导图社区 3 Financial Statement Analysis

- 96

- 6

- 2

- 举报

3 Financial Statement Analysis

根据CFA2022年考纲编写,全面覆盖原版书上重要内容,节约大量看书时间,让你高效备考,快速通过考试

编辑于2022-05-05 10:54:49- CFA

- 2024cpa会计科目第17章收入、费用和利润

2024cpa会计科目第17章,本章属于非常重要的章节,其内容知识点多、综合性强,可以各种题型进行考核。既可以单独进行考核客观题和主观题,也可以与前期差错更正、资产负债表日后事项等内容相结合在主观题中进行考核。2018年、2020年、2021年、2022年均在主观题中进行考核,近几年平均分值 11分左右。

- 2024cpa会计科目第十二章或有事项

2024cpa会计科目第十二章,本章内容可以各种题型进行考核。客观题主要考核或有资产和或有负债的相关概念、亏损合同的处理原则、预计负债最佳估计数的确定、与产品质量保证相关的预计负债的确认、与重组有关的直接支出的判断等;同时,本章内容(如:未决诉讼)可与资产负债表日后事项、差错更正等内容相结合、产品质量保证与收入相结合在主观题中进行考核。近几年考试平均分值为2分左右。

- 2024cpa会计科目第十一章借款费用

2024cpa会计科目第十一章,本章属于比较重要的章节,考试时多以单选题和多选题等客观题形式进行考核,也可以与应付债券(包括可转换公司债券)、外币业务等相关知识结合在主观题中进行考核。重点掌握借款费用的范围、资本化的条件及借款费用资本化金额的计量,近几年考试分值为3分左右。

3 Financial Statement Analysis

社区模板帮助中心,点此进入>>

- 2024cpa会计科目第17章收入、费用和利润

2024cpa会计科目第17章,本章属于非常重要的章节,其内容知识点多、综合性强,可以各种题型进行考核。既可以单独进行考核客观题和主观题,也可以与前期差错更正、资产负债表日后事项等内容相结合在主观题中进行考核。2018年、2020年、2021年、2022年均在主观题中进行考核,近几年平均分值 11分左右。

- 2024cpa会计科目第十二章或有事项

2024cpa会计科目第十二章,本章内容可以各种题型进行考核。客观题主要考核或有资产和或有负债的相关概念、亏损合同的处理原则、预计负债最佳估计数的确定、与产品质量保证相关的预计负债的确认、与重组有关的直接支出的判断等;同时,本章内容(如:未决诉讼)可与资产负债表日后事项、差错更正等内容相结合、产品质量保证与收入相结合在主观题中进行考核。近几年考试平均分值为2分左右。

- 2024cpa会计科目第十一章借款费用

2024cpa会计科目第十一章,本章属于比较重要的章节,考试时多以单选题和多选题等客观题形式进行考核,也可以与应付债券(包括可转换公司债券)、外币业务等相关知识结合在主观题中进行考核。重点掌握借款费用的范围、资本化的条件及借款费用资本化金额的计量,近几年考试分值为3分左右。

- 相似推荐

- 大纲

Financial Statement Analysis

绪论

Introduction

Roles of Financial Reporting and Financial Statement Analysis

Role of financial reporting: provide information about a company's performance, financial position, and changes in financial position for users

Role of financial statement analysis: use financial reports and other information to evaluate the past, current, and potential performance and financial position of a company to make economic decisions

Primary Financial Statements and other framework

Complete set of financial statements

Statement of financial position (i.e., a balance sheet,B/S)

公式: Assets = Liabilities + Owners' equity

Statement of comprehensive income (i.e., a single statement of comprehensive income or an income statement and a statement of comprehensive income)

Revenue + Other income –Expenses = Income – Expenses = Net income

CI(comprehehsive income)=NI(Net income)+OCI(other comprehehsive income)

Statement of changes in equity

实收资本(Paid- in capital)

留存收益(Retained earnings)

Statement of cash flows

Operating: day- to- day operations of the company

Investing: long- term assets, such as property and equipment

Financing: obtaining or repaying capital to be used in the business

Accompanying notes or footnotes to the financial statements

The basis of preparation for the financial statements

Information about the accounting policies, methods, and estimates

资产负债表是存量,其他是流量

Additional information

Management discussion and analysis [MD&A]

External auditor's report

Introductory

Scope

Opinion

Unqualified audit opinion

Qualified audit opinion

Adverse audit opinion

Disclaimer of opinion

Governance report

Corporate responsibility report

Other sources of information

Proxy statements

Interim reports (semiannually or quarterly,unaudited)

Press releases

External sources (the economy, the industry, the company, and peer (comparable) companies

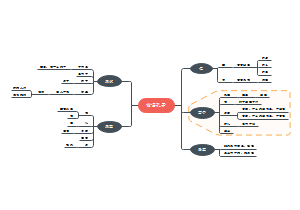

Financial Statement Analysis Framework

Articulate the Purpose and Context of Analysis(表达分析目的与背景)

Collect Data(搜集数据)

Process Data(加工数据)

Analyze/Interpret the Processed Data(分析/解释加工后的数据)

Develop and Communicate Conclusions/ Recommendations(沟通结论或推荐)

Follow- Up(跟进)

Finalcial reporting standards

Objective of Financial Reporting

Provide financial information about the reporting entity

Standard- Setting Bodies and Regulatory Authorities

Standard- setting bodies

International Accounting Standards Board(IASB)

IFRS

Financial Accounting Standards Board(FASB)

US GAAP(generally accepted accounting principles)

Regulatory authorities

International Organization of Securities Commissions (IOSCO)

US SEC (the Securities and Exchange Commission).

Objectives

Protecting investors

Ensuring that markets are fair, efficient, and transparent

Reducing systemic risk

International Financial Reporting Standards(IFRS) Framework

Qualitative characteristics of financial reports

Fundamental characteristics

Relevance

Materiality

Faithful representation

Complete

Neutral

Free form error

Enhancing characteristics

Comparability

Verifiability

Timeliness

Understandability

Constraints on financial reports

Tradeoffs are necessary

Benefits derived from information should exceed the costs of providing and using it

Balance between costs and benefits

Elements

Financial position

Assets

Liabilities

Equity

Performance

Income

Expenses

Underlying assumptions

Accrual accounting(与cash basis区分)

Going concern

Measurement of financial statement elements

Historial cost

Amortized cost

Current cost(同一资产当前价格)

Realizable(settlement) value: sell the asset in an orderly disposal

Present value

Fair value

General features and requirements

内容:四表+notes

Features

Fair presentation

Going concern

Accrual basis

Materiality and aggregation

No offsetting

Frequency: at least annunally

Comparative information

Structure and content requirements

Classified B/S: distinguish between current and non-current assets

Minimum information

On the face of financial statements

In the notes

Comparative information

Comparison of IFRS with Alternative Reporting Systems

Differences between IFRS and US GAAP

Monitoring Developments in Financial Reporting Standards

A company can reach about a new standard not yet implemented if the standard

Does not apply

Will have no material impact

Management is still evaluating the impact

The impact of adoption is discussed

总体财务分析

Understanding income statements(I/S)

Components and Format of the Income Statement

Revenue

Net revenue(adjusted for cash of volume discounts,etc.)

Net revenue=revenue-sales return&allowance

sales/turnover

Expense

group by nature: depreciation

group by function: cost of goods sold(COGS)

Net income(net earnings,profit or loss)

利润计算

毛利润(gross profit)=revenue - COGS

operating profit=gross profit - 销售、管理研发等费用(SG&A)

息税前利润(EBIT)= operating profit+ other income -other expense

税前利润(EBT)=EBIT-利息费用(interest expense

net income=EBT-所得税费用(income tax expense)

Format

Single-step

Multi-step

Revenue Recognition

Income increases in economic benefits in the form of

Inflows or enhancements of assets

Decreases of liabilities that result in increases in equity, other than those relating to contributions from equity participants

General principles

Can occur independently of cash movements

revenue is recognized when it is earned, meaning the risk and reward of ownership is transferred

Trade/accounts receivable

Unearned revenue

Accounting standards

Five steps

1.Identify the contract(s) with a customer

2.Identify the separate or distinct performance obligations in the contract

3.Determine the transaction price

4.Allocate the transaction price to the performance obligations in the contract

5.Recognize revenue when (or as) the entity satisfies a performance obligation

Factors to consider whether the customer has control of an asset

Entity has a present right to payment,

Customer has

Legal title

physical possession,

Significant risks and rewards of ownership

Accepted the asset.

特殊情况

Barter transaction

IFRS: Revenue must be based on fair value from similir non-barter transactions with unrelated parties

US GAAP: Revenue can be recoginzed at fair value only if the firm has historially transactions

Goss/net reporting

Expense Recognition

Matching principle

Period costs

计算方法

Specific identification method

FIFO

Weighted average

LIFO(只能在US GAAP下使用)

特殊情况

Doubtful accounts:

Companies make estimates based on previous experience of how much of the revenue will ultimately be uncollectible

Company records its estimate of uncollectible amounts as an expense (bad debt expense) on the income statement, not as a direct reduction of revenues

Warranties: Recognize an estimated warranty expense in the period of the sale, and to update the expense as indicated by experience over the life of the warranty

Depreciation and amortisation(long-lived assets)

Depreciation: tangible

Amortisation: intangible

Non- Recurring Items and Non- Operating Items

Discontinued operations: 利润表中以终止经营业务单独列出

Extraordinary items

IFRS prohibit classification of any income or expense items as"extraordinary"

US GAAP will no longer include the concept of extraordinary items after December 15, 2015

Unusual or infrequent items

IFRS: items of income or expense that are material and/or relevant to the understanding of the entity's financial performance

US GAAP: material items that are unusual or infrequent are shown as part of a company's continuing operations

disclosed separately

会计变更

Changes in ccounting policies

Retrospective application: the financial statements for all fiscal years shown in a company's financial report are presented as if the newly adopted accounting principle

Changes in accounting estimates

Prospectively; no adjustments are made to prior statements, and the adjustment is not shown on the face of the income statement but in the notes

A correction of an error for a prior period

Restating the financial statements for the prior periods presented in the current financial statements

Note disclosures are required regarding the error

Non-operating items

Reported separately from operating income

Under IFRS, there is no definition of operating activities

US GAAP: operating activities generally involve producing and delivering goods and providing services

Earnings Per Share(EPS)

Capital structure

Complex: a company has issued any financial instruments that are potentially convertible into common stock,for example,

Convertible bonds

Convertible preferred stock

Employee stock options

Warrants

Simple: a company’s capital structure does not include such potentially convertible financial instruments

basicEPS=diluted EPS

Basic EPS

公式

说明

Weighted average number of shares outstanding is a time weighting

Stock dividend/split

Stock split: a-for-b split表示有N股的人在分割后有N*a/b股

Diluted EPS

公式

时间加权

计算方法

可转换: If-converted

Effects

Convertible preferred securities would no longer be outstanding; instead, additional common stock would be outstanding. Thus, the weighted average number of shares outstanding would be higher

If such a conversion had taken place, the company would not have paid preferred dividends. Thus, the net income available to common shareholders would be higher

分子、分母同时增加,对diluted EPS影响不确定

假设所有优先股都转换

stock option/warrants: treasury stock method

if diluted EPS>basic EPS,use basic EPS

Analysis of the Income Statement

Common-size analysis

Financial ratios

Comprehensive Income

定义

IFRS: the change in equity during a period resulting from transaction and other events

US GAAP: the change in equity [net assets] of a business enterprise during a period from transactions and other events and circumstances from non- owner sources

除了向所有者出资或向其分配利润之外所有权益的所有变化

组成

Net income

Other comprehensive income(both IFRS and US GAAP)

Foreign currency translation adjustments.

Unrealized gains or losses on derivatives contracts accounted for as hedges

Unrealized holding gains and losses on available- for- sale securities

Certain costs of a company’s defined benefit post- retirement plans

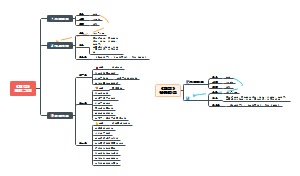

Understanding balance sheets(B/S)

Components and Format of the Balance Sheet

Components

Assets(A)

Liabilities(L)

Equity(E)(net assets)

说明

The balance sheet under current accounting standards is a mixed model with respect to measurement

Even the items measured at current value reflect the value that was current at the end of the reporting period, the values of those items obviously can change after the balance sheet is prepared

The value of a company is a function of many factors. Important aspects of a company's ability to generate future cash flows are not included in its balance sheet

Current and non-current classification

Assets

Current: Within one year or one operating cycle

Non-current: greater than one

Liabilities

Currernt

Expected to be settled in the entity's normal operating cycle

Held primarily for the purpose of being traded

It is due to be settled within one year after the balance sheet date

The entity does not have an unconditional right to defer settlement of the liability for at least one year after the balance sheet date

Working capital: The excess of current assets over current liabilities

Non-current

Format

IFRS/US GAAP: Classified balance sheet--separately classified current and non- current assets and liabilities

IFRS: Liquidity-based presentation; all assets and liabilities are presented broadly in order of liquidity

Current

Current Assets

Cash and cash equivalents

特点: highly liquid, short-term,value changes significantly with interest rates

Financial assets, measured and reported at either amortized cost or fair value

Marketable securities

treasury bills, notes, bonds, and equity securities, such as common stocks and mutual fund shares

Trade receivables(accounts receivable)

Reported at net realizable value(NRV)

Bad debt expense

Allowance for doubtful accounts(contra account)

accounts receivable - allowance for doubtful accounts=NRV

Inventories

Cost of inventories

Purchase

Conversion

Other costs incurred in bringing the inventories to their present location and condition

Measure of cost

Standard cost

Retail method

IFRS: NRV

US GAAP: The lower of cost or market value

Other current assets

Prepaid expense: Paid in advance and will be recognized as an expense in future periods

Deferred tax liabilities

Current Liabilities

Trade payables(accounts payable) and notes payable

Any notes payable, loans payable, or other financial liabilities that are due within one year (or the operating cycle, whichever is longer) appear in the current liability section of the balance sheet

Any portions of long- term liabilities that are due within one year (i.e., the current portion of long- term liabilities) are also shown in the current liability section of the balance sheet

Accured expenses

Income taxes payable

Accrued interest payable

Accrued warranty costs

Accrued employee compensation(wages payable)

Deferred income(deferred revenue, unearned revenue): A company receives payment in advance of delivery of the goods and services associated with the payment

Non-current

Non-Current Assets

Property, plant and equipment(PPE)

IFRS:Cost or revaluation model

US GAAP: Only cost model

Investment property

定义

IFRS: property not used in the production of goods or services or for administrative purposes but to earn rental income or capital appreciation (or both)

US GAAP: no specific definition

计算(IFRS)

Cost model

Fair value model

A company must apply its chosen model to all of its investment property

Intangible assets

Example: patents, licenses, and trademarks.

计算

IFRS

Cost model

Revaluation model

US GAAP: only cost model

Goodwill

Financial assets

Held- to- maturity: measured at amortised cost if the asset's cash flows occur on specified dates and consist solely of principal and interest, and if the business model is to hold the asset to maturity

Unrealized gains or losses: not recoginsed

Available- for- sale

Measured at fair value

Any unrealized holding gains or losses recognized in other comprehensive income.

Held for trading (trading securities)

定义:financial assets that is acquired primarily for the purpose of selling in the near term

Measured at fair value, and any unrealized holding gains or losses are recognized as profit or loss on the income statement

Non-Current Liabilities

Long-term financial liabilities

Example: loans and notes or bonds payable

Reported at amortised cost on the balance sheet.

Deferred tax liabilities

Equity

Components

“三股”

Common stock

数量关系

The number of authorized shares

The number of issued shares

The number of outstanding shares: issued shares - treasury shares

Preferred shares

Treasury shares

A purchase of treasury shares reduces shareholders' equity by the amount of the acquisition cost and reduces the number of total shares outstanding

Non- voting and do not receive any dividends

“三益”

Retained earnings: cumulative amount of earnings recognized in the income statements which have not been paid to the owners of the company as dividends

Accumulated other comprehehsive income

Non-controlling(minority) interest: the equity interests of minority shareholders in the subsidiary companies that have been consolidated by the parent (controlling) company but that are not wholly owned by the parent company.

Statement of changes in equity

Total comprehensive income for the period;

The effects of any accounting changes that have been retrospectively applied to previous periods

Capital transactions with owners and distributions to owners

Reconciliation of the carrying amounts of each component of equity at the beginning and end of the year

Analysis of the Balance Sheet

Vertical common-size analysis

方法: stating each balance sheet item as a percentage of total assets

分类

Time-series analysis

Cross-sectional analysis

Balance sheet ratios

Liqudity ratios

Solvency ratios

Understanding cash flow statements(CF/S)

Components and Format of the Cash Flow Statement

Classification of cash flow and non-cash activities

Operating activities(CFO)

概念: The company’s day- to- day activities that create revenues, such as selling inventory and providing services, and other activities not classified as investing or financing

分类

Cash inflows

Cash sales

Collection of accounts receivable

Cash outflows

Cash payments for inventory, salaries, taxes, and other operating-related expenses

Paying accounts payable

Operating activities include cash receipts and payments related to trading securities (cash equivalents)

Investing activities(CFI)

定义: purchasing and selling long- term assets and other investments

分类

Cash inflows: cash receipts from the sale of non-trading securities; property, plant, and equipment; intangibles; and other long- term assets

Cash outflows: cash payments for the purchase of these assets.

关于long-term assets

范围

Property, plant, and equipment(PPE)

Other long- term assets

Both long- term and short- term investments in the equity and debt issued by other companies

Exclude

Any securities considered cash equivalents

Securities held for dealing or trading purposes

Financing activities(CFF)

定义: Obtaining or repaying capital, such as equity(shareholders) and long-term debt(creditors)

分类

Cash inflows

Cash receipts from issuing stock (common or preferred) or bonds

Cash receipts from borrowing

Cash outflows

Cash payments to repurchase stock (e.g., treasury stock)

Repay bonds and other borrowings

Indirect borrowing using accounts payable is not considered a financing activity—such borrowing is classified as an operating activity

Non-cash transaction: Not involve an inflow or outflow of cash,but is required to be disclosed, either in a separate note or a supplementary schedule to the cash flow statement

Differences between IFRS and US GAAP

比较

IFRS allow more flexibility

Interest and dividends received as either CFO or CFI

Interest and dividends paid as either CFO or CFF

US GAAP: 除了支付股息为CFF,其他均为CFO

Summary

Income tax expenses

Separately disclosed under IFRS and US GAAP.

US GAAP: CFO

IFRS: also CFO, unless the tax expense can be specifically identified with an investing or financing activity

Methods for reporting cash flow from operating activities(针对CFO,其他两个都是直接法)

Direct

It shows each cash inflow and outflow related to a company's cash receipts and disbursements.

Primary argument: provides information on the specific sources of operating cash receipts and payments

The additional information is useful in understanding historical performance and in predicting future operating cash flows

Indirect

特点

Shows how cash flow from operations can be obtained from reported net income as the result of a series of adjustments and begins with net income

Adjustments are made for non-cash items, for non-operating items, and for the net changes in operating accruals

Arguments

The main argument is that it shows the reasons for differences between net income and operating cash flows

Another argument is that it mirrors a forecasting approach that begins by forecasting future income and then derives cash flows by adjusting for changes in balance sheet accounts

The Cash Flow Statement: Linkages and Preparation

Linkages of the CF/S with the I/S and B/S

The beginning and ending balances are shown on the company's balance sheets and the bottom of the cash flow statement reconciles beginning cash with ending cash

Any differences between the accrual basis and the cash basis of accounting for an operating transaction result in an increase or decrease in some (usually) short-term asset or liability on the balance sheet

图解

Steps in preparing the cash flow statement

CFO

Direct method

Cash received from customers(cash collection)

ΔAccounts receivable = Ending accounts receivable -Beginning accounts receivable = revenue- cash collected from customers

Cash received from customers= Revenue – ΔAccounts receivable

Cash paid to suppliers

Δ Inventory = Ending inventory-Beginning inventory = purchases- cost of goods sold

ΔAccounts payable = Ending accounts payable -Beginning accounts payable = purchases- cash paid to suppliers

Cash paid to suppliers = Cost of goods sold + Δ Inventory – ΔAccounts payable

Cash paid to employees = Salary and wages expense - Δ Salary and wages payable

Cash paid for other operating expenses = Other operating expenses + Δ Prepaid expenses – Δ Other accrued liabilities

Cash paid for interest = Interest expense – Δ Interest payable

Cash paid for income taxes = Income tax expense – Δ Income tax payable

Indirect method

CFI

Historical cost of PPE sold =Beginning balance PPE (from balance sheet)+ PPE purchased (from informational note)- ending balance PPE (from balance sheet)

Accumulated depreciation on PPE sold =Beginning balance accumulated depreciation (from balance sheet)+ depreciation expense (from income statement)- ending balance accumulated depreciation (from balance sheet)

Cash received from sale of PPE =Historical cost of PPE sold- accumulated depreciation on PPE sold = book value of PPE sold+ gain on sale of equipment (from the income statement)

CFF

Change in long- term debt = net issuance or retirement

Change in common stock = net issuance or repurchase

Cash dividends paid =Beginning balance of retained earnings (from the balance sheet)+ net income (from the income statement)- ending balance of retained earnings (from the balance sheet)

Overall statement of cash flows

Direct

CFO: Cash received from customers

- Cash paid to

Suppliers

Employees

- Cash paid for

Other operating expenses

Interest

Income tax

= Net cash provided by operating activities

CFI: Net cash used for investing activities =Cash received from sale of equipment-Cash paid for purchase of equipment

CFF

Cash paid to retire long-term debt

Cash paid to retire common stock

Cash paid for dividends

Net cash used for financing activities

Indirect(CFO): Adjustments to net income(反向)

Additions

Non-cash items

• depreciation expense of tangible assets

• amortization expense of intangible assets

• depletion expense of natural resources

• amortization of bond discount

Non-operating items

• loss on sale or write-down of assets

• loss on retirement of debt

• loss on investments accounted for under the equity method

Increase in deferred income tax liability

Changes in working capital

Decrease in current operating assets (e.g., accounts receivable,inventory, and prepaid expenses)

Increase in current operating liabilities (e.g., accounts payable and accrued expense liabilities)

Subtractions

Non-cash items (e.g., amortisation of bond premium)

Non-operating items

• Gain on sale of assets

• Gain on retirement of debt

• Income on investments accounted for under the equity method

Decrease in deferred income tax liability

Changes in working capital

Increase in current operating assets (e.g., accounts receivable, inventory, and prepaid expenses)

Decrease in current operating liabilities (e.g., accounts payable and accrued expense liabilities)

Conversion of cash flows from the indirect to the direct method(CFO)

Disaggregating net income into total revenues and total expenses

Remove any non-operating and non-cash items

Convert accrual amounts of revenues and expenses to cash flow amounts of receipts and payments by adjusting for changes in working capital accounts

Cash Flow Statement Analysis

Evaluation of the sources and uses of cash

Where the major sources and uses of cash flow are between operating, investing, and financing activities

The primary determinants of operating cash flow,investing cash flow, and financing cash flow

Common-size analysis

To express each line item of cash inflow (outflow) as a percentage of total inflows (outflows) of cash

To express each line item as a percentage of net revenue

Free cash flow to the firm and to equity

FCFF

定义: the cash flow available to the company's suppliers of debt and equity capital after all operating expenses (including income taxes) have been paid and necessary investments in working capital and fixed capital have been made

计算

FCFF = NI(Net income)+ NCC(Non-cash charges) + Int(Interest expense)*(1 – Tax rate) – FCInv(Capital expenditures) – WCInv(Working capital expenditures)

FCFF = CFO(cash flow from operating activities) + Int(1 – Tax rate) – FCInv

FCFE

定义: the cash flow available to the company's common stockholders after all operating expenses and borrowing costs (principal and interest) have been paid and necessary investments in working capital and fixed capital have been made

计算

FCFE = CFO – FCInv + Net borrowing

FCFE = CFO – FCInv – Net debt repayment

Cash flow ratios

Cash flow performance (profitability) ratios

Cash flow coverage (solvency) ratios

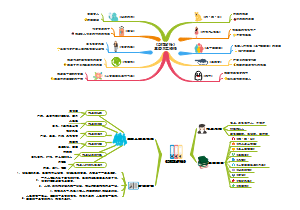

Financial analysis techniques

Analytical Tools and Techniques

Common- Size Analysis

Cross-sectional analysis: compares a specific metric for one company with the same metric for another company or group of companies

Trend analysis

Ratios

概念: one quantity in relation to another (usually as a quotient)

注意

The ratio is an indicator of some aspect of a company's performance, telling what happened but not why it happened

Differences in accounting policies can distort ratios, and a meaningful comparison should involve adjustments to the financial data

Not all ratios are necessarily relevant to a particular analysis

The ratio analysis does not stop with computation; interpretation of the result is essential

Common Ratios Used in Financial Analysis

Activity ratios

Description: measure how efficiently a company performs day-to-day tasks, and is also called asset utilization ratios or operating efficiency ratios

计算

对主要指标评价

Inventory turnover and DOH

A high inventory turnover ratio (low DOH)

Might indicate highly effective inventory management

Possibly indicate the company does not carry adequate inventory, so shortages could potentially hurt revenue

A low inventory turnover ratio (high DOH)

An indicator of slow-moving inventory, perhaps due to technological obsolescence or a change in fashion

Comparing the company's sales growth with the industry can offer insight

Receivables turnover and DSO

A relatively high receivables turnover ratio (low DSO)

Highly efficient credit and collection

The company's credit or collection policies are too stringent, suggesting the possibility of sales being lost to competitors offering more lenient terms

A relatively low receivables turnover ratio (high DSO)

Raise questions about the efficiency of the company's credit and collections procedures

Comparison of the company’s sales growth relative to the industry can help the analyst assess whether sales are being lost due to stringent credit policies

Payables turnover and the number of days of payables

A relatively high payables turnover ratio (low days payable)

The company is not making full use of available credit facilities

A company taking advantage of early payment discounts

An excessively low turnover ratio (high days payable)

A company hastrouble making payments on time

exploitation of lenient supplier terms

If liquidity ratios indicate that the company has sufficient cash and other short-termassets to pay obligations and yet the days payable ratio is relatively high, theanalyst would favor the lenient supplier credit and collection policies as an explanation

Working capital turnover: This ratio indicates how efficiently the company generates revenue with its working capital. A higher ratio indicates greater efficiency

Fixed asset turnover: This ratio measures how efficiently the company generates revenues from its investments in fixed assets. A higher ratio indicates more efficient use

Total asset turnover: This ratio measures the company’s overall ability to generate revenues with a given level of assets. A higher ratio indicates greater efficiency

Liquidity ratios

Description

Liquidity measures how quickly assets are converted into cash

Liquidity ratios measure the ability to pay off short-term obligations.

These liquidity ratios reflect a company's position at a point in time, and use data from the ending balance sheet rather than averages

计算

对指标评价

主要指标

Current ratio: expresses current assets in relation to current liabilities.

Quick ratio: includes only the more liquid current assets ( "quick assets") in relation to current liabilities

Cash ratio(最严格): normally represents a reliable measure of an entity’s liquidity in a crisis situation. Only highly marketable short-term investments and cash are included

其他

Defensive interval ratio

This ratio measures how long the company can continue to pay its expenses from its existing liquid assets without receiving any additional cash inflow

A higher defensive interval ratio indicates greater liquidity

Cash conversion cycle (net operating cycle): A shorter cash conversion cycle indicates greater liquidity, and a longer cash conversion cycle indicates lower liquidity

A higher ratio indicates a higher level of liquidity

Solvency ratios

Description

Solvency refers to a company's ability to fulfill its long-term debt obligations

Solvency ratios provide information regarding the relative amount of debt in the company's capital structure and the adequacy of earnings and cash flow to cover interest expenses and other fixed charges as they come due

计算

对主要指标评价

Debt or leverage ratios

Debt- to- assets ratio: measures the percentage of total assets financed with debt

Debt- to- capital ratio: measures the percentage of a company's capital represented by debt

Debt- to- equity ratio: measures the amount of debt capital relative to equity capital.

Financial leverage ratio: measures the amount of total assets supported for each one money unit of equity. A higher ratio means the company is more leveraged

A higher ratio indicates weaker solvency

Coverage ratios

Interest coverage: measures the number of times a company's EBIT could cover its interest payments

Fixed charge coverage: measures the number of times a company's earnings can cover the company's interest and lease payments

A higher ratio implies stronger solvency

Profitability ratios

Description

Profitability ratios measure the return earned by the company during a period

Return-on-sales profitability ratios express various subtotals on the income statement (e.g., gross profit, operating profit, net profit) as a percentage of revenue. Essentially, these ratios constitute part of a common-size income statement discussed earlier

Return on investment profitability ratios measure income relative to assets, equity or total capital employed by the company

计算

对主要指标评价

Gross profit margin: Higher gross profit margin indicates some combination of higher product pricing and lower product costs

Operating profit margin: An operating profit margin increasing faster than the gross profit margin can indicate improvements in controlling operating costs

Pretax margin: If pretax margin is increasing primarily as a result of increasing amount of nonoperating income, the analyst should evaluate whether the increase will continue

Net profit margin: The net income used in calculating net profit margin is adjusted for nonrecurring items to offer a better view of a company's potential future profitability.

ROA(return on assets): measures the return earned by a company on its assets. The higher the ratio, the more income is generated by a given level of assets

ROE(return on equity) measures the return earned by a company on its equity capital, including minority equity, preferred equity, and common equity

Integrated financial ratio analysis

概念: DuPont analysis, by the decomposition of ROE

方法

Two components

Three components

Five components

前三项乘积为销售净利率

Equity Analysis

Valuation ratios

计算

对主要指标评价

Price to earnings ratio (P/E ratio) is probably the most widely cited indicator in discussing the value of equity securities, which relates share price to the earnings per share (EPS)

Some analysts use other market multiples, such as price to book value (P/B) and price to cash flow (P/CF)

Dividends

可持续增长率

RR(retention rate)

Credit Analysis

Z-score

计算: Z = 1.2 × (Current assets – Current liabilities)/Total assets + 1.4 × (Retained earnings/Total assets) + 3.3 × (EBIT/Total assets) + 0.6 × (Market value of stock/Book value of liabilities) + 1.0 × (Sales/Total assets)

说明:In Altman's initial study, a Z-score of lower than 1.81 predicted failure

其他

Model Building and Forecasting

意义: The results of an analyst’s financial analysis, including commonsize and ratio analyses, are integral to this process, along with the judgment of the analysts

方法

Sensitivity analysis

Scenario analysis

Simulation

资产与负债分析

Inventories

Cost of Inventories

Capitalized Items

Costs of purchase

Purchase price

Import and tax-related duties

Transport, insurance during transport, handling

Other costs directly attributable to the acquisition of finished goods, materials, and services

Costs of conversion: costs directly related to the units produced, such as direct labor, and fixed and variable overhead costs

Other costs incurred in bringing the inventories to their present location and condition

Expensed Items

Abnormal costs incurred as a result of waste of materials, labor or other production conversion inputs

Storage costs (unless required as part of the production process)

All administrative overhead and selling costs.

Treated as expenses and recognised on the income statement

Inventory Valuation Methods

IFRS and US GAAP

Specific identification

The cost of sales and ending inventory reflect the actual costs incurred to purchase (or manufacture) the items specifically identified as sold and the items specifically identified as remaining in inventory

This method matches the physical flow of the specific items sold and remaining in inventory to their actual cost

First in, first out(FIFO)

假设: the oldest goods purchased (or manufactured) are sold first and the newest goods purchased (or manufactured) remain in ending inventory

Cost of sales reflects the cost of goods in beginning inventory plus the cost of items purchased (or manufactured) earliest in the accounting period

The value of ending inventory reflects the costs of goods purchased (or manufactured) more recently

Weighted average cost

The average cost of the goods available for sale (beginning inventory plus purchase, conversion, and other costs) during the accounting period to the units that are sold and to the units in ending inventory

The weighted average cost per unit is calculated as the total cost of the units available for sale divided by the total number of units available for sale in the period

Only US GAAP: Last in, first out(LIFO)

假设: the newest goods purchased (or manufactured) are sold first and the oldest goods purchased remain in ending inventory

Cost of sales reflects the cost of goods purchased (or manufactured) more recently, and the value of ending inventory reflects the cost of older goods

Inventory systems

Periodic Inventory Systems

Inventory values and costs of sales are determined at the end of an accounting period

The ending inventory amount is subtracted from the goods available for sale to arrive at the cost of sales

Perpetual Inventory Systems

Inventory values and cost of sales are continuously updated to reflect purchases and sales

The allocation of goods available for sale to cost of sales and ending inventory is the same if the inventory valuation method used is either specific identification or FIFO., but not true for the weighted average cost method or LIFO.

Comparison of different methods

In an environment of declining inventory unit costs and constant or increasing inventory quantities

FIFO (in comparison with weighted average cost or LIFO) will allocate a higher amount of the total cost of goods on the income statement and a lower amount to ending inventory on the balance sheet

A company's gross profit, operating profit, and income before taxes will be lower under FIFO

In an environment of rising inventory unit costs and constant or increasing inventory quantities

FIFO (in comparison with weighted average cost or LIFO) will allocate a lower amount of the total cost of goods on the income statement and a higher amount to ending inventory on the balance sheet

A company's gross profit, operating profit, and income before taxes will be higher under FIFO

The carrying amount of inventories under FIFO will more closely reflect current replacement values

The cost of sales under LIFO will more closely reflect current replacement value

The LIFO Method

Effects of LIFO Methods

The potential income tax savings are a benefit of using the LIFO method when inventory costs are increasing

Effect for financial statements

Income statement consequences of using the LIFO method include higher cost of sales, and lower gross profit, operating profit, income tax expense, and net income. The lower income tax paid will result in higher net cash flow from operating activities

The balance sheet consequences include lower ending inventory, working capital, total assets, retained earnings, and shareholders'equity

The lower income tax paid will result in higher net cash flow from operating activities

Some of the financial ratio effects are a lower current ratio, higher debt-to-equity ratios, and lower profitability ratios

LIFO reserve

LIFO reserve = FIFO inventory value - LIFO inventory value

COGS(FIFO) = COGS(LIFO) - ΔLIFO reserve

LIFO liquidations

定义: the number of units sold exceeds the number of units purchased or manufactured, the number of units in ending inventory is lower than the number of units in beginning inventory

产生原因

Rising inventory unit costs

The carrying amount of inventory: FIFO>LIFO

LIFO reserve may increase over time

The number of inventory units manufactured or purchased exceeds the number of units sold

LIFO reserve may increase as the result of the addition of new LIFO layers (the quantity of inventory units is increasing and each increase in quantity creates a new LIFO layer)

结果

Produce an inventory-related increase in gross profits

A decline in the LIFO reserve from the prior period may be indicative of LIFO liquidation

Inventory Adjustments (IFRS and US GAAP Requirements)

IFRS

Inventories shall be measured and carried on the balance sheet at the lower of cost and net realisable value(NRV)

NRV=selling price in the ordinary course of business - estimated costs necessary to make the sale - estimated costs to get the inventory in condition for sale

会计处理

Impairment

The inventory carrying amount must be written down to its NRV

The loss is recognised as an expense on the income statement, and the expense may be included as part of cost of sales or reported separately

Reversal

Reversal is not more than the amount of the original write-down

The reversal of any write-down of inventories is recognised as a reduction in cost of sales

US GAAP

Inventories shall be measured at the lower of cost or market to value inventories

Prohibit the reversal of write-downs. Any write-down reduces the value of the inventory, and the loss in value (expense) is generally reflected in the income statement in cost of goods sold

影响

Reduces both profit and the carrying amount of inventory on the balance sheet

Negative effect on profitability, liquidity, and solvency ratios

Activity ratios will be positively affected.

US GAAP is similar to IFRS in its treatment of inventories of agricultural and forest products and mineral ores. These inventories may be measured at net realisable value according to well-established industry practices

Evaluation of Inventory Management

Presentation and Disclosure

IFRS

a. the accounting policies adopted in measuring inventories, including the cost formula (inventory valuation method) used

b. the total carrying amount of inventories and the carrying amount in classifications appropriate to the entity

c. the carrying amount of inventories carried at fair value less costs to sell

d. the amount of inventories recognised as an expense during the period (cost of sales)

e. the amount of any write-down of inventories recognised as an expense in the period

f. the amount of any reversal of any write-down that is recognised as a reduction in cost of sales in the period

g. the circumstances or events that led to the reversal of a write-down of inventories

h.the carrying amount of inventories pledged as security for liabilities

US GAAP

除了f和g, 其他和IFRS相同

US GAAP also require disclosure of significant estimates applicable to inventories and of any material amount of income resulting from the liquidation of LIFO inventory

Inventory Ratios

Inventory turnover ratio

Days of inventory on hand(DOH)

Financial Analysis Illustrations

A significant increase (attributable to increases in unit volume rather than increases in unit cost) in raw materials and/or work- in- progress inventories

The company expects an increase in demand for its products

An anticipated increase in sales and profit

A substantial increase in finished goods inventories while raw materials and work- in- progress inventories are declining

A decrease in demand for the company's products and hence lower future sales and profit.

A potential future write down of finished goods inventory

Long-lived assets

Acquisition of Long- Lived Assets

Property, Plant, and Equipment

成本计算

Capitalised

定义: All the expenditures necessary to get the asset ready for its intended use

特点: on the balance sheet; provide benefits beyond one year in the future

实例

Expenditures that extend the original life of the asset

Purchase cost

Feight costs, insurance and installation

Testing costs

The borrowing(interest) costs incurred directly related to the construction of an asset (or acquires an asset that requires a long period of time to get ready for its intended use)

Interest expenditure

For the company's own use: on the balance sheet as a part of the relevant long-lived asset (i.e., property, plant, and equipment)

Sell: on the company's balance sheet as part of inventory

Expensed

特点: not expected to provide benefits in future periods

实例

Depreciation expense

Training required to use the property and equipment

IFRS或US GAAP对投资收益的记录

IFRS, but not under US GAAP: income earned on temporarily investing the borrowed monies decreases the amount of borrowing costs eligible for capitalisation

Interest payments made prior to completion of construction that are capitalised are classified as an investing cash outflow(CFI)

Expensed interest may be classified as an operating or financing cash outflow under IFRS and is classified as an operating cash outflow under US GAAP

Intangible assets

Internally develop

Expensed

Purchased in situations other than business combinations, such as buying a patent

Capitalised

Goodwill: capitalised, no depreciation

IFRS和US GAAP要求

IFRS

The expenditures on research (or during the research phase of an internal project) should be expensed

Companies can recognise an intangible asset arising from development (or the development phase of an internal project) if certain criteria are met

US GAAP: both research and development costs should be expensed as incurred except capitalisation of certain costs related to software development

Impact on financial statements and ratios

Capitalised

In the period of the expenditure

Increases the amount of assets on the balance sheet

Investing cash outflow on the statement of cash flows

In subsequent periods: depreciation or amortisation expense

Reduces net income on the income statement

Reduces the value of the asset on the balance sheet

No impact on the cash flow statement.

Expensed

Reduces net income by the after-tax amount of the expenditure in the period it is made

On the balance sheet

No asset is recorded

No depreciation or amortisation occurs in subsequent periods

The lower amount of net income is reflected in lower retained earnings on the balance sheet

On the CF/S: operating cash outflow in the period

No effect on the financial statements of subsequent periods

Depreciation and Amortisation

Definitions

Cost model: at any point in time, the carrying amount= historical cost - the amount of accumulated depreciation or amortization

Revaluation model: a company reports the long-lived asset at fair value, permitted under IFRS but not under US GAAP

Calculation

Depreciation

Straight-line

Accelerated method(double decling method)(开始折旧费用较多)

最后一年:折旧费用=期初账面价值-残值

Units-of-production method

Amortisation

Only those intangible assets assumed to have finite useful lives are amortised over their useful lives, following the pattern in which the benefits are used up, and assets assumed to have an indefinite useful life (i.e. without a finite useful life) are not amortised

Acceptable amortisation methods are the same as the methods acceptable for depreciation

The Revaluation Model

Uses of Revaluation Model(IFRS)

A key difference between the two models is that the cost model allows only decreases in the values of long-lived assets compared with historical costs but the revaluation model may result in increases in the values of long-lived assets to amounts greater than historical costs

IFRS allow a company to use the cost model for some classes of assets and the revaluation model for others, but the company must apply the same model to all assets within a particular class of assets and must revalue all items within a class to avoid selective revaluation

记录

If a revaluation initially decreases the carrying amount of the asset class, the decrease is recognised in profit or loss

Later, if the carrying amount of the asset class increases

The increase is recognised in profit or loss to the extent that it reverses a revaluation decrease of the same asset class previously recognised in profit or loss

Any increase in excess of the reversal amount will not be recognised in the income statement but will be recorded directly to equity in a revaluation surplus account

If a revaluation initially increases the carrying amount of the asset class, the increase goes directly to equity under the heading of revaluation surplus

Any subsequent decrease in the asset's value: (1)first decreases the revaluation surplus; (2)goes to income

Impacts on Financial Statements and Ratios

An increase in the carrying amount of depreciable long-lived assets increases

Total assets

Shareholders' equity

reduce reported leverage

Assets revaluations

Decrease the carrying amount of the assets reduce

Net income

In the year of the revaluation, Profitability measures such as ROA, ROE

However, the company may appear more profitable in future years

Asset revaluations that increase the carrying amount of an asset

Initially increase depreciation expense, total assets, and shareholders' equity.

Profitability measures, such as ROA and ROE would decline

Impairment of Assets

Impairment of Property, Plant, and Equipment(PPE)

Test for impairment

Accounting standards do not require to be tested annually for impairment

If there is no indication of impairment, the asset is not tested for impairment, or the recoverable amount of the asset should be measured in order to test for impairment

Impairment losses

when should be recognised

The asset's carrying amount is not recoverable

The carrying amount is more than the recoverable amount

Impacts on financial statements

Reduce the carrying amount of the asset on the balance sheet

Reduce net income on the income statement

Non-cash item and will not affect cash from operations

在IFRS和US GAAP下的记录方式

IFRS: measured as the excess of carrying amount over the recoverable amount of the asset

Recoverable amount of an asset is defined as "the higher of its fair value less costs to sell and its value in use”

Value in use is a discounted measure of expected future cash flows

US GAAP: An asset's carrying amount is considered not recoverable when it exceeds the undiscounted expected future cash flows.

If the asset's carrying amount is not recoverable, the impairment loss is measured as the difference between the asset's fair value and carrying amount

Impairment of Intangible Assets

With a finite life

Amortised and may become impaired and are not tested annually for impairment

Tested only when significant events suggest the need to test

With indefinite lives

Not amortised

Carried on the balance sheet at historical cost but are tested at least annually for impairment

Impairment of Long-Lived Assets Held for Sale

A long-lived (non-current) asset is reclassified as held for sale rather than held for use when it ceases to be used and management's intent is to sell it

At the time of reclassification

Assets previously held for use are tested for impairment

Long-lived assets held for sale stop to be depreciated or amortised

Reversals

IFRS

Permit impairment losses to be reversed if the recoverable amount of an asset increases regardless of whether the asset is classified as held for use or held for sale

Do not permit the revaluation to the recoverable amount if the recoverable amount exceeds the previous carrying amount

US GAAP

Once an impairment loss has been recognised for assets held for use, it cannot be reversed

For assets held for sale, if the fair value increases after an impairment loss, the loss can be reversed

Derecognition

Sale of Long-Lived Assets

The gain or loss on the sale of long-lived assets = the sales proceeds - the carrying amount of the asset at the time of sale

Carrying amount is typically the net book value (i.e., the historical cost minus accumulated depreciation), unless the asset’s carrying amount has been changed to reflect impairment and/or revaluation

记录

I/S: A gain or loss on the sale of an asset

A component of other gains and losses

In a separate line item when the amount ismaterial

CF/S

CFO: using the indirect method adjusts net income to remove any gain or loss on the sale

CFI: include the amount of proceeds from the sale in cash from investing activities

Long-Lived Assets Disposed of Other Than by a Sale

Long-lived assets to be disposed of other than by a sale are classified as held for use until disposal. The long-lived assets continue to be depreciated and tested for impairment, unless their carrying amount is zero, as required for other long-lived assets owned by the company

When an asset is retired or abandoned, the accounting is similar to a sale, except that the company does not record cash proceeds. Assets are reduced by the carrying amount of the asset at the time of retirement or abandonment, and a loss equal to the asset's carrying amount is recorded

When an asset is exchanged, accounting for the exchange typically involves removing the carrying amount of the asset given up, adding a fair value for the asset acquired, and reporting any difference between the carrying amount and the fair value as a gain or loss

Presentation and Disclosures

Disclosures of Property, Plant, and Equipment

IFRS

The measurement bases

The depreciation method

The useful lives (or, equivalently, the depreciation rate) used

The gross carrying amount

The accumulated depreciation at the beginning and end of the period

A reconciliation of the carrying amount at the beginning and end of the period

US GAAP

The depreciation expense for the period

The balances of major classes of depreciable assets

Accumulated depreciation by major classes or in total

A general description of the depreciation method(s) used in computing depreciation expense with respect to the major classes of depreciableassets

Disclosures of Intangible Assets

IFRS: whether the useful lives are indefinite or finite

If finite, for each class of intangible asset

The useful lives(or, equivalently, the amortisation rate) used

The amortisation methods used and the gross carrying amount

The accumulated amortisation at the beginning and end of the period and where amortisation is included on the income statement

A reconciliation of the carrying amount at the beginning and end of the period

If infinite

The carrying amount of the asset

Why it is considered to have an indefinite life

US GAAP

The gross carrying amounts and accumulated amortisation in total

By major class of intangible assets, the aggregate amortisation expense for the period, and the estimated amortisation expense for the next five fiscal years

Disclosures Related to Impairment Losses

IFRS

Each class of assets the amounts of impairment losses and reversals

The main classes of assets affected by impairment losses and reversals of impairment losses

the main events and circumstances leading to recognition of these impairment losses and reversals of impairment losses

US GAAP

No reversal of impairment losses

description of the impaired asset, what led to the impairment, the method of determining fair value, the amount of the impairment loss, and where the loss is recognised on the financial statements

Under IFRS, for tangible and intangible assets, if the revaluation model is used, the date of revaluation, details of how the fair value was obtained, the carrying amount under the cost model, and the revaluation surplus must be disclosed

Investment Property

Definition

IFRS: as property that is owned for the purpose of earning rentals or capital appreciation or both (for example, earning rent)

US GAAP: no specific definition of investment property

Accounting for Investment Property(IFRS)

Cost model or a fair value model

The fair value model differs from the revaluation model used for property, plant, and equipment, so a company must be able to reliably determine the property's fair value on a continuing basis

Under the revaluation model, whether an asset revaluation affects net income depends on whether the revaluation initially increases or decreases the carrying amount of the asset. In contrast, under the fair value model, all changes in the fair value of the asset affect net income

In general

A company must apply its chosen model (cost or fair value) to all of its investment property until it disposes of the property or changes its use such that it is no longer considered investment property

The company must continue to use the fair value model for that property even if transactions on comparable properties, used to estimate fair value, become less frequent

Disclosures of Investment Property

Companies are required to disclose whether they use the fair value model or the cost model

If the company uses the fair value model

Additional disclosures about how it determines fair value

Reconciliation between the beginning and ending carrying amounts of investment property

If the company uses the cost model

Additional disclosures similar to those for property, plant, and equipment

The fair value of investment property.

Income taxes

Differences between Accounting Profit and Taxable Income

原因

Different guidelines for how income is reported on a company's financial statements

How income is measured for income tax purposes

一些名词

Taxable Income: the portion of its income that is subject to income taxes under the tax laws of its jurisdiction

Income Tax Payable: the basis for its income tax payable (a liability) or recoverable (an asset), which is calculated on the basis of the company's tax rate and appears on its balance sheet

Income Tax Paid: the actual amount paid for income taxes (not a provision, but the actual cash outflow)

Income Tax Expense: on its income statement and is an aggregate of its income tax payable (or recoverable in the case of a tax benefit) and any changes in deferred tax assets and liabilities

Changes in deferred tax assets and liabilities are added to income tax payable to determine the company's income tax expense (or credit) as it is reported on the income statement

Deferred tax

概念

Deferred Tax Assets(DTA): Actual income taxes payable > financial accounting income tax expense

Deferred Tax Liabilities(DTL): Financial accounting income tax expense>income taxes payable

Both appear on the balance sheet

影响

Any deferred tax asset or liability is based on temporary differences that result in an excess or a deficit amount paid for taxes

Only a temporary difference because taxes will be recoverable or payable at a future date

Accounting Profit(income before taxes; pretax income) :does not include a provision for income tax expense

Tax Base and Carrying Amount

Tax base: the amount at which the asset or liability is valued for tax purposes

Tax loss carry forward: a company experiences a loss in the current period that may be used to reduce future taxable income

Carrying amount: the amount at which the asset or liability is valued according to accounting principles

Changes in Income Tax Rates

Income tax rates increase

Deferred taxes(both DTA and DTL) increase

Income tax rates decrease

Deferred taxes(both DTA and DTL) decrease

Temporary and Permanent Differences

Permanent differences

概念: differences between tax and financial reporting of revenue (expenses) that will not be reversed at some future date and don't give rise to deferred tax

Items

Income or expense items not allowed by tax legislation

Tax credits for some expenditures that directly reduce taxes

影响: a difference between the company's effective and statutory tax rate

Effective tax rate = Income tax expense ÷ Pretax income (accounting profit)

Temporary differences

概念

Difference between the tax base and the carrying amount of assets and liabilities, which is only possible if the difference reverses itself at some future date

IFRS and US GAAP both prescribe the balance sheet liability method for recognition of deferred tax. This balance sheet method focuses on the recognition of a deferred tax asset or liability should there be a temporary difference between the carrying amount and tax base of balance sheet items

分类

Taxable Temporary Differences

Temporary differences that result in a taxable amount in a future period when determining the taxable profit as the balance sheet item is recovered or settled

Result in a deferred tax liability when

The carrying amount of an asset exceeds its tax base

The tax base of the liability exceeds its carrying amount

Deductible Temporary Differences

Temporary differences that result in a reduction or deduction of taxable income in a future period when the balance sheet item is recovered or settled

Result in a deferred tax asset when

The tax base of an asset exceeds its carrying amount

The carrying amount of the liability exceeds its tax base

Treatment

Recognition and Measurement of Deferred Tax

Measurement of Deferred Tax

计算

Income tax expense= tax payable+ ΔDTL- ΔDTA

At the end of each fiscal year, DTA and DTL are recalculated by comparing the tax bases and carrying amounts of the balance sheet items

DTA

ΔDTA= tax payable- income tax expense

DTA= (tax base- carrying value)*tax rate

DTL

ΔDTL= income tax expense - tax payable

DTL= (carrying value - tax base)*tax rate

Neither deferred tax assets nor liabilities are discounted to present value in determining the amounts to be booked. Both must be adjusted for changes in tax rates

Must be reassessed at the balance sheet date

Recognition of a Valuation Allowance

Under US GAAP, deferred tax assets are reduced by creating a valuation allowance, reducing the deferred tax asset and income in the period in which the allowance is established

The reversal will increase the deferred tax asset and operating income

Recognition of Deferred Tax Charged Directly to Equity

Regard whether the taxes should be included with deferred tax liabilities or whether it should be taken directly to equity

处理

Deferred tax liabilities should be treated as liability whenthey are expected to reverse

Deferred tax liabilities should be treated as equity whenthey are not expected to reverse

The deferred tax liability should be excluded from both debt and equity when both the amounts and timing of tax payments resulting from the reversals of temporary differences are uncertain

Non current(long term) liabilities

Bonds Payable

Accounting for Bond Issuance

Bonds contain two types of future cash payments

Face value

Also referred to as the principal, par value, stated value, or maturity value

Periodic interest payments

Based on the interest rate promised in the bond contract ,which is referred to as the coupon rate, nominal rate, or stated rate

Discounted to the present to arrive at the market value of the bonds

Effective interest rate: The market rate at the time of issuance

On the issuing company's statement of cash flows, the cash received (sales proceeds) from issuing bonds is reported as a financing cash inflow(CFF)

Market rate VS coupon rate

Market rate = coupon rate: at par

Market rate < coupon rate: at premium

Market rate > coupon rate: at premium

Bonds issued with a coupon rate of zero (zero-coupon bonds) are always issued at a discount to face value with no periodic interest payments

Accounting standards

IFRS: all debt issuance costs are included in the measurement of the liability, bonds payable

US GAAP

Debt issuance costs as an asset (a deferred charge)

amortised on a straight-line basis to the relevant expense (e.g., legal fees) over the life of the bonds

IFRS and US GAAP: cash outflows related to bond issuance costs are included in the financing section of the statement of cash flows

Accounting for Bond Amortisation, Interest Expense, and Interest Payments

绪论

The amount reported on the balance sheet for bonds is the historical cost plus or minus the cumulative amortisation, which is referred to as amortised cost

Companies initially report bonds as a liability on their balance sheet

IFRS: at the amount of the sales proceeds net of issuance costs

US GAAP: at the amount of the sales proceeds, ignoring any bond issuance costs

分类

At par

Initially: carrying amount = face value

The carrying amount will not change over the life of the bonds

Periodic interest expense = Periodic interest payment to bondholder

At premium

Initially: carrying amount > face value

As the premium is amortised, the carrying amount (amortised cost) of the bonds will decrease to the face value

Reported interest expense < coupon payment

At discount

Initially: carrying amount < face value

As the discount is amortised, the carrying amount (amortised cost) of the bonds will increase to the face value

Reported interest expense > coupon payment

Amortising methods for the premium or discount of bonds

Effective interest rate method

Required under IFRS and preferred under US GAAP

Applies the market rate in effect when the bonds were issued to the current amortised cost of the bonds to obtain interest expense for the period

The difference between the interest expense and the interest payment is the amortisation of the discount or premium

Straight-line method: evenly amortises the premium or discount over the life of the bond, similar to straight-line depreciation on long-lived assets

Effects on the financial statements

IFRS: interest payments on bonds can be included as an outflow in either the operating section or the financing section of the statement of cash flows ( CFO, CFF )

US GAAP: CFO

Cash interest paid is not shown directly on the statement of cash flows, but companies are required to disclose interest paid separately

Amortisation of a discount (premium) is a non-cash item and thus, apart from its effect o n taxable income, has no effect on cash flow

In the section of the statement of cash flows that reconciles net income to operating cash flow, amortisation of a discount (premium) is added back to (subtracted from) net income

Current Market Rates and Fair Value Reporting

原因: As market interest rates change, the bonds'carrying amount diverges from the bonds' fair market value

A company selecting the fair value option for a liability with a fixed coupon rate will report gains (losses) when market interest rates increase (decrease)

市场利率变化对公司债务的影响

Market interest rates decline/ other factors cause the fair value of a company's bonds to increase

The fair value of a bond with a fixed coupon rate increases

Acompany's economic liabilities may be higher than its reported debt based on amortised historical cost

Company reports a decrease in the fair value of its liability and a corresponding gain

Market interest rates increase/ other factors cause the fair value of a company's bonds to decline

The fair value of a bond with a fixed coupon rate decreases

Acompany's economic liabilities may be lower than its reported debt based on amortised historical cost

Company reports a decrease in the fair value of its liability and a corresponding loss

Using financial statement amounts based on amortised cost may underestimate (or overestimate) a company's debt-to-total-capital ratio and similar leverage ratios

Derecognition of Debt

Once bonds are issued, a company may leave the bonds outstanding until maturity or redeem the bonds before maturity by

Calling the bonds (if the bond issue includes a call provision)

Purchasing the bonds in the open market

不同情况

Remain outstanding until maturity

The company pays bondholders the face value of the bonds at maturity

The discount or premium on the bonds would be fully amortised at maturity

The carrying amount would equal face value

在财务报表上的记录: Bonds payable is reduced by the carrying amount at maturity (face value) of the bonds and cash is reduced by an equal amount, which appears in the statement of cash flows as a financing cash outflow(CFF)

Redeem bonds before maturity and extinguish the liability early

Bonds payable is reduced by the carrying amount of the redeemed bonds

The difference between the cash required to redeem the bonds and the carrying amount of the bonds is a gain or loss on the extinguishment of debt on the income statement

A gain or loss on the extinguishment of debt is disclosed in a separate line item when the amount is material

A company typically discloses further detail about the extinguishment in the management discussion and analysis (MD&A) and/or notes

Debt Covenants

目标: benefit borrowers to the extent that they lower the risk to the creditors and reduce the cost of borrowing

分类

Affirmative covenants: restrict the borrower's activities by requiring certain actions

Negative covenants: require that the borrower not take certain actions

Presentation and Disclosure of Long-Term Debt

Balance sheet: The non-current (long-term) liabilities section of usually includes a single line item of the total amount of a company's long-term debt due after one year, with the portion of long-term debt due in the next twelve months shown as a current liability

Notes

More information on the types and nature of a company's debt

These note disclosures can be used to determine the amount and timing of future cash outflows

内容

Stated and effective interest rates, maturity dates

Restrictions imposed by creditors (covenants)

Collateral pledged (if any)

The amount of scheduled debt repayments for the next five years

Leases

Advantages of leasing

Less costly financing and less restrictive provisions

The lessor may be in better position to take advantage of tax benefits(tax shield) of ownership, such as depreciation and interest

The lessor may be better able to value and bear risks associated with ownership,such as obsolescence, residual value, and disposion of asset

The lessor may enjoy economies of scale

Classification

For lessee

IFRS: Finance lease

GAAP

Operating lease

Finance lease

For lessor

IFRS

GAAP

Operating lease

Finance lease

Sales-type lease

Direct finance lease

Accounting and reporting

Lessee

Classification criteria

Finance lease(meet at least one)

Ownership have been substantially transferred to the lessee at the end of the lease

Lessee would cheaply purchase the asset at the end of the lease

The lease term is 75 percent or more of the useful life of the leased asset

Present value of lease payments is more than 90 percent fair value of the leased asset

Specialized nature of the leased asset that is not valuable for others

Operating lease: The lease cannot meet any of the five criteria

On the financial statements

Balance sheet

Finance lease (IFRS and GAAP)

Right-of-use asset (leased asset)

Lease liability(fair value和lease payment现值中的较小值)

Operating lease (only US GAAP)

Right-of-use asset (leased asset)

Lease liability

Income statement

Finance lease

Report depreciation expense on ROU asset

Report interest expense on lease liability

Operating lease: report single lease expense

Cash flow statement

Finance lease

Reduction of lease liability - CFF

Interest payment - CFO; CFO or CFF

Operating lease: cash payment - CFO

Lessor

A lessor will classify a lease as a direct financing lease if it meets all of the following conditions

The transfer of ownership criteria are not met

A third party guarantees the residual value of the asset at the end of the lease.

The sum of the promised lease payments and the asset's residual value is greater than or equal to the fair value of the asset

Lessor Reporting of Leases

Pensions and Other Postemployment Benefits

Defined contribution plan(DC)

定义

A retirement plan in which the firm contributes a sum each period to the employee's retirement account.

The firm's contribution can be based on any number of factors, including years of service, the employee's age, compensation, profitability, or even a percentage of the employee's contribution

The investment decisions are left to the employee, who assumes all of the investment risk

Defined benefit plan(DB)

定义

The firm promises to make periodic payments to employees after retirement.

The benefit is usually based on the employee’s years of service and the employee’s compensation at or near retirement

Because the employee's future benefit is defined, the employer assumes the investment risk

记录

Key element: The net pension asset or net pension liability

The fair value of the plan's assets > the estimated pension obligation(PV)

Overfunded; records a net pension asset on its balance sheet

The fair value of the plan's assets < the estimated pension obligation(PV)

Underfunded; records a net pension liabillity on its balance sheet

On the financial statements

IFRS

I/S

Current service cost

Past service cost

Interest expense

Interest income

B/S

Actuarial gains and losses are recognized in OCI

Differences between the actual return on plan assets and interest income

US GAAP

I/S

Current service cost

Expected return

Interest expense

Amortization of past service cost

Amortization of actuarial gains and losses

B/S

Unamortization of actuarial gains and losses are recognized in OCI.

Unamortization of past service cost.

Differences between the actual return on plan assets and expected return

Evaluating Solvency: Leverage and Coverage Ratios

Leverage ratio

Debt-to-assets ratio = total debt / total assets

Debt-to-capital ratio = total debt / (total debt + total equity)

Debt-to-equity ratio = total debt / total equity

Financial leverage ratio = average total assets / average total equity

Coverage ratio

Interest coverage = EBIT / interest payments

Fixed charge coverage = (EBIT + lease payments) / (interest payments + lease payments)

财务报告质量分析与应用

Financial reporting quality

Conceptual Overview

Relationships between Financial Reporting Quality and Earnings Quality

Financial reporting quality: High-quality reporting provides decision-useful information, as well as the company's financial condition at the end of the period

Quality of reported results (earnings quality)

内容

The quality of earnings, cash flow, and/or balance sheet items