导图社区 ACCA SBR 思维导图

- 122

- 4

- 2

- 举报

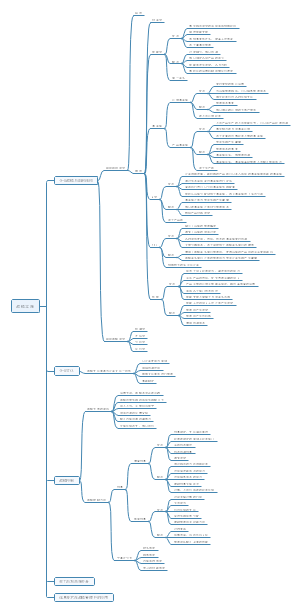

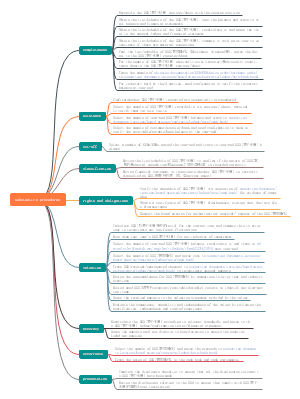

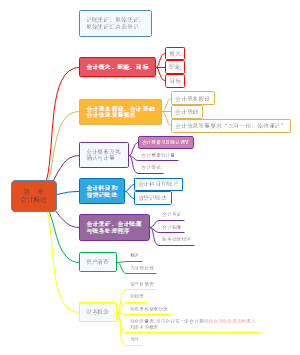

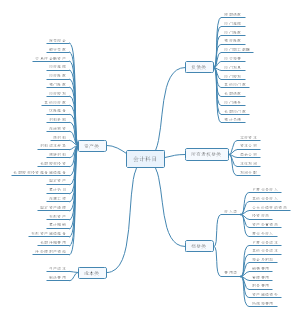

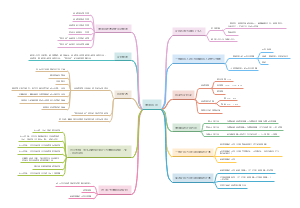

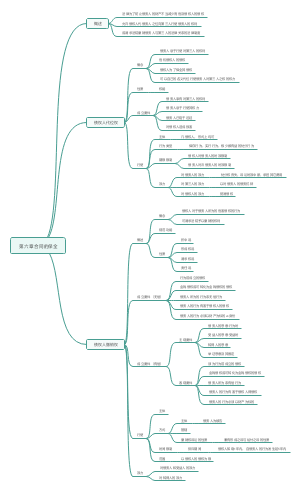

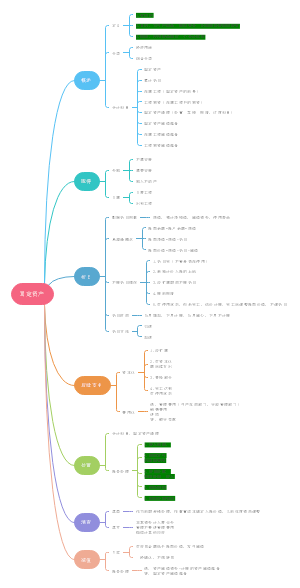

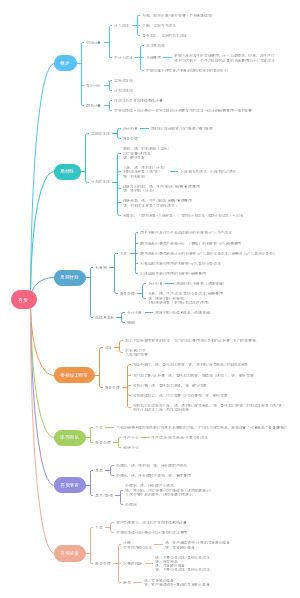

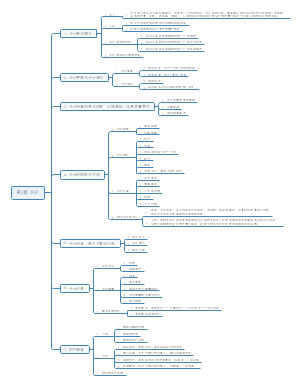

ACCA SBR 思维导图

你是否想要通过ACCA SBR考试,拿到专业会计师的证书?你是否想要掌握SBR课程的核心知识和技能?如果你的答案是肯定的,那么我有一个好消息要告诉你。我做了一份关于ACCA SBR课程的思维导图,它包含了SBR课程的主要内容。我想把这份思维导图分享给大家,希望能帮助更多人通过ACCA SBR考试,实现自己的职业目标。如果你对这个项目感兴趣,请关注我的社交媒体账号,我会定期更新更多内容。让我们一起学习一起进步吧!

编辑于2023-03-31 23:20:40 江苏省- ACCA

- 《吃掉那只青蛙》精简版

《吃掉那只青蛙》通过易懂的比喻和大量实际案例,为读者描绘了一张清晰的时间管理与自我调控路线图。这是一本非常实用的成功学著作,让人受益匪浅。坚持每天完成一小步,持续进步,我们就能取得最后的胜利,享受成功的喜悦。这是一本激励人心的正能量读物。

- 《波士顿咨询工作法》精简版

《波士顿咨询工作法》是日本管理学专家内田和成所著,向读者介绍了波士顿咨询公司独特而高效的工作方法。这本书深入浅出地剖析了波士顿咨询公司如何通过“分解法”、“事实调查法”和“目的导向法”等方法,在复杂的商业顾问领域保持卓越的市场地位。内田和成先生融汇中西方管理思想,探讨怎样运用这些先进方法提高工作效率、分析复杂问题、制定有效决策。这本书为商界人士提供了宝贵的解决问题思路,也为所有的职场工作者提升自身管理能力提供了科学指导。

- 《蓝海战略》精简思维导图

这份详细的“蓝海战略”思维导图为你提供了深入理解和应用蓝海战略的全方位视角。首先,它定义了蓝海战略,并明确区分了蓝海战略和红海战略的本质区别。接着,该导图指导你如何步步深入地制定并执行蓝海战略,包括如何构建战略画布,寻找蓝海,并且执行这一策略。为了更具操作性,它还列举了“四个关键动作框架”,旨在启发你如何在实践中具体应用蓝海战略,包括创新、消除、减少和提升四个方向。最后,导图通过列举几个著名的成功案例,如“太阳马戏团”、“瑞士瑞银”和“苹果公司”,使得理论知识更有生动感,更便于理解和学习。这份思维导图希望能够帮助刚步入职场的你,深入理解并巧妙运用蓝海战略,开启你的职业生涯新篇章。

ACCA SBR 思维导图

社区模板帮助中心,点此进入>>

- 《吃掉那只青蛙》精简版

《吃掉那只青蛙》通过易懂的比喻和大量实际案例,为读者描绘了一张清晰的时间管理与自我调控路线图。这是一本非常实用的成功学著作,让人受益匪浅。坚持每天完成一小步,持续进步,我们就能取得最后的胜利,享受成功的喜悦。这是一本激励人心的正能量读物。

- 《波士顿咨询工作法》精简版

《波士顿咨询工作法》是日本管理学专家内田和成所著,向读者介绍了波士顿咨询公司独特而高效的工作方法。这本书深入浅出地剖析了波士顿咨询公司如何通过“分解法”、“事实调查法”和“目的导向法”等方法,在复杂的商业顾问领域保持卓越的市场地位。内田和成先生融汇中西方管理思想,探讨怎样运用这些先进方法提高工作效率、分析复杂问题、制定有效决策。这本书为商界人士提供了宝贵的解决问题思路,也为所有的职场工作者提升自身管理能力提供了科学指导。

- 《蓝海战略》精简思维导图

这份详细的“蓝海战略”思维导图为你提供了深入理解和应用蓝海战略的全方位视角。首先,它定义了蓝海战略,并明确区分了蓝海战略和红海战略的本质区别。接着,该导图指导你如何步步深入地制定并执行蓝海战略,包括如何构建战略画布,寻找蓝海,并且执行这一策略。为了更具操作性,它还列举了“四个关键动作框架”,旨在启发你如何在实践中具体应用蓝海战略,包括创新、消除、减少和提升四个方向。最后,导图通过列举几个著名的成功案例,如“太阳马戏团”、“瑞士瑞银”和“苹果公司”,使得理论知识更有生动感,更便于理解和学习。这份思维导图希望能够帮助刚步入职场的你,深入理解并巧妙运用蓝海战略,开启你的职业生涯新篇章。

- 相似推荐

- 大纲

SBR

Code of Ethics and conducts

Ethical principles

Integrity (straightforward and honest)

Objective (no self interest or bias)

Professional competence and due care

Confidentiality

Professional behaviour (compliance with laws and regulations)

Threats to fundamental principles

Self interest

Self review

Advocacy

Familiarity

Intimidation

Appropriate action

1. Disclose this to appropriate internal governance authority

2. Seek professional advice from ACCA and legal advice if necessary

3. Resign

Stakeholders

Shareholders

Financing source

Customers

Social responsible policy

Creditors

Sourcing of key components

Employees

Working hard

Good ideas

Regulators

Litigation costs

Steps in ethical questions

1. Why and to who is it important?

2. What are the impact of each items?

3. What is wrong with the decision? What are the consequences?

Directors are appointed to run the business on behalf of the company's shareholders who are the primary stakeholder. Deliberate manipulation of financial statements will reduce stakeholders' confidence in the reliability of the financial statements and the accountancy profession as a whole. directors are deliberating flouting International Financial Reporting Standards (IFRS® Standards) to improve their bonus and maintain debt covenant obligations

4. It is in contrary with which ethical principles?

Financial statements should be

Fair

Transparent

Comply with accounting standards

Information should be

Relevant

Provide faithful representation

Qualitative characteristics of useful fin. information

Comparability

Verifiability

Timeliness

Understandability

Related parties

Related entity (controlled by related parties)

Definition

Has control or joint control

Significant influence

Member of the key management personel (also family)

must disclose the nature of the related party relationship as well as information about all transactions and outstanding balances

Revised 2018 Conceptual Framework

Elements of FS should be recognised when it provides

Relevant informaiton

Faithful representation

Recognition should be cost constrain (cost effective)

Economic resource

A right that has the potential to produce economic benefits

Assets

A present economic resource controlled by the entity as a result of past events.

Liability

A present obligation of the entity to transfer an economic resource as a result of past events.

Obligation

A duty of responsibility that an entity has no practical ability to avoid.

Valuation

Inventory

Lower of historical cost and NRV

Values

Value in use

PV of future cash flows

Fair value

Market based measurement, assumption that market participants would use the price.

Net realiasable value

Estimated selling price in the ordinary course of business less cost of completion and costs of sale.

Employee benefits (pension) IAS 19

Defined benefit scheme

Calculation

1. Calculate change in PV of defined benefit obligation

+ Opening defined benefit obligation

+ interest on obligation

(PV of future benefit obligation + past service cost) * r

+ current service cost

advisory cost during the year

+ past service cost

cost of pensions earned in the period

- benefit paid

in current year to former empoloyees

+ Curtailment

Reduntance employee

- Settlement

Disposal or restructuring

- gain on remeasurement through OCI

balancing figure

= Closing defined benefit obligation

2. Calculate changes in FV of plan asset

+ Opening FV of plan assets

+ Interest on plan assets

FV of plan asset begin * r

+ Contributions

received current year

- Benefit paid

in current year

- Settlement

Disposal or restructuring

+ loss on remeasurement through OCI

balancing figure

= Closing FV of plan assets

3. P&L

Defined benefit expense

+ Current service cost

advisory cost during the year

+ Past service cost

cost of pension earned in the period

+ Net interest on net defined benefit asset

(PV of future benefit obligation + Past service cost - FV of plan asset) * r

= Defined benefit expense recognised in P&L

OCI

+ Remeasurement gain on defined benefit obligation

- Remeasurement loss on plan assets

if loss was negative at plan asset, then plus

= Remeasurement of defined benefit plans

4. BS

+ PV of pension obligation

20X1 20X0

- FV of plan assets

20X1 20X0

= Net pension liability

20X1 20X0

Curtailment => Past service cost

Reduction in net pension liability when the number of employees becomes redundance

Recognise at earlier of:

Plan curtailment occurs

Entity recognises the related restructuring costs

Basic settlement => Past service cost

obligation which Hudson has to pay as compensation for terminating the employee’s services regardless of when the employee leaves the entity

Recognise earlier of when the plan of termination is announced and when the entity recognises the associated restructuring costs associated with the closure

Remeasurement component => OCI

Actuarial gain and losses

Changes in asest ceiling

Defined contribution scheme

Only recognise amount due to pension scheme at year end as current liability

Contribution paid by company

PL

Contribution paid by employee

Adjusted in employee's net salary

IAS 19 Amendment 2018

When a plan amendment, curtailment or settlement take place, the actuarial assumptions should also be remeasured

Business combination IFRS 3

Goodwill

Explaination

Recognised when one company obtains the control over the other

Presentation

As a non-current asset at acquisition date

Valuation

+ Fair value of consideration

Deferred consideration

present value at acquisition date, changes to PL

Contingent consideration

Fair value at acquisition date, changes to PL

+ NCI

- Fair value of net assets

Fair value of net asset should be adjusted for the adjustment info available within 12 months after acquisition

= Goodwill

Valuation subsequently

Impairment test every year

Negative goodwill

Review the identified net asset amount

PL

Business

Integrated set of activities and assets which can be conducted and managed to provide a return to investors.

Require

Input

Process

If no input and process, then as asset acquisition

no business acquisition occurs where substantially all of the fair value of the gross assets acquired is concentrated in a single asset or group of similar assets

Asset acquisition

Only if it is not a business acquisition

Control

Power over the investee

No need to be exercised

Or arrangement to appoint/remove and set remuneration of management

Exposure or rights to variable returns

Ability to use its power

Business combination

In which an acquirer obtains control of one or more businesses.

Consolidated financial statements IFRS 10

Groups

Subsidiary (with control)

Full consolidation

Goodwill

NCI

Associate IAS28 (significant influence, >20%)

Equity method

+ Cost of investment

+ Share of post-acquisition retained earnings & OCI

PL

- Impairment losses to date

= Investment in associate

Financial instrument (not for trading, <20%)

Initial measurement

Fair value + transaction cost

Subsequent measurement

Amortised cost if

Is held within a business model and collect contractual cash flows, and

cash flows are solely payments of principal and interest

Financial instrument (all other cases)

Initial measurement

Fair value

Subsequent measurement

Fair value through PL

Partial acquisition (from associate to subsidiary)

As if two steps

1. As the shareholding is sold

+ Fair value of shareholding

- Carring amount

= Remeasurement gain

2. Subsidiary has been purchased

+ Consideration new

+ FV of current shareholding

+ NCI

- FV of all net assets

= Goodwill

Partial disposal (control is lost)

Working

1. Goodwill

2. Group retained reserve

saparate retained reserves b/f

3. Group profit on disposal

+ FV of consideration received

+ FV of remaining investment

- Net asset when control is lost

- Goodwill

+ NCI when control is lost

= Group profit on disposal

4. NCI

5. Investment in associates

+ FV at date control lost

+ Share of post acquisition retained reserves

= Investment in associate year end

Additional acquisition from 60% to 80%

Already a subsidiary, so just transaction between shareholders

No new goodwill

Only adjustment to NCI

i.e. 20% / 40% x NCI share at further acquisition

Consolidation financial statement question

Associate

With control: full consoliation

No control: as investment in associate

Working

1. Fair value adjustment table

2. Unrealised profit on inventories

Inventory in stock * profit margin / (1+profit margin)

Deferred tax because group pays tax before the profit is realised

3. Goodwill

+ Consideration transferred

+ NCI

- Share capital

- Retained earnings at acquisition

- Fair value adjustment

Net assets acquired

- Impairements to date

= Year-end value

4. Retained earnings

5. Non-controlling interest NCI

+ NCI at acquisition

+ NCI share of post acquisition

- NCI share of impairment loss

= NCI end date

6. Investment in associates (no control)

+ Cost of associate

+ Share of post-acquisition retained reserves

- Impairment of investment

= Investment in associate

Consolidation of cash flow statements IAS 7

Steps

1. Assets

2. Equity

3. Liabilities

4. Working capital

5. Purshase of subsidiary

6. Cash flow statement

Net cash flow from operating activities

+ Cash from operating activities

Profit before tax

Adjustments

+ Non-cash transaction regarding PPE

+ Depreciation

+ Impairment

+ Interest

+ service cost of pension

- Contributions of pension

Changes in working capital

- Tax

- Interest

= Net cash flow from operating activities

Effect of subsidiary

Assets and liabilities

100% consolidate

Fair value adjustment

Deferred tax effect

Dividend

No effect since it is from one to anohter

NCI share of divident

Cash outflow in financing cash

Methods

Direct method

Shows major classes of gross cash receipts and payments

Advantage

Easier for user to understand

Discloses information not available elsewhere in the financial statements

Disadvantage

More time consuming and expensive

Indirect method

Advantage

Easier to use

Nearly all companies use it

Disadvantage

Difficult to understand

Open to manipulation

Asset held for sale and discontinued operations IFRS 5

Held for sale

Definition

The carrying amount will be recovered through a sale transaction rather than through continueing use.

Valuation

Lower of carrying amount and fair value less cost to sell

Carring amount= net assets + goodwill - NCI

If the asset was impaired previously, than any increase of the measure can reverse the impairment loss

Subsequent change in FV => PL

Steps

1. Calculate CA

To PL

2. Revaluate

Higher of CA and FV

To OCI

3. Impairment

Lower of CA and recoverable amount

Recoverable amount: higher of value in use and FV less cost to sell

To PL

4. Classify as Held to sale

Lower of CA and FV less cost

5. Sell profit

Criteria:

Available for immediate sale in its present condition

Sale must be highly probable

Reasonable price

Significant changes are unlikely

Management is committed to the plan

Actively locating a buyer

Expected to be in one year from the date

Within 12 months time

Approach

Assets written down to fair value less cost to sell

PL

No further depreciation or amortisation

Subsequent change to further impairment loss

Present

Single amount

Separately from other assets and liability

As Current asset and liability (no offset)

Restructuring provision

Only directly attributable costs of the restructuring

Criteria

Restructuring has been communicated to media

Detailed formal plan is in place

Discontinued operations

Classification

Separate major line of business or geographical area of operaitons

Part of a single co-ordinated plan to dispose

Subsidiary was acquired exclusively with a view to resale

When losing control, must disclose the following in the cash flow statement

Total consideration received

Cash consideration

Amount of cash held by subsidiary

Amount of assets and liabilities summarised by each category

Financial instrument IFRS 9

Financial assets

Derecognised when

Contractual right has expired

All risk and rewards are transferred

Debt and equity instrument (not held for trading)

Initial measurement

Fair value + transaction cost

Subsequent measurement

Amortised cost if

Is held within a business model and collect contractual cash flows, and

cash flows are solely payments of principal and interest

All other cases

Initial measurement

Fair value

Subsequent measurement

Fair value through PL

Convertible bond IAS 32

Presentation

NCL component

= principal payable / (1 + r for non convertible liability)^n + PV of coupon interests using r

Equity

= principal - NCL component

Factoring

Derecognise AR when

has no further right to receive cash

All risk and rewards are transferred

No control over AR

Accounting

Initial part of AR derecognise

Difference in PL

Guarantee as financial liability

Bond with credit risk

Low credit risk

Stage one financial asset

Credit allowance for 12 month expected loss

High credit risk

Stage two financial asset

Credit allowance for lifetime losses

Fair value measurement IFRS 13

Value in use

Present value of cash flows generated discounted at suitable rate of interest

Impairment loss

Reduce the carrying amount of the asset

Expensed in PL

Cannot be netted off the revaluation surplus if no specific surplus was formed

IAS 40 Investment property

Valuation

Fair value model

Cost model

Hierarchy

Quoted price in active markets

Directly or indirectly observable price

Unobservable input

Determine FV

Definition of FV

An exit price in the principal market

Principal market

The accessable market with highest volume and level of activity in general.

If no principal market, then Most advantageous market

The market where the profit is maximise

FV should not consider transaction cost, but only consider transportation cost.

Lease IFRS 16

Definition

Contract conveys the right to control

Identifiable assets

For a period of time (more than 12 months)

Exchange for consideration (high value)

Lessor

Financial lease

Derecognise asset

Recognise lease receivable equal to net investment

Lessee

Lease liability

Equal to sum of payments

NCL

Total lease liability in n+1

CL

Total lease liability - NCL part

Total lease liability

Liability begin + interest - instalment

Finance costs

PL

ROU * r

Add to carrying amount of lease liability

Payments

Deduct from carrying amount of lease liabiilty

ROU

Equal to cumulative PV of annual payable + initial costs

Depreciation

PL

ROU / n

Deferred tax

Temporary difference between carrying amount of ROU and Lease liability

Sales and lease back

1. Identify sales contract as IFRS 15 Revenue from contract with customers

Yes, sales

Asset derecognise

No sales

Asset remain in SOFP

2. Calculate carrying amount

3. Calculate remaining ratio = PV of lease / FV of asset

4. ROU = CA * remaining ratio

Provision, Contigent liabilities and assets IAS 37

Should be recognised if

Obligation from a past event

No realistic alternative but to settle

Outflow of economic resource is probable

Obligation can be measured reliably

Provision should be reviewed at the end of each accounting period

Reimbursement ie. insurance

Recognised only when it is virtually certain

Amount recognised

Best estimate of expenditure required to settle the obligation

Restructuring provision

Should be recognised when

Detailed formal plan for the restructuring

Valid expectation has been created in those affected

Onerous contract

A contract in which the unavoidable costs of meeting the obligations under the contract exceed the economic benefits expected to be received under it

present value of the unavoidable costs, net of the expected benefits under the contract

Foreign currency

Types

Presentation currency

currency in which the financial statements are presented

Functional currency

primary economic environment in which the entity operates

primary factors: the currency which mainly influences the sales price for their goods

Secondary factors including the currency in which financing activities are obtained

Steps

1. SOFP of associate

2. PL of associate

3. Goodwill

4. Group retained earnings

5. NCI

6. Translation reserve

7. Exchange difference

Rates

Share capital and pre-acquisition retained earnings subsidiary

fx at acquisition date

Post acquisition retained earnings

average fx rate at each year

Dividend

Actual rate

Goodwill

Closing rate each year

Monetary and non-monetary item

Closing rate

Foreign subsidiary

FX difference to OCI & Translation reserve

if dispose then to PL

Other topics

Accounting policies and changes IAS 8

Prior period error

Retrospectively

Restating the comparative figures

Restating opening balances

Event after reporting date IAS 10

Material non-adjusting event after reporting date but before FS is authorised

Should be disclosed

Income tax IAS 19

Deferred tax asset

Based on carry forward of unused tax losses

Only recognise when there is strong evidence that future taxable profit will be available.

Possible to offset if

There is legally enforceable right to offset the current tax asset and liability as amount relate to the same taxation authority on the same entity.

When calculating temporary difference for PPE

PPE use historical rate

Tax base use closing rate

Revenue IFRS15

Single performance satisfied over time

If a contract contains significant financing component

Adjust the promised amount for the effect of time value.

Entity should only account for revenue from a contract with a customer when it meets the following criteria. If not meet, then recognise as receivable and loss allowance.

The contract has been approved;

Rights regarding goods and services can be identified;

Payment terms can be identified;

It is probable the seller will collect the consideration it is entitled to.

Revenue should be recognised

when or as a performance obligation is satisfied by transferring the promised good or service to the customer

Gift card

Unexercised right as breakage.

For every 1 $ redeemed, 1.43 (1/0.7) recognise as revenue. The reset recognise as contract liability

If consideration is not in form of cash

Then measure FV of the consideration

If FV cannot be estimated, then use stand-alone selling price

Intangible asset IAS 38

Definition

Identifiable asset

Non-monetary

Has no physical substance

Valuation

Without finite useful life

Impairment at the end of each period

PL

With finite useful life

Amortise from the start date

PL

R&D costs

Only recognise when tech and commercially feasible

Impairment each year

start when regulatory approval is obtained

Intangible asset held for sale

Should be accounted under IAS 2 Inventory

Joint arrangement IFRS 11

with separate vehicle

Joint venture

Equity accounting

without separate vehicle

Joint operation

Joint operator must recognise proportionally

Government grants IAS 20

Grant relates to assets

Deferred income or deduction from PPE

Grant relates to income

PL

Financial instrument Disclosure IFRS 7

Entity must enable users of FS to evaluate

1. Significance of financial instrument

2. Nature and extent of risks arising form financial instrument

Different types of risks

Credit risk

Qualitative

Quantitative

Market risk

Currency risk

Interest rate risk

Price risk

Management commentary Practice statement 1

Objective

1. Provide management's view of entity's performance, position and progress

2. To supplement and complement information presented in FS

Should contain

1. Nature of the business

2. Objectives and strategies

3. Major resources, risks and relationships

4. Results of operation and prospects

5. Critical performance measures and indicators

Making materiality judgements Practice statement 2

Key points

FS should provide financial info that is useful to primary users

Disclose does not need to be made if the information is not material

Assessed both from quantitative and qualitative perspective

4 steps process

1. identify

2. Assess

3. Organise

4. Review

Integrated reporting

Conveys business model and sources of value creation

Primary purpose

Explain how the organisation generates value over time

Examine external environment

Describes prospects and challenges for the future

Capital

Financial

Social

Human

Natural

Manufactural

Human

Benefits

Enhanced sys of accountability

Stronger decision making

Better reputation

More harmonisation

Better communication and relationship

Impairment of assets IAS 36

No asset should be carried at more than its recoverable amount

indicate impairment

Recoverable amount

Higher of fair value less costs of disposal and its value in use

Value in use

PV of future cash flows

Operating segment IFRS 8

Definition

A component of an entity which engages in business activities from which it may earn revenues and incur cost

Does not prescribe a basis for allocating costs, but requires a reasonable basis.

Suggest reasonable basis!

Requires reconciliation between segment reported amounts and those in the consolidated FS

Disclose

Nature of difference

Basis of accounting transactions

Should be reported separately if > 1 criteria are not met:

Nature of the product

Production process

Method used to distribute product

Customer

Regulatory environment

Quantitative thresholds

Revenue, Profit, or Asset of the segment is 10% or more of the group combined

Alternative performance measure

APMs are not defined in IFRS, hence less comparable

Some not uniform APMs such as free cash flow, should be clear descript and calculation is disclosed

Reconciliation is needed

APMs should use measures equal or more prominent than IFRS standards

Should provide income tax effects

Inventory IAS 2

NRV

estimated selling price in the ordinary course of business less the costs of completion and costs of sale

Share-based payment IFRS 2

Cash settled Share-based payment

Liability

Using option pricing model

FV of the liabiilty at the date, * n/vesting period

Difference => PL

Recognise at grant date

Each year recognise over the vesting period proportionally

Equity settled share based payment

As equity

FV on the grant or issue date

Share based payemnt with choice of settlement

Split in equity and liability components

+ FV of the good or service

- FV of debt component

= FV of equity component