导图社区 价值建模与估值

- 91

- 2

- 0

- 举报

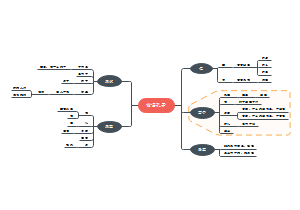

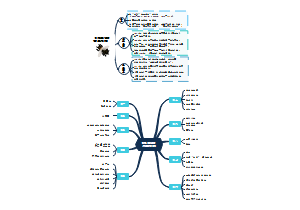

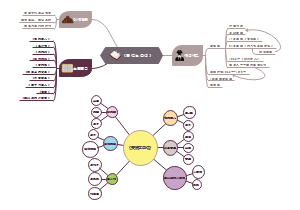

价值建模与估值

一张思维导图带你学习价值建模与估值,知识点有债券定价、期权定价、市场风险、信用风险、操作风险等,希望梳理的内容对你有所帮助!

编辑于2021-09-24 14:22:27- 债券定价

- 价值建模

- 市场风险

- 相似推荐

- 大纲

价值建模与估值

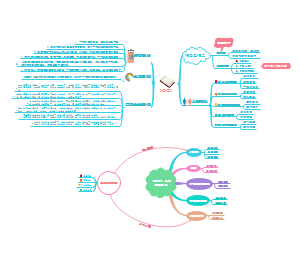

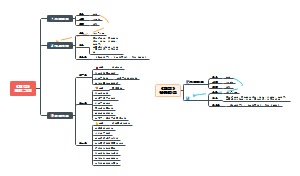

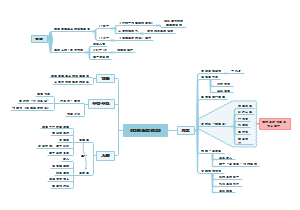

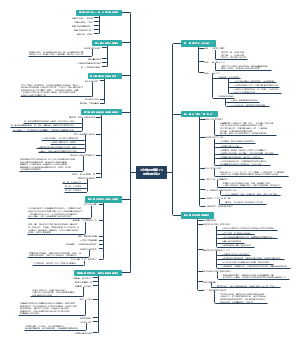

债券定价

pricing conventions, discounting and arbitrage

discount factor

d(0.5) given the present value of 1 unit of currency to ve received at the end of that term

bondreplication (运用strips的逻辑)

一价法则

spot rate= zero rate

利率

spot rate

即 zero rates

spot 与 discount factor 的关系(半年复利)

forward rate

套利法则:forward rate是收益、future realized spot rate 是成本,收>成 借短投长

maturity effects: coupon rate 比relevant(相关) forward rate 高时,bond prices与period正向

Par rate

是一种特殊的coupon rate

A(t)时disount factor 的加总

relationship between spot forward par

upward-sloping term structure:forward>spot>par

downward-sloping term structure: par>spot>forward

prcing bond using spot forward and annuity factor

半年支付一次票息下:the value of the bond c=oupon p= par

flattening and steepening term structure

flattening: longer-term rates fall by more than shorter-term rates long长期

steepening: longer-term rates increase by more than shorter- term rates long短期

bond yields and return caculation

YTM

properties of YTM

YTM与价格呈反向关系、at premium coupon rate > YTM

term structure of spot rate is upward-sloping, forward>spot>YTM

downward-sloping:YTM>spot>forward

relationship between YTM and spot rate

coupon effect

upward: YTM与coupon反向

downward: YTM与coupon正向

all else equal lower coupon rate→ higher coupon rate

coupon rate 与 duration 反向

decomposition(分解) of bond profit/ loss

carrty-roll-down

rate change

spread change

applying duration convexity and DV01

duration

macaulay duration

zero coupon>discount>premium

modified duration

=macaulay duration/(1+periodic market yield)

dollar duration

= modified duration × full price

effective duration

\

portfolio duration

hedge

DV01 and DV01 hedge

DV01=DD×1bp=MD×P×1bp

Hedge Ratio=初始头寸的DV01(per100)÷对冲头寸的DV01(per100)

duration based hedge

分母对应合约标的资产

convexity

与YTM反向

与coupon反向

与T正向(T²成比例)

callable bond and puttable bond

callable=straght bond- call option 有利于issuer

利率与其duration正向,一开始负凸性

puttable=straight bond+put option 有利于买方

利率预期duration反向,一直都是正凸性

barbell and bullet strategy

barbell 凸性较大 短+长

bullet 凸性较小 中

期权定价

modeling non-parrel term structure shifts and hedging

key rate shifts

the rate of a given maturity is affected solely by its closet key rate

forwardbucket shifts

一个bucket上移1个bp

二叉树

风险中性概率

美式期权注意提前行权

BSM模型

the assumptions of BSM model

注意均值、方差服从对数正态分布

the formula without dividends

N(d1)=delta of call 1-N(d1)=-N(d1)

N(d2)=the probability that a call option will be exercised in a risk-neutral world

the formula with dividends

对S0按照相应的利率折现即可

美式期权

call一样美式put大于等于欧式put 先算欧式 再与选项对比即可

the greeks

Δ

the rate of change of the option price with respect to the price of the underlying asset

long call short put 的Δ都>0

at the money 处 Δ=0.5

Γ

the rate of change of the portfolio's delta with respect to the price of the underlying asset

long 都>0

at the money 处最大 与T反向

gamma of stocks/forward = 0(线性产品)

Vega

the rate of change of the value of the option with respect to the volatility of the underlying asset

long 都>0

与T正向 与根号T成比例

θ

到期时间

long都<0

与T反向

ρ

利率

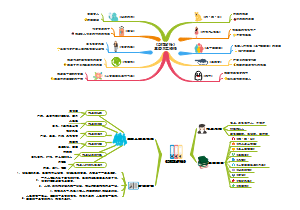

市场风险

measures of financial risk

coherent risk measures(ES)

montonicity(单调性) value高,risk低

subadditivity

homogeneity β>0, ρ(βX)=βρ(X)

translational invariance: risk is associated with the assets in portfolio

VAR

assumption

reteruns conform to a normal distributuon iid

每日波动率保持恒定(正态分布)

increase at increasing rate when degree of confidence increases

increases at decreasing rate when the holding period is longer

计算法则

平方根法则

different confidence level

expected shortfall(ES)

满足 subaddlitivity while VaR does not

tell us what to expect in bad states-it gives an idea of how bad might be-while VaR tells us nothing other than to expect a loss higher than the VaR itself

calculating and applying VaR

历史模拟法

最新一天的数据替换掉最旧一天的数据

VaR即是总天数×(1-VaR百分比)

ES即 除去VaR那一天后 最坏的数据的平均值

full revaluation method

burdensome but great advantage of accuracy

delta-normal model

只能用于线性产品 不能用于(MBS, Fixed-income securities with embedded option

蒙特卡罗模拟

providing correlations between risk factors can be defined in some way

measuring and monitoring volatiliity

参数法: imposes a specific distributional assumption on conditional asset reteruns

Historical stancdard deviation approach

use of historical time series data in order to determine the shape of the conditional distribution

EWMA

只需要前一期的收益率

、

GARCH(1,1)

是γ=0的special case of EWMA

VL是 long run average variance rate(均值回归) γ=(1-α-β)

通常用w=γVL VL=W/(1-α-β) α+β,回归速度越慢,越持久

unstable if α+β>1

非参数法:uses historical data directly, without imposing aspecific set of distributional assumptions

Historical simulation

MDE

implied-volatility based approach

优点

forward-looking(及时反映市场预测)

reacts immediately to market conditions

缺点

model independent

BSM model assume volatility is constant over the life of the option

options on the same underlying asset may trade different implied volatilities

emirical result indicate implied volatility is onaverage greater than realized volatility(隐含波动率通常更大)

信用风险

external and internal credit ratings

conditional and unconditional defuat probabilities

hazard rates

h把 is the average hazard rate between time zero and time t

the unconditional default probability between time 0 and time t is:

rating process

through-the cycle

时间长、稳定、经济好时 低估 经济差时 高高估

point-in-time

时间短

country risk

sources of country risk

GDP、political risk、legal、economic structure

impact of sovereign default

factors affecting sovergin ratings

sovereign credit sperad

操作风险

measuring credit risk

modelling credit risk capital

expected loss(ES)

the bank's capital is a buffer(缓冲器)against unexpected loss

the mean and standard deviation of credit losses

α与ρ正向关系,与根号ρ正相关

the Gaussian copula model

内部评级模型 使用映射

one-factor correlation model

相关系数少、半正定

risk allocation

对每笔信贷资产的风险进行加总

operational risk

approaches to calculate operational risk capital

basic indicator approach

三年年收入×15%

the standardized approach

分为8个业务条线,不同的业务条线给予不同的" beta factor"(18%,15%,12%)

advacned measurement approach(AMA)

8个业务条线给予7种不同类型的风险(risk sensivity 最好)

2 banks presented with the same data were liable to come up with quite different capital requirements under AMA

standardized measurement approach (SMA)

最新的方法 风险敏感且稳健(robustness)

measures to manage operational risk

loss frequency 服从泊松分布 loss severity 服从对数正态分布

estimation procedures

内外部数据结合 外部数据有可能偏大 因为只有较大的数据才会被披露

potential biases

reducing operational risk

risk control and aself assessment

key risk indicator

insurance

education and culture

stress testing

stress test looks at a much longer period wheras stress testung usually lokks at shorter period

one disadvantage of VAR and ES is that they are backward-looking

stress testing is designed to be forward-looking does not provide a probability distribution for losses

stress testing looks at relatively small number of scenarios(all bad) whereas VAR/ES looks at a wide range of scenarios(some good some bad)