, and stabilizing expectations, maintain stable housing prices or promote a reasonable return of housing prices, stabilize fluctuations in the real estate market, meet residents' housing needs, and restore the essence of housing as a place for living.

5.2.1 Land supply: Control the total amount, rationalize the structure and rhythm

Controling the total amount: Land Ticket System

Reclaim the idle land in rural areas that has been left uncultivated due to population outflow into farmland. As long as the newly approved construction land area in cities is smaller than the reclaimed farmland, it will not only adhere to the farmland red line but also expand the supply of construction land for urban development.

Through land ticket transactions, new sources of income are created for rural residents who move to cities, serving as the cost for settling down.

Controling structure

The excessive proportion of industrial land and the insufficient supply of housing land exhibit a structural imbalance. Having too much industrial land but with low output inevitably leads to waste.

The land supply structure should be reasonably planned based on the population and mobility trends of the city, as well as the city's industries and its ability to generate GDP.

There is a structural imbalance in the supply between core large cities and smaller cities.

The land supply structure should be planned based on the urban industrial layout and the trend of population mobility.

In first- and second-tier cities, the land supply for residential areas can be appropriately increased. At the same time, idle and vacant houses should be revitalized.

In third- and fourth-tier cities, the supply of real estate land should be controlled, and efforts should be made to accelerate the disposal of housing inventory.

Optimization of supply structure

Implementing centralized land supply to cool down the land auction market.

5.2.2 The financial system: the upper limits on banks' real estate mortgage concentration ratio + the 'three red lines' policy for property developers

The real estate industry has excessively seized financial resources, but its contribution to output has failed to keep up. There is a significant imbalance in the financing structure.

(1)The industry, driven by the increasingly high leverage, expanded blindly, which contributed to the housing price bubble.

(2)The excessive financial credit extended to the real estate sector has led to capital 'diverting from the real economy to the virtual economy,'(脱实向虚) resulting in reduced credit availability for other sectors and a deteriorating financing environment for small and medium-sized enterprises (SMEs)

The excessive allocation of bank credit to the real estate industry has increased the difficulty for the country in regulating the economy.

Since 2012, regulatory restrictions have been relaxed, ushering in the era of large-scale asset management. Various types of asset management financial products have emerged one after another. The original intention of the policy was to guide residents' savings into the real economy. However, through various financial innovations and multiple layers of nesting, the funds ultimately still flowed into real estate and infrastructure.

To curb excessive financing in the real estate industry, the government has implemented new policies for both banks and real estate developers, the two parties involved in the real estate leverage.

5.2.2.1 Banks:management on real estate mortgage concentration ratio

At the end of December 2020, PBOC and CBIRC issued the "Notice on Establishing a Management System for Real Estate Loan Concentration of Banking Financial Institutions", setting upper limits for the proportion of real estate loans and personal housing loans for five types of institutions, and giving banks that exceeded the limits a 2-4 year period for excessive rectification.

Reduce the lending willingness of banks to the real estate industry from the supply side and optimize the credit structure

5.2.2.2 Real estate developers: The "three red lines" to keep leverage within a reasonable range.

Background of introduction: The "fast turnover" business model of real estate enterprises

Real estate developers acquire land and accelerate new project launches to meet pre-sale requirements, then put the projects on the market for pre-sale

After receiving the advance payment, due to insufficient strict supervision of the advance payment, when real estate developers withdraw the advance receipts in advance, they will not accelerate the construction and delivery process, but instead start a new round of "land acquisition - new construction - advance sale" procedures.

By doing so, the company can rapidly expand its scale, which is conducive to obtaining larger-scale financing in the future.

The prerequisite is that residents are willing to purchase pre-sale properties, and their expectation of rising housing prices remains unchanged.

Under the "fast turnover" model, the leverage of real estate enterprises has been increasing continuously. Once there are problems with the capital chain (such as poor sales performance and unfavorable capital turnover), it may trigger a series of economic and social issues, and at the same time cause damage to the asset quality of the financial system, potentially leading to systemic risks.

As the housing supply in some cities becomes excessive, sales continue to decline, and the external financing conditions tighten, the phenomenon of unfinished projects has occurred frequently.

In August 2020, the Ministry of Housing and Urban-Rural Development and the People's Bank of China held a meeting for key real estate enterprises, setting out "three red lines" regulatory requirements for real estate financing.

(1)The debt-to-asset ratio excluding prepayments should not exceed 70%.

(2)Net debt ratio should not exceed 100%

(3)The ratio of cash to short-term liabilities must not be less than 1.

property developers are categorized into four tiers based on their compliance with the metrics:

Red Tier: In breach of all three red lines — Barred from increasing interest-bearing debt

Orange Tier: In breach of two red lines — Annual debt growth capped at 5%

Yellow Tier: In breach of one red line — Annual debt growth capped at 10%

Green Tier: Compliant with all three red lines — Annual debt growth capped at 15%

Policy effect: Since 2022, the real estate industry has entered a downturn period. The financial flow of real estate enterprises has become increasingly strained, and their willingness and ability to invest and acquire land have both weakened.

5.2.3 Parallel Development of Housing Rental and Sales (租售并举): Develop and improve the rental market and build a multi-level housing supply system.

The housing rental market in China has long been neglected.

· Chinese people have an obsession with buying houses and believe that real estate can retain and increase its value.

· Real estate enterprises are reluctant to develop rental housing (the rental income cash flow is small and slow, and it is not as quick and direct as selling houses).

· Renters do not have property rights and may not be entitled to the same social security and welfare benefits such as education and medical care.

· In the rental market, there are relatively few specialized operating institutions. The vast majority of rental properties are in the hands of individual landlords, resulting in an overly fragmented market.

Promoting parallel development of housing rental and sales, and increasing the supply of rental housing.

First is for the government to improve the public rental housing and affordable rental housing systems to meet the demand for stable housing.

The government can raise the funds needed for building rental housing by issuing REITs.

Second is to cultivate specialized housing rental operation enterprises.

(1)An intermediary agency that does not own the property rights but only provides rental and housing services - integrates the scattered housing resources of individual landlords, expands diversified supply, and improves rental efficiency

(2)Real estate developers engage in the business of renting out commercial housing.

Implementing equal rights for renting and selling

5.3 A different real estate cycle

Historical experience: The prosperity of the real estate sales market is closely related to government policies.

Relaxing purchase restrictions and lowering mortgage interest rates - the real estate market would recover

Introducing policies to tighten restrictions on home purchases and lending - the real estate market would weaken

In the second half of 2020, following the implementation of a series of regulatory policies such as the "three red lines", the real estate market cooled down. Housing prices and sales area both declined year-on-year and even turned negative.

Starting from the second half of 2021, the economic pressure began to increase. To stabilize the economy, the real estate regulation began to show a marginal relaxation.

On the demand side, local governments are implementing city-specific policies to stimulate the housing market. These measures include: lowering mortgage rates and down payment ratios; easing or lifting home purchase restrictions; increasing the cap on housing provident fund loans; relaxing household registration (hukou) requirements, which in turn lowers the threshold for purchasing property.

On the supply side, the government has prioritized ensuring the delivery of pre-sold homes to restore market confidence. Furthermore, it has rolled out a "three-arrow" strategy (comprising credit, bonds, and equity financing) to provide liquidity support for real estate developers and ease their financial strain.

However, after this round of relaxation, the market did not stabilize and recover. In 2022, housing prices and sales data remained in a negative growth range.

Why is the public not buying it?

Firstly, people's wallets have become tighter.

The debt of residents has reached a relatively high level.

The slowdown in economic recovery, coupled with unstable employment, has undermined future income expectations. As a result, residents have reduced current consumption and increased precautionary savings to prepare for unexpected situations.

Secondly, the credit risk incidents of developers have aroused a strong sense of risk aversion among residents.

The tightening of external financing and the sluggish sales situation have further exacerbated the financial pressure on real estate companies, resulting in delays in the delivery of some projects.

Residents' trust in real estate developers has dropped to an all-time low. Many are adopting a wait-and-see attitude and are only willing to purchase existing properties.

Thirdly, the expectation of rising house prices has disappeared.

In the short term, the credit risks of real estate enterprises, policy adjustments, and the downward pressure on the economy all combine to undermine residents' expectations for rising house prices, especially in the third- and fourth-tier cities.

The LPR has been repeatedly lowered. Due to the time lag between the "re-pricing date" of personal mortgage loans and the changes in policy interest rates, the difference in interest rates between new and old loans has widened. Residents have taken the initiative to repay their loans in advance to avoid high interest payments.

The contraction of mortgage loans, which are high-yield and stable quality assets of banks, directly affects the bank's profit situation, thereby influencing its ability and willingness to provide credit, and leading to a decrease in the effectiveness of monetary policy.

In the long term, factors such as an aging population, low birth rates, and a slowdown in urbanization mean that future housing demand will decline, and there will be no impetus for housing prices to rise.

Why have the "three red lines" failed to achieve the desired effect?

The root cause of the current credit risks faced by real estate enterprises lies in the previous fast-turnaround strategy, which pushed up the leverage ratios of these enterprises and led to a large-scale expansion of their operations.

The trigger that causes risks for real estate companies is the decline in property sales. The poor collection of sales proceeds further exacerbates the financial strain on these companies, ultimately leading to inability to repay debts and delaying the project delivery schedule.

If internal financing weakens while external financing becomes more stringent, the situation will undoubtedly deteriorate for developers already under financial strain. The more regulatory thresholds a firm violates, the greater its funding pressure becomes, necessitating more capital support to resolve its debts.

The tightening of policies has accelerated the exposure of credit risks for real estate companies, causing financial institutions to be even more reluctant to lend money to these companies.

At the level of people's livelihood, many real estate projects are facing difficulties in delivery, falling into a vicious cycle of "high financial pressure - project suspension - residents' concerns over the delivery of pre-sale properties, reduced home purchases - further increase in the pressure to recover funds - larger-scale suspension - further decline in sales".

In July 2022, the Political Bureau meeting set the task of "stabilizing housing delivery and protecting people's livelihoods". Various departments have successively introduced multiple policies for "stabilizing housing delivery" and "protecting real estate enterprises".

In 2023, the construction area completed saw a significant year-on-year increase, indicating that the "rescue of housing projects" has made some progress. However, the financial pressure on real estate companies has not improved significantly, and the sales of new houses remain sluggish. The local land revenue also declined year-on-year.

How will the real estate industry develop in the future?

(1)The fast-turnaround strategy is no longer sustainable. Future sales will mainly rely on the sale of existing properties.

The cycle of the real estate project will be extended.

(2)The real estate market will enter an era dominated by SOEs

In the long run, the policy of "housing for residence, not for speculation" remains firmly in place.

In the short term, the lack of trust in pre-sale housing sales, the increased uncertainty in the income end of residents, and the high level of household leverage all contribute to a decline in the demand for housing purchases by the household sector.

In the long term, the growth rate of the Chinese population eligible for home purchases is gradually declining, and the slowdown in the urbanization process means that there is an upper limit to the potential new purchasing power.

In the past, our country has frequently used real estate as a means to stimulate the economy. After years of development and construction, the current supply of housing has largely been able to meet the housing needs of the majority of people.

Real estate is a pillar industry of the national economy. Instability in the real estate sector can easily lead to widespread consequences. The future regulatory direction should focus on ensuring the stable operation of both the economy and the real estate market. This means not only controlling housing prices from rising but also avoiding significant fluctuations in the market.

Measures should be taken to establish and improve a long-term mechanism for promoting the stable and healthy development of the real estate market.

Lecture Six: Finance

6.1 Before 2012: The Era of Interest Rate Control

Before 2012, China's interest rates were generally controlled. The central bank set the levels of deposit and loan interest rates (or within a relatively narrow floating range), and there was a relatively stable interest spread.

The bank's revenue model was relatively stable, so there was a tendency to expand its scale - provided that the non-performing loans could be controlled.

Lend money to SOEs or platform companies with soft budgetary constraints, and use land and real estate as collateral.