导图社区 4 Corporate Issuers

- 136

- 0

- 0

- 举报

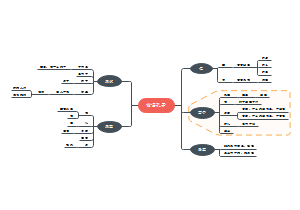

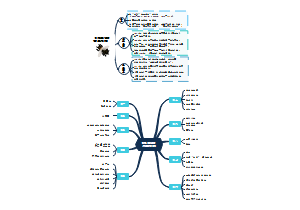

4 Corporate Issuers

2023年CFA二级企业发行人科目,主要内容有4个模块,其中第一个部分最重要,学习过程中应加强对公式和概念方面的理解和记忆

编辑于2023-06-05 10:02:07 上海- 2024cpa会计科目第17章收入、费用和利润

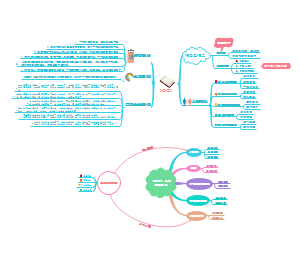

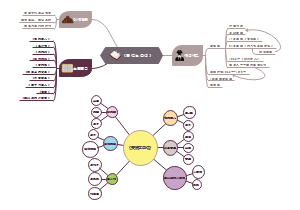

2024cpa会计科目第17章,本章属于非常重要的章节,其内容知识点多、综合性强,可以各种题型进行考核。既可以单独进行考核客观题和主观题,也可以与前期差错更正、资产负债表日后事项等内容相结合在主观题中进行考核。2018年、2020年、2021年、2022年均在主观题中进行考核,近几年平均分值 11分左右。

- 2024cpa会计科目第十二章或有事项

2024cpa会计科目第十二章,本章内容可以各种题型进行考核。客观题主要考核或有资产和或有负债的相关概念、亏损合同的处理原则、预计负债最佳估计数的确定、与产品质量保证相关的预计负债的确认、与重组有关的直接支出的判断等;同时,本章内容(如:未决诉讼)可与资产负债表日后事项、差错更正等内容相结合、产品质量保证与收入相结合在主观题中进行考核。近几年考试平均分值为2分左右。

- 2024cpa会计科目第十一章借款费用

2024cpa会计科目第十一章,本章属于比较重要的章节,考试时多以单选题和多选题等客观题形式进行考核,也可以与应付债券(包括可转换公司债券)、外币业务等相关知识结合在主观题中进行考核。重点掌握借款费用的范围、资本化的条件及借款费用资本化金额的计量,近几年考试分值为3分左右。

4 Corporate Issuers

社区模板帮助中心,点此进入>>

- 2024cpa会计科目第17章收入、费用和利润

2024cpa会计科目第17章,本章属于非常重要的章节,其内容知识点多、综合性强,可以各种题型进行考核。既可以单独进行考核客观题和主观题,也可以与前期差错更正、资产负债表日后事项等内容相结合在主观题中进行考核。2018年、2020年、2021年、2022年均在主观题中进行考核,近几年平均分值 11分左右。

- 2024cpa会计科目第十二章或有事项

2024cpa会计科目第十二章,本章内容可以各种题型进行考核。客观题主要考核或有资产和或有负债的相关概念、亏损合同的处理原则、预计负债最佳估计数的确定、与产品质量保证相关的预计负债的确认、与重组有关的直接支出的判断等;同时,本章内容(如:未决诉讼)可与资产负债表日后事项、差错更正等内容相结合、产品质量保证与收入相结合在主观题中进行考核。近几年考试平均分值为2分左右。

- 2024cpa会计科目第十一章借款费用

2024cpa会计科目第十一章,本章属于比较重要的章节,考试时多以单选题和多选题等客观题形式进行考核,也可以与应付债券(包括可转换公司债券)、外币业务等相关知识结合在主观题中进行考核。重点掌握借款费用的范围、资本化的条件及借款费用资本化金额的计量,近几年考试分值为3分左右。

- 相似推荐

- 大纲

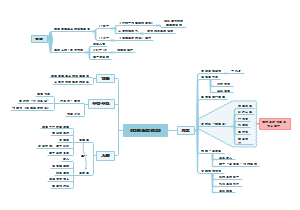

Corporate Issuers

Analysis of Dividends and Share Repurchases

Dividends

Procedure of Dividend Payment

Cash Dividends

Regular

Extra or special (irregular) dividends

A company that does not pay dividends on a regular schedule

A dividend that supplements regular cash dividends with an extra payment

Liquidating Dividends

Goes out of business and the net assets of the company (after all liabilities have been paid) are distributed to shareholders

Sells a portion of its business for cash and the proceeds are distributed to shareholders

Pays a dividend that exceeds its accumulated retained earnings (impairs stated capital)

The effect on shareholders' wealth and financial ratios

Reduces both the value of the company's assets (cash is being paid out) and the market value of equity (by reducing retained earnings)

Liquidity ratio (e.g.,cash ratio and current ratio) decreases

Financial leverage ratios(e.g.,debt-to-equity ratio and debt-to-asset ratios) increases

Stock Dividends

Non-cash form of dividends: the company distributes additional shares of its common stock to shareholders instead of cash

The effect on shareholders' wealth and financial ratios

Stock Splits

The effect on a two-for-one stock split

Reverse Stock Split

Increase the share price

Reduce the number of shares outstanding

No effect on the market value of the firm's equity

Both stock dividends and stock splits have no effect on total shareholders' equity

A stock dividend is accounted for as a transfer of retained earnings to contributed capital

A stock split does not affect any of the balances in shareholder equity accounts

Dividend reinvestment plan(DRP)

Advantages

Encourage a diverse shareholder base by providing small shareholders an easy means to accumulate additional shares

Stimulate long-term investment in the company

New-issue DRPs allow the company to raise new equity capital without the flotation costs associated with the secondary equity issuance using investment bankers

DRPs allow the accumulation of shares using cost averaging

Disadvantages

The extra record keeping involved in jurisdictions where capital gains are taxed

Cash dividends are fully taxed in the year received even when reinvested

Theories of dividend policy and company value

Dividend policy does not matter

Perfect capital market assumptions

No taxes or transaction costs, and symmetric information among all investors

No meaningful distinction between dividends and share repurchases under MM assumption

Dividend is irrelevant to company value

Dividend policy matters

Bird in the hand

Prefer cash dividend to capital gains as it is more certain

A company that pays dividends will have a lower cost of equity capital, resulting in a higher share price

Tax aversion

Taxable investors prefer the way that incurs lower tax

Dividends are taxed at higher rates than capital gains in some countries

Extreme: this argument would advocate a zero dividend payout ratio

Signaling

A company's BOD and management may use dividends to signal to investors about the company's prospects

Dividend increases or decreases may affect share price

A company's dividend initiation or increase tends to be associated with share price increases

Dividend cuts or omissions present powerful and often negative signals

Agency costs

Between shareholders and managers

Managers may have an incentive to maximize their own welfare at the company's expense

Potential investment agency problem might be alleviated by the payment of dividends

Between shareholders and bondholders

The payment of dividends reduces the cash cushion available to the company for the disbursement of fixed payments to bondholders

The payment of large dividends could lead to underinvestment in profitable projects

Factors affecting dividend policy

Investment opportunities: More profitable investment opportunity, less cash dividend

The expected volatility of future earnings: The more volatile earnings are, the greater the risk that a given dividend increase may not be covered by earnings in a future time period

Financial flexibility: A company with substantial cash holdings is in a relatively strong position to meet unforeseen operating needs and to exploit investment opportunities with minimum delay

Flotation costs: make it more expensive for companies to raise new equity capital than to use their own internally generated funds

Contractual and legal restrictions

Impairment of capital rule: dividend paid < retained earnings

Debt covenants: a response to the agency problems that exist between shareholders and bondholders

Tax considerations: effective tax rate depends on taxation systems

Double taxation system: Corporate earnings are taxed at the corporate level and then taxed again at the shareholder level if they are distributed to taxable shareholders as dividends

Dividend imputation tax system

Corporate profits distributed as dividends are taxed just once at the shareholder's tax rate

Effective tax rate = shareholder's marginal tax rate

When earnings that have been taxed at the corporate level are distributed to shareholders in the form of dividends, shareholders receive a tax credit,known as a franking credit

If the shareholder's marginal tax rate is higher than the company's, the shareholder pays the difference between the two rates

Split-rate tax system

Corporate earnings that are distributed as dividends are taxed at a lower rate at the corporate level than earnings that are retained

At the individual level, dividends are taxed as ordinary income. Earnings as dividends are still taxed twice, but the relatively low corporate tax rate on earnings mitigates that penalty

Shareholder preference for current income vs. capital gains

All else equal, the lower an investor's T(D) relative to T(CG), the stronger preference for dividends

Other issues impinge on this preference

T(CG) do not have to be paid until the shares are sold, whereas T(D) must be paid in the year received even if reinvested

In some countries, shares are held at the time of death benefit from a step-up valuation ortax exemption as of the death date

Tax-exempt institutions (e.g. pension funds and endowment funds) are major shareholders in most industrial countries and are exempt from both T(D) and T(CG)

Types of dividend policies

Stable dividend policy (most common)

Not reflect short-term volatility in earnings

Target payout adjustment model

The expected increase in dividends = (Expected earnings * target payout ratio – previous dividend) * adjustment factor

Target payout ratio: the proportion of earnings that the company intends to distribute (pay out) to shareholders as dividends over the long term

Adjustment factor: divided by the number of years over which the adjustment in dividends should take place

Constant dividend payout ratio policy (seldom used)

A higher degree short-term volatility in earnings and/or in investment opportunities

Involves more uncertainty

Global trends in payout policies

The fraction of companies paying cash dividends has been in long-term decline in most developed markets

The fraction of companies engaging in share repurchases has trended upward

There has been a negative relationship between dividend initiations/increases and enhanced corporate governance and transparency

Share repurchase

Shares that have been issued and subsequently repurchased are classified as

Treasury shares: may be reissued

Canceled shares: will be retired

not then considered for dividends, voting, or computing earnings per share

Share repurchase methods

Buy in the open market: the most common; maximum flexibility

Buy back a fixed number of shares at fixed price (tender offer)

Fixed price; repurchase a specific number of shares at a fixed price; at a premium to the current market price

Set a fixed date and a fixed price tender offer can be accomplished quickly

Dutch auction

The company stipulates a range of acceptable prices

Uncovers the minimum price at which the company can buy back the desired number of shares with the company paying that price to all qualifying bids

Repurchase by direct negotiation

The impact on financial statements and ratios

Using the company's surplus cash (internal financing)

Balance sheet

Both asset and equity decrease

Leverage ratio (D/E) increases

Income statement: A repurchase increases EPS only if the funds used for the repurchase would not earn their cost of capital if retained by the company

Using debt to finance the repurchase (external financing)

Balance sheet

Asset constant, debt increases and equity decreases

Leverage (D/E) increases even more

Income statement

Earnings yield<after-tax cost of financing the repurchase, EPS decreases

Earnings yield>after-tax cost of financing the repurchase, EPS increases

Earnings yield=after-tax cost of financing the repurchase, EPS constant

The effect of a share repurchase on book value per share(BVPS)

BVPS > market price (repurchase price), BVPS increases

BVPS < market price (repurchase price), BVPS decreases

BVPS = market price (repurchase price), BVPS constant

Share repurchases vs. cash dividends

Share repurchases are equivalent to cash dividends of equal amount in their effect on shareholders' wealth

Share repurchases usually subject to more restrictions

Share repurchases may not commit the company to follow through with repurchasing shares

Share repurchases in general do not distribute cash in a proportionate manner

Rationales for share repurchases

Potential tax advantages.

Share price support/signaling that the company considers its shares a good investment

Added managerial flexibility

Offsetting dilution from employee stock options

Increasing financial leverage

Analysis of dividend safety

Calculation of dividend coverage ratio

Net income method: Dividend coverage ratio = net income/dividend paid

Free cash flow method: FCFE coverage ratio = FCFE/(dividends + share repurchases)

Scenarios that may raise concerns about dividend safety

Companies that support their dividends and repurchases by reducing productive capital spending, by adding net debt or by some combination of the two

Extremely high dividend yields in comparison with a company's past record and forward-looking earnings

Environmental, Social, and Governance (ESG) Considerations in Investment Analysis

Global Variations in Ownership Structures

Environmental, social, and governance (ESG)

Ownership structures

Dispersed vs. Concentrated ownership

Dispersed ownership: many shareholders, none of which has the ability to individually exercise control over the corporation

Concentrated ownership: reflects an individual shareholder or a group (called controlling shareholders) with the ability to exercise control over the corporation

Dual-class shares: grant one share class superior or sole voting rights, whereas the other share class inferior or no voting rights

Horizontal vs. vertical ownership

Horizontal ownership: involves companies with mutual business interests that have cross-holding share arrangements with each other

Vertical ownership (pyramid ownership): involves a company or a group that has a controlling interest in two or more holding companies, which results in controlling interest in the target company

Conflicts within different ownership structures

Principal-agent problem: The combination of dispersed ownership and dispersed voting power vs. managers

Principal-principal problem

The combination of concentrated ownership and concentrated voting power vs. managers + minority shareholders

The combination of dispersed ownership and concentrated voting power

The combination of concentrated ownership and dispersed voting power arises with voting caps

Types of influential shareholders

Banks

Families

State-Owned Enterprises (SOEs)

Institutional Investors

Group Companies

Private Equity Firms

Foreign Investors

Managers and Board Directors

Evaluating Corporate Governance Policies and Procedures

Effective corporate governance is critical for a company's reputation and competitiveness

Shareholder activism: shareholders attempt to compel a company to act in a desired manner

Board policies and practices

Board of Directors Structure

Board Independence

Board Committees

Board Skills and Experience

Board Composition

Other Considerations in Board Evaluation

Executive remuneration

Transparency of compensation

Performance criteria for incentive plans (both short term and long term)

The linkage of remuneration with the Company strategy

Pay differential between the CEO and the average worker

Shareholder voting rights

Identifying and Evaluating ESG-related Risks and Opportunities

Materiality and investment horizon

Approaches to identify ESG factors

Proprietary methods

Ratings and analysis from ESG data providers

Not-for-profit industry initiatives and sustainability reporting frameworks

ESG integration

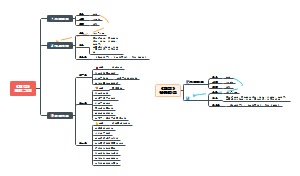

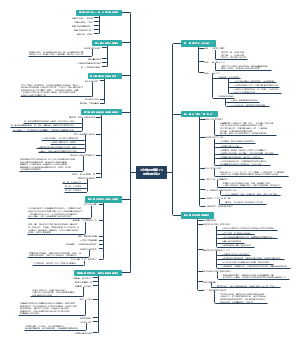

Cost of Capital: Advanced Topics

Cost of Capital Factors

Weighted average cost of capital (WACC)

公式

Determining WACC is challenging

There is no single, "right" methodto calculate the costs of each source of capital

Assumptions are needed regarding long-term target capital structure, which might not be the current capital structure

The company's marginal tax rate must be estimated and might be different than its average or effective tax rate

Cost of Capital

ERP(equity risk premium): a market risk premium for bearing systematic risk

IRP (idiosyncratic risk premium): a company-specific risk premium

Factors influencing a company's cost of capital

Top-Down, External

Capital Availability

Greater capital availability typically leads to more favorable terms for corporate issuers and lower associated costs of capital

Lower perceived risk translates into lower credit spreads, ERPs, and costs of capital for companies in more mature economies

In less developed capital markets, a lack of corporate debt markets could require companies to rely on other means for funding, such as bank loans or the shadow banking system

Market Conditions

Lower interest rates and tighter credit spreads (during expansionary times), decrease costs of debt and equity capital

Higher relative rates of inflation increase the cost of capital for companies

In countries with greater exchange rate volatility , companies have higher costs of capital

Legal and Regulatory Considerations, Country Risk

Investors in environments offering greater investor protections typically demand lower credit spreads and ERPs, leading to lower costs of capital for corporate issuers

Regulatory policies and guidelines set by government or other related entities

Tax Jurisdiction: The higher a company's marginal income tax rate, the greater the tax benefit associated with using debt in the capital structure

Bottom-Up, Company Specific

Revenue, Earnings and Cash Flow Volatility

Asset Nature and Liquidity

Financial Strength, Profitability, and Financial Leverage

Security Features

Estimating the Cost of Debt

Factors affecting methods of estimating the cost of debt

Type of debt

Traded Debt (YTM)

Non-Traded Debt

If credit ratings exist, apply matrix pricing to estimate a YTM

If no credit rating exists, first estimates a bond's rating class; then matrix pricing

Bank debt

Amortizing loans typically have a lower cost of debt

If a company has recently taken on new bank debt, the interest rate on that loan could be a good estimate of the company's cost of debt

Leases

The present value of the residual value and the lessor's direct initial costs are often not known to the lessee (company) or analyst

The incremental borrowing rate (IBR)

If this rate is not known, the analyst might use the non-traded debt estimation method

Debt liquidity

Credit rating

Debt currency

International Considerations: country risk rating (CRR)

定义: A CRR is a rating applied to a country based on the assessment of risk pertaining to that country, in areas such as economic conditions, political risk, exchange rate risk, and securities market development and regulation

处理: By comparing the median interest rate with the benchmark country's rate, the country risk premium can be derived

The equity risk premium (ERP)

Historical Approach

公式: historical ERP= a broad-based equity market index return -government debt return

Analyst's assumptions

Returns are stationary

Markets are relatively efficient

Decisions in the development of a historical ERP

Equity Index Selection: Broad-based, market-value weighted indexes are typically chosen (e.g., S&P 500 Index, Russell 3000 Index)

Time Period: trade-off

Selection of the Mean Type

Selection of the Risk-Free Rate Proxy

Limitations

ERPs can vary over time so estimates based on a long time series of historical data are not representative of the future ERP

Survivorship bias

Forward-looking Approach

Survey-based estimates

方法: gauge expectations by asking people what they expect

Limitations: these estimates tend to be sensitive to recent market returns

Dividend discount models

Gordon growth model(GGM)

GGM ERP (assumes growth rate is constant)

公式: GGM ERP= Dividend yield on the index based on year-ahead aggregate forecasted dividends and aggregate market value +Consensus long-term earnings growth rate -Long term government bond yield

For rapid growing economies, an analyst might assume multiple earnings growth stages

A fast growth stage

A transition growth stage

A mature growth stage

Assumption: the growth rate of earnings, dividends, and prices will grow at the same rate, resulting in a constant P/E

P/E increases (or decreases) can result from an increase (or decrease) in the earnings growth rate or a decrease (or increase) in risk

Macroeconomic modeling (Grinold-Kroner model)

替代计算(选择长期预测数据)

Limitations

The Cost of Equity (Required Return on Equity)

Public companies

DDMs

the bond yield plus risk premium build-up method

re=rd+RP

Advantages: Estimating a company's cost of debt provides a starting point estimate of the return demanded by that company's debt investors

Disadvantages

Determination of RP is relatively arbitrary

Approach requires company to have traded debt

If the company has multiple traded debt securities, each with different features, there is no prescription regarding which bond yield to select

Common practice: use the company's long term bond YTM

risk-based models

re = Compensation for the time value of money + Compensation for bearing risk

类型

CAPM

β is a measure of the sensitivity of the company stock's returns to changes in the ERP

market model: estimate βi

Fama–French Models

Required return of stock j = rf + β1ERP + β2SMB + β3HML

The five-factor Fama–French model

re = rf + β1ERP + β2SMB + β3HML + β4RMW + β5CMA

RMW: profitability premium, equal to the average difference in equity returns between companies with robust and weak profitability

CMA: investment premium, equal to the average difference in equity returns between companies with conservative and aggressive investment portfolios

Summary

The use of risk-based models is similar

Historical returns are used to estimate the relationship between a company's stock's excess returns and these factors

Slope coefficients from the estimated regression, along with expectations for the factor risk premiums and the risk-free rate, are used to calculate an estimate of the company's required return on equity

Analyst's considerations

Estimates from the different risk factor models often yield different results

The beta coefficient on the market factor (ERP) normally differs between the single factor CAPM and multifactor models

The use of a short-term risk-free rate when computing excess returns to estimate the factor betas in these risk-based models can result in the understatement of the risk-free rate

Private companies

The required return on equity for private companies

A size premium (SP)

An industry risk premium (IP)

A specific-company risk premium (SCRP)

Two choices to estimate the required return on equity

Expanded CAPM

公式

注意事项

β: a peer group of publicly traded companies in the same industry

Determine whether additional risk premia for company size and other company-specific risk factors are warranted. If warranted, add relevant size and company-specific risk premium

Build-up approach

公式

各部分关系

International considerations

Extended CAPM

Global CAPM

A global market index is the single factor, there are no assumed significant risk differences across countries

Expanding this model to include a second factor, such as domestic market index returns, mitigates this to a degree but depends on the availability of reliable financial data in the emerging market

International CAPM

Country spread and risk rating models

ERP = ERP for a development market + (λ × Country risk premium)

λ is the level of exposure of the company to the local country

Country risk premium= the yield on emerging market bonds - the yield on developed market government bonds (sovereign yield spread)

Comparison of International Adjustment Methods

If the company's operations are global, but limited to developed countries, the GCAPM and ICAPM are reasonable methods to apply

If however, the company's operations extend to developing countries, the estimation of the CRP using the sovereign yield approach might be appropriate, but these estimations are based on historical rates and might not reflect the risk premium going forward

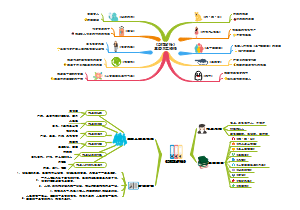

Corporate Restructuring

Corporate Evolution, Actions, and Motivations

Corporate issuers change over time

Evolutionary: launching new products and expanding capacity

Revolutionary: changes to the legal and accounting structure of the issuer (e.g.,acquisitions, divestitures and spin offs)

Corporate Life Cycle and Actions

Types of corporate restructurings

Investment

Equity investment: a company purchasing a material stake in another company's equity but less than 50% of its shares

Joint venture: two or more companies form and jointly control a new, separate company to achieve a business objective

Acquisition: one company (the acquirer) purchases most or all of another company's (the target), shares to gain control of either an entire company, a segment of the other company, or a specific group of assets

Divestment

原因: Conglomerate discount——An issuer trading at a valuation lower than the sum of its parts

类型

Sale

Spin off: a company separates a distinct part of its business into a new, independent company

Restructuring

Opportunistic improvement

Forced improvements

Leveraged Buyouts

Motivations for Corporate Structural Change

特点: all types of changes have been found to be pro-cyclical

Evaluating Corporate Restructurings

过程

Initial Evaluation

What is happening and why: involves reading the issuer's press release, securities filings, conference call transcripts, and relevant third-party research

Materiality

Size

For restructuring involving a transaction: the value of the transaction relative to the issuer's enterprise value (EV) (>10%)

For restructurings not involving a transaction, it is the scale of the intended action that is material

Fit: how the change fits in with earlier actions, previously announced strategies, and the analyst's own expectations for the issuer

Time

Preliminary Valuation

Comparable company analysis

方法

Uses the valuation multiples of similar, listed companies to value a target

Common multiples used include enterprise value to EBITDA or sales, price to earnings, (less commonly) enterprise value to free cash flow to the firm

It is more often employed for assessing the valuation of targets in spin offs than for acquisitions or sales because of premium

优缺点

Advantages

Reasonable approximation of a target company's value relative to similar companies in the market

The required data are readily available

The estimates of value are derived directly from the market

Disadvantages

A comparable set of listed companies can be difficult to find or may not exist

The method is sensitive to market mispricing

To estimate a fair takeover price, analysts must add an estimated takeover premium

Comparable transaction analysis

方法: Analysts use valuation multiples from historical acquisitions of similar targets

优缺点

Advantages

The value estimates come from actual transaction prices for similar targets

It is not necessary to separately estimate a takeover premium because it is embedded in the comparable transaction multiples

Disadvantages

The market for corporate control is illiquid

Historical valuation multiples reflect not only historical industry conditions, but also historical macroeconomic conditions that can significantly influence transaction multiples

There is a risk that past acquirers over-or underpaid

Premium paid analysis

Takeover premium (PRM)=(DP-SP)/SP

The meanings

DP = deal price per share of the target

SP = unaffected stock price of the target

Modeling and Valuation

Pro forma financial statements

过程

Pro Forma Income Statement (Acquisition) Modeling

Pro Forma Weighted Average Cost of Capital