导图社区 5 Equity Investments

- 71

- 1

- 1

- 举报

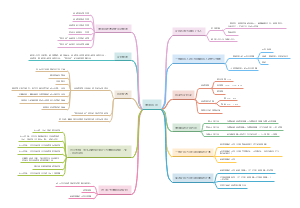

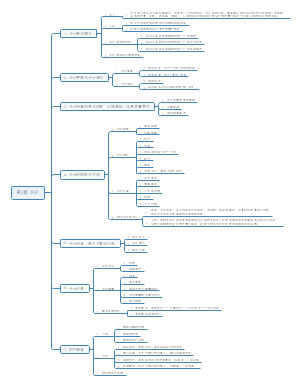

5 Equity Investments

CFA一级课程Equity investments,根据2022年考纲编写,希望能给大家带来帮助~

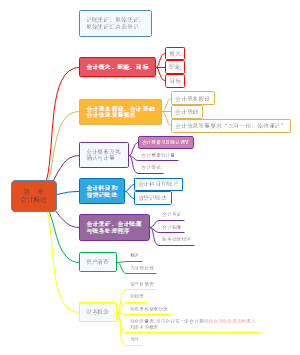

编辑于2022-05-30 09:53:55- 2024cpa会计科目第17章收入、费用和利润

2024cpa会计科目第17章,本章属于非常重要的章节,其内容知识点多、综合性强,可以各种题型进行考核。既可以单独进行考核客观题和主观题,也可以与前期差错更正、资产负债表日后事项等内容相结合在主观题中进行考核。2018年、2020年、2021年、2022年均在主观题中进行考核,近几年平均分值 11分左右。

- 2024cpa会计科目第十二章或有事项

2024cpa会计科目第十二章,本章内容可以各种题型进行考核。客观题主要考核或有资产和或有负债的相关概念、亏损合同的处理原则、预计负债最佳估计数的确定、与产品质量保证相关的预计负债的确认、与重组有关的直接支出的判断等;同时,本章内容(如:未决诉讼)可与资产负债表日后事项、差错更正等内容相结合、产品质量保证与收入相结合在主观题中进行考核。近几年考试平均分值为2分左右。

- 2024cpa会计科目第十一章借款费用

2024cpa会计科目第十一章,本章属于比较重要的章节,考试时多以单选题和多选题等客观题形式进行考核,也可以与应付债券(包括可转换公司债券)、外币业务等相关知识结合在主观题中进行考核。重点掌握借款费用的范围、资本化的条件及借款费用资本化金额的计量,近几年考试分值为3分左右。

5 Equity Investments

社区模板帮助中心,点此进入>>

- 2024cpa会计科目第17章收入、费用和利润

2024cpa会计科目第17章,本章属于非常重要的章节,其内容知识点多、综合性强,可以各种题型进行考核。既可以单独进行考核客观题和主观题,也可以与前期差错更正、资产负债表日后事项等内容相结合在主观题中进行考核。2018年、2020年、2021年、2022年均在主观题中进行考核,近几年平均分值 11分左右。

- 2024cpa会计科目第十二章或有事项

2024cpa会计科目第十二章,本章内容可以各种题型进行考核。客观题主要考核或有资产和或有负债的相关概念、亏损合同的处理原则、预计负债最佳估计数的确定、与产品质量保证相关的预计负债的确认、与重组有关的直接支出的判断等;同时,本章内容(如:未决诉讼)可与资产负债表日后事项、差错更正等内容相结合、产品质量保证与收入相结合在主观题中进行考核。近几年考试平均分值为2分左右。

- 2024cpa会计科目第十一章借款费用

2024cpa会计科目第十一章,本章属于比较重要的章节,考试时多以单选题和多选题等客观题形式进行考核,也可以与应付债券(包括可转换公司债券)、外币业务等相关知识结合在主观题中进行考核。重点掌握借款费用的范围、资本化的条件及借款费用资本化金额的计量,近几年考试分值为3分左右。

- 相似推荐

- 大纲

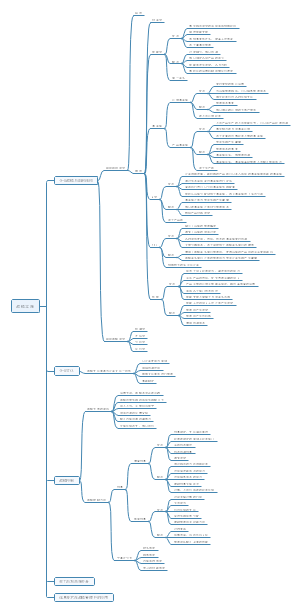

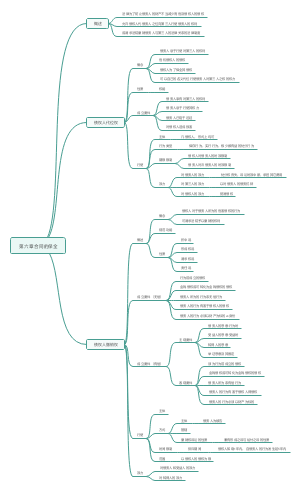

Equity Investments

Market Organization Structure

The Functions of the Financial System

Helping People Achieve Their Purposes in Using the Financial System

To save money for the future

To borrow money for current use

To raise equity capital

To manage risks

Hedger

To exchange assets for immediate and future deliveries

To trade on information

Information-motivated traders

Determining Rates of Return

Equilibrium interest rate

Capital Allocation Efficiency

Well-Functioning Financial Systems

Characteristics

Complete markets

Operational efficiency

Information efficiency

Allocation effiiciency

Market regulation

Classification of Markets

分类

How securities are sold

Through primary market

Sold publicly

Underwritten offering(the most common way)

Investment bank purchases the entire issue at a price that is negotiated between the issuer and bank

Investment bank bears the risk of buying the unsold portion of securities

Investment banks have strong incentives to choose a low price that banks can allocate valuable shares to benefit their clients and thereby indirectly benefit the banks

Best efforts

The investment bank doesn't purchase the whole issue

Bank is not obligated to buy the unsold portion if the issue is undersubscribed

Investment bank generally are supposed to select the offering price that will raise the most money

Indications of interest

定义: the investment bank finds investors who agree tobuy part of the issue.

This process of gathering indications of interest is called book building, andthe investment bank during this process is called book builder or book runner

If securities must be issued quickly, the process is called accelerated book building

Sold privately and other methods

Private Placement: Seurities are sold drectly to quaififed ivesor, ypil with the asta of aninvestment bank

Shelf Registration: Type of public fering that allows the issuer to file a single, all-encompassing offering circular that covers a series of bond issues

Dividend Reinvestment Plan: A dividend reinvestment plan(DRP or DRIP) allows existing shareholders to usetheir dividends to buy new shares from the firm at a slight discount

Rights Offering: In rights offering, existing shareholders are given the right to buy new shares at adiscount to the current market price

Through secondary market

根据交易时间分类

根据交易方式分类

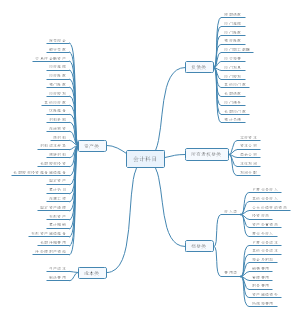

Classification of Assets

Financial assets

Security

Fixed income securities

Bonds: With longer matrities (with maturity longer than 10 years)

Notes: Intermediate term(with maturity between 2 to 10 years)

Bills: Short term(with maturity less than 1 year)

Commercial paper: Short term issed by firms(with maturity less than 1-2years)

Certificates of deposit: issued by banks

Repurchase agreements: Borrower sells a high quality asset and has both theright and obligation to repurchase it (at a higher price) in the future, which can be for terms as short as one day

Convertible debt: Convertible debt are typically convertible into stock, usually at the option of the holder after some period

Equity securities

Pooled investment vehicles

Public/private

Public: trade in liquid markets in which seller scan esaily find buyers for their securities

Private: not traded in public markets which are often illiquid and not subject to regulation

Currency: Issued by ational monetary authorities, and some of these currencies are regarded as reserve currencies

Derivative contracts

Real assets

分类

Commodity

Real estate

特点

Provide income, tax advantage, diversification benefits

Entail substantial management costs

Require substantial due diligence before investing

Financial Intermediaries

Positions

Long position

People have long positions when they own assets or contracts and benefit form an increase in the price

Short position

Borrow securities from security lenders who are long holders. Then sell theborrowed securities to other traders

Benefit from a decrease in the price.

The potential gains on a short position are limited to no more than 100, whereas the potential losses are unbounded

Payment-in-lieu

Leveraged positions

Definition: traders buy securities by borrowing some of the purchase price

Leverage ratio=1/margin

Buy on margin: traders can buy securities by borrowing some of the purchase price

The interest rate that the buyers pay for their margin loan is called the call money rate

Margin requirement

Initial margin(IM): a minimum amount of equity at the time of a newmargin purchase

Maintenance margin(MM): the investor's required equity position in theaccount;

Margin call: if an investor's margin account balance falls below the maintenance margin, the buyer will receive a margin call and will be required to either liquidate the position or bring the account back to its maintenance (minimum) margin requirement

Margin call price for a leverage position

Orders and Instructions

Security Market Indexes

Definitions about Market Indexes

How an index is constructed

Identify the target market and what is the index intended to measure

Pick the representative securities from the market

Decide the weight for every securities

Determine the rebalance frequency

Determine the time of securities re-examination

Uses of Security-Market Indexes

Reflection of investor confidence

Benchmark of manager performance

Proxies for measure of market return and risk

Proxies for measure of beta and risk adjusted return

Model portfolio for index funds

Weighting schemes for stock indexes

Calculation of value and returns

Calculation of Single-Period Returns

Price return

PRI= the price return of the index portfolio (as a decimal number, i.e., 12 percent is 0.12) VPRI1 = the value of the price return index at the end of the period VPRI0 = the value of the price return index at the beginning of the period

price return of each constituent security

PRi= the price return of constituent security i (as a decimal number) Pi1 = the price of constituent security i at the end of the period Pi0 = the price of constituent security i at the beginning of the period

N = the number of individual securities in the index wi= the weight of security i (the fraction of the index portfolio allocated to security i)

Total return: the price appreciation, or change in the value of the price return index plus income (dividends and/or interest)

TRI = the total return of the index portfolio (as a decimal number) IncI= the total income (dividends and/or interest) from all securities in the index held over the period

TRi= the total return of constituent security i (as a decimal number) Inci= the total income (dividends and/or interest) from security i over the period

Over Multiple Time Periods

VPRI 0 = the value of the price return index at inception VPRIT = the value of the price return index at time t PRIT = the price return (as a decimal number) on the index over period t, t = 1, 2, …, T

VTRI 0 = the value of the index at inception VTRIT = the value of the total return index at time t TRIT = the total return (as a decimal number) on the index over period t, t = 1, 2, …, T

分类

Price-Weighted Index

计算

特点: simple, high priced stocks tilted

Equal-Weighted Index

计算: wi=1/N,where wi = fraction of the portfolio that is allocated to security i or weight of security i N = number of securities in the index

特点: small caps tilted

Market Capitalization-Weighted(value-weighted) Index

方法:the weight on each constituent security is determined by dividing its market capitalization by the total market capitalization (the sum of the market capitalization) of all the securities in the index

wi= fraction of the portfolio that is allocated to security i or weight of security i Qi = number of shares outstanding of security i Pi= share price of security i N = number of securities in the index

特点: large cap stocks tilted, momentum effect

A Float-Adjusted Market Capitalization-Weighted Index

计算方法: the weight on each constituent security is determined by adjusting its market capitalization for the number of shares of the constituent security that are available to the investing public

fi= fraction of shares outstanding in the market float wi= fraction of the portfolio that is allocated to security i or weight of security i Qi= number of shares outstanding of security i Pi= share price of security i N = number of securities in the index

Fundamental weighting

计算方法: weighting by using measures of a company's size that are independent of its security price to determine the weight on each constituent security,e.g. book value, cash flow, revenues, earnings, dividends,etc

Fi denote a given fundamental size measure of company i

特点: value tilted, contrarian-style

Rebalancing and Reconstitution

Rebalacing: To maintain the weight of each security consistent with the index's weighting method, the index provider rebalances the index by adjusting the weights of the constituent securities on a regularly scheduled basis, usually quarterly

Reconstruction

Reconstitution is the process of changing the constituent securities in an index

Constituent securities that no longer meet the criteria are replaced with securities that do meet the criteria

Uses of market indexes

Gauges of market sentiment

Proxies for measuring and modeling returns, systematic risk, and risk-adjusted performance

Proxies for asset classes in asset allocation models

Benchmarks for actively managed portfolios

Model portfolios for such investment products as index funds and exchange-traded funds (ETFs)

Other investment indexes

Equity indexes

Broad Market Indexes

Multi-market indexes

Fundamental Weighting in Multi-Market Indexes

Sector indexes

Style indexes

Market Capitalization

Large cap

Midcap

Small cap

Value/Growth Classification

Market Capitalization and Value/Growth Classification

Fixed income indexes

Aggregate indexes can be subdivided by market sector (government, government agency, collateralized, corporate); style (maturity, credit quality); economic sector, or some other characteristic to create more narrowly defined indexes

分类方法

Type of issuer (government, government agency, corporation)

Type of financing (general obligation, collateralized)

Currency of payments

Maturity

Credit quality (investment grade, high yield, credit agency ratings)

Absence or presence of inflation protection

Fixed-income indexes are based on

Aggregate or broad market indexes

Market sector indexes

Style indexes

Economic sector indexes

Specialized indexes such as high-yield, inflation-linked, and emerging market indexes

Several issues with the construction

Large universe of securities

Turnover is high

Dealer markets

Infrequent trading

Costly and difficult for investors to replicate fixed-income indexes and duplicate their performance

Alternative investment indexes

Commodity indexes(futures contracts)

Real estate indexes

Appraisal indexes(price smooth), underestime risk

Repeat sales indexes: 价值更准确,但可能数据缺少,造成sample selection bias

Real estate investment trust (REIT) indexes

Hedge fund indexes

Survivorship,back fill bias(upward)

Rather than index providers determining the constituents, the constituents determine the index

Market Efficiency

What is Efficient Capital Market

Current security prices fully reflect all available information

Market value: is the price at which an asset can currently be bought or sold.

Intrinsic value( fundamental value) : the value that would be placed on it by investors if they had a complete understanding of the asset's investment

Security prices adjust rapidly to the infusion of new information and prices should be expected to react only to the elements of information releases that are not anticipated fully by investors

The time frame for an asset 's price to incorporate information can be used to measure a market' s efficiency

Factors affect the degree of market efficiency

The number of market participants; positively related

Availability of information and financial disclosure should promote market efficiency

Impediments to trading

Transaction and information costs: higher costs ofinformation, analysis, and trading, more inefficient of the market

Three forms of market efficiency

Tests, Implications and Conclusions of EMH

Abnormal returns

Technical analysis

Fundamental analysis

Event study

If markets are semi-strong from efficient, investors should invest passively

In general, mutual fund managers can not beat a passive index strategy from time to time

Market Anomalies

Anomalies in time-series data

Calendar anomalies

January effect: returns in January are significantly higher than the rest of the months in that year

Reasons

Window dressing

Tax loss selling

The overreaction effect: "winner" securities would underperform the market and "loser" securities would outperform the market

Momentum anomalies: securities that have high returns in the short-term will be continued by higher return

Both the overreaction effect and momentum effects are contradictions to the weak form of market efficiency

Anomalies in cross-sectional data

Size effect: stocks of small-sized firms tend to outperform stocks of large-sized firms

Value effect: studies have shown that Value stocks have consistently outperformed growth stocks

Value stocks: lower price-to-earnings(P/E), lower market-to-book(M/B), and higher dividend yields

Growth stocks: higher P/E, higher M/B, and lower dividend yields

Other identified anomalies

Closed-end investment funds: closed-end funds trade at a discount from NAV

Earnings Surprise: The unexpected part of the earnings announcement,; the portion of earnings that is unanticipated by investors

Positive (negative) surprises should cause appropriate and rapid price increases (decreases).Most of the results indicate that earnings surprises are reflected quickly in stock prices, but the adjustment process is not always efficient

Initial public offerings(IPO): The percentage difference between the issue price and the closing price at the end of the first day of trading is often referred to as the degree of underpricing

Economic fundamentals: equity returns are related to prior information on such factors as interest rates, inflation rates, stock volatility, and dividend yields

Behavior Finance

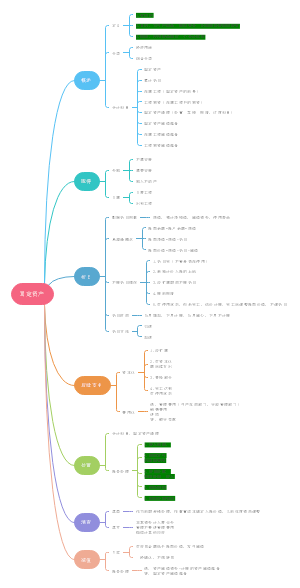

Equity Valuation: Concepts and Basic tools

Evaluate a security

Intrinsic value vs. Market price

Intrinsic value: based on an analysis of investment fundamentals and characteristics

By comparing estimates of value and market price can arrive at one of three conclusions: The security is undervalued, overvalued, or fairly valued

Market price is assumed to move toward intrinsic value

Things to consider when deciding whether to invest based on estimated intrinsic value

The degree of difference between market prices and estimated values

Confidence in valuation model.

Confidence in inputs used in the valuation model.

Reasons why stock is mispriced

Major categories of equity valuation models

Discounted cash flow models(present value model)

背景

Dividends

Extra dividend (special dividend):not pay dividends on a regular schedule or a dividend that supplements regular cash dividend with an extra payment

Stock dividends: a type of dividend in which a company distributes additional shares of its common stock to shareholders instead of cash

Changes in number of shares (stock split/reverse stock split)

Stock split: a for b(a>b)表示原来b股拆分为a股,股价下降

Reverse stock split: b for a(a>b)表示原来a股合并为b股,股价上升

Chronology

Share repurchases

定义: a company uses cash to buy back its own shares

作用

Signaling a belief that their shares are undervalued

Flexibility in the amount and timing of distributing cash to shareholders

Tax efficiency in markets where tax rates on dividends exceed tax rates on capital gains

The ability to absorb increase in outstanding shares because of the exercise of employee stock options

计算

Valuing preferred stock

The characteristics of preferred stock

Receive a stated dividend for an infinite period

Perpetuity

公式

Valuing common stock

Gordon growth model(Constant growth model)

Assumption for the infinite period DDM

Dividends grow at a constant rate

The constant growth rate will continue for an infinite period

The required rate of return ris greater than the infinite growth rate g. If it is not, the model gives meaningless results

公式

相关参数计算

Do=(1-RR)xEPS

The required rate of return

Capital Asset Pricing Model(CAPM)

r=current bond yield + equity risk premium

Growth rate in dividends

Use the historical growth in dividends for the firm

Use the median industry dividend growth rate

Estimate the sustainable growth rate

g=RR*ROE; RR=1-dividend payout rate

Limitations

Very sensitive to estimates of r and g

Difficult with non-dividend stocks

Difficult with unpredictable growth patterns(use multi-stage model)

Important conculsion

The wider the difference between r and g, the smaller the value of the stocks

Small changes in the difference between r and g will cause large changes in the stocks' value

Two-stage DDM: The growth rate starts at a high level for a relatively short period of time and then reverts to a long-run perpetual level

Free cash flow to equity(FCFE)

FCFE

FCFE=net income + depreciation - increase in working capital-fixed capital investment(FC Inv)-debt principal repayments +new debt issues

FCFE=cash flow from operations - FC Inv + net borrowing

V0

Multiplier models

Price multiples

Price to Earnings(P/E)

P0=D1/(r-g)

Justified P/E

Leading P/E: based on expected earnings Ei (expected 12-month earnings),next period: P0/E1=(D1/E1)/(r-g)=(1-RR)/(r-g)

Trailing P/E: based on actual earnings for the previous period; P0/E0=(D0/E0)/(r-g)=(1-RR)(1+g)/(r-g)

Price to Sales

Price to Book Value

Price to Cash Flow

Enterprise Value to EBITDA

Enterprise value(EV) is total company value, not equity

EV=market value of common stock + market value of preferred equity+market value of debt - cash and short-term investments

Two main ways to apply these multiples

Price multiples based on comparables: Compare relative values between one firm to another using price multiples with market price

Price multiples based on fundamentals: The value justified by (based on) fundamentals or a set of cash flow predictions therefore are independent of the current market price

优缺点

Price multiples

Rationale for using price multiples: The economic rationale underlying the method of comparables is the law of one price--Identical assets should sell for the same price.

Advantages

Can be calculated easily

Can be used both cross-sectional(versus the market or another comparable) and in time series

DIsadvantages

Reflect only past performance/data

Conclusion drawn under the comparable and fundamental method may be reverse

Price multiples may lose validity when firms use different accounting methods

Price multiples for cyclical firms may be highly influenced by current economic conditions

Enterprise value

Advantages

Useful for comparing firms with different degrees of financial leverage

EBITDA is useful for valuing capital-intensive business

EBITDA is usually positive even when EPS is not

DIsadvantages: Market value of debt is often not available

Bond values may be estimated from current quotations for bonds with similar maturity, sector, and credit characteristics

Substituting the book value of debt for the market value of debt provides only a rough estimate of the debt's market value

Asset-based models

定义: a company uses estimates of the market or fair value of the company's assets and liabilities

使用情况

The model is not really applicable for

A firm with a high proportion of intangible assets or "off the books" assets

Assets tend to be more difficult to estimate under a hyper-inflationary condition

The approach is most applicable when

The intangible assets, which are typically difficult to value, are a relatively small proportion of corporate assets

Financial companies, natural resource companies, and formerly going concerns that are being liquidated

Frequently used for valuation of private companies

Comparison

Discounted cash flow model

Price multiples

Price multiple valuations based on fundamentals

Asset-based models

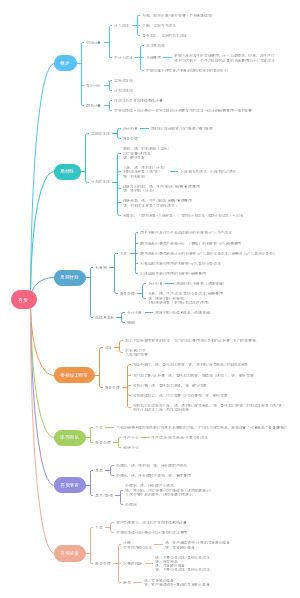

Introduction to Industry and Company Analysis

Top-down process

Three-Step Valuation Process

General Economic Influence

Industry Influences

Company Analysis

Economic and industry environment will have a major influence on the success of a firm and the realized rate of return on its stock

General Economic Influence

Macroeconomic factors

Technology

Demographics(population)

Governments

Social influence

Industry Influences

步骤

1||| Understanding a company's business and business environment

2||| Identifying active equity investment opportunities

3||| Portfolio performance attribution

The major approaches to industry classification

Products and services they offer

方法: use a firm's principal business activity(the largest source of sales or earnings) to classify firms

Some systems

Global Industry Classification Standard (GlCS)

Russell Global Sectors (RGS)

Industry Classification Benchmark(ICB)

Sensitivity to business cycles

Cyclical firm

特点

High earnings volatility

High operating leverage

实例: basic materials and processing, consumer discretionary, energy, financial services, industrial and producer durables, and technology

Non-cyclical firm

特点: demand is relatively stable over the business cycle

实例: Health care, utilities, telecommunications, and consumer staples

分类

Defensive industries: least affected by the stage of the business cycle and include utilities, consumer staples(such as food producers), and basic services(such as drug stores)

Growth industries: demand so strong they are largely unafected by the stage of the business cycle

Limitations

Business-cycle sensitivity is a continuous spectrum rather than an "either/or" issue, so placement of companies in one of the two major groups is somewhat arbitrary

Different countries and regions of the world frequently progress through the various stages of the business cycle at different times. Comparing two companies currently exposed to different demand environments as fundamental data from such companies to establish industry benchmark values would be misleading

Statistical methods, such as cluster analysis

定义: groups firms that historically have had highly correlated returnsbut have lower returns correlations between different groups

Limitations

Historical correlations may not be the same as future correlations

The groupings of firms may differ over time and across countries

The grouping of firms is sometimes non-intuitive

The method is susceptible to statistical error(i.e., firms can be grouped by a relationship that occurs by chance, or not grouped together when they should be)

Strengths and Weaknesses of Current Systems (Commercial vs.Governmental)

Government systems do not disclose information about a specific business or company

Commercial classification systems are adjusted more frequently than government classification systems, which may be updated only every five years or so

Government classification systems generally do not distinguish between small and large businesses, between for-profit and not-for-profit organizations, or between public and private companies

Commercial classification include only for-profit and publicly traded organizations

分析方法

Peer group

定义: a group of companies engaged in similar business activities whose economics and valuation are influenced by closely related factors

步骤

1||| Examine commercial classification systems

2||| Review the subject company's annual report for a discussion of the competitive environment

3||| Review competitors' annual reports to identify other potential comparable companies

4||| Review industry trade publications to identify comparable companies

5||| Confirm that each comparable company derives a significant portion of its revenue and operating profit from a business activity similar to the primary business of the subject company

Pricing power

Barriers to entry

Low barriers to entry->little pricing power

high barriers to entry do not necessarily mean high pricing power

Low barriers to exit may have higher pricing power(Overcapacity)

Industry concentration: not necessarily indicates that concentrated industries always have pricing power

Industry capacity

Undercapacity -> higher pricing power and higher return on capital

Overcapacity -> lower pricing power and lower return on capital

Market share stability: Stable market shares typically indicate less competitive industries

Competitive Advantage

Michael porter' s "five forces " framework

Industry life cycle

Elements considered in an industry analysis

Study statistical relationships between industry trends and a range of economic and business variables

Use various approaches to develop practicaland reliable industry variables

Identify the difference between their forecasts and consensus forecast and find out the industry which is miss-valued

Examine the performance compared with other industries to identify superior ones

Determine the consistency, volatility and risk return over time to identify industries with potential highest return

Examining industry prospects by testing strategic groups

Company analysis

内容

Provide an overview of the company, including a basic understanding of its businesses, investment activities, corporate governance, and perceived strengths and weaknesses

Relevant industry characteristics

The demand for the company's products and services

The supply of products and services and an analysis of costs

Company's pricing environment

Financial ratios, including comparisons over time and comparisons with competitors

Three generic competitive strategies

Cost leadership

Differentiation

Focus

Overview of Equity Securities

Classification of Public Equity Securities

Common shares

特点: Shareholders have voting rights and a residual claim on company's net assets(after the claims of debt holders and preferred stockholders)

Voting rights

Statutory voting: each share represents one vote

Cumulative voting

特殊类型

Callable common shares: Give the issuing company the option(or right), to buy back shares from investors at a call price

Putable common shares: Give investors the option or right to sell their shares(l.e,"put" them) back to the issuing company at a price

Preference shares

定义: type of equity interest which ranks above common shares with respect to the payment of dividends and the distribution of the company's netassets upon liquidation

分类

Cumulative preference shares: If the company decides not to pay a dividend in one or more periods, the unpaid dividends accrue and must be paid in full before dividends on common shares can be paid

Participating preference shares: Entitle shareholders to receive an additional dividend if the company's profits exceeds a pre-specified level

Convertible preference shares: Entitle shareholders to convert their shares into a specified number of common shares

Private Equity Securities

特点

Liquidity is lower due to lack of public trading market

Share price is negotiated by two parties rather than determined by market trades

Because there is no government or exchange requirement, the financial disclosure will be less transparent

Low requirement on financial report contribute to low reporting cost

Corporate governance is generally weaker

Less pressure for short-term performance, therefore more attention is paid to a longer-term focus

Gain superior return when the firm launches IPO

分类

Venture captial

Leveraged buyout(LBO)

Private investment in public equity(PIPE)

Non-domestic Equity Securities

Direct investing: buy and sell securities directly in foreign market

对投资者的要求: investors must be familiar with the trading, clearing, and settlement regulations and procedures of that market

Investing directly often results in less transparency and more volatility

Investors can use such securities as depository receipts and global registered shares

Depoeitory receipts(DR)

定义: a security that trades like an ordinary share on a local exchange and represents an economic interest in a foreign company, which allows the publicly listed shares of a foreign company to be traded on an exchange outside its domestic market

分类

根据上市公司是否参与

Sponsored

The foreign company whose shares are held by the depository has a direct involvement in the issuance of the receipts

Investors in sponsored DRs have the same rights as the direct owners of the common shares((e.g., the right to vote and to receive dividends)

Sponsored DRs are generally subject to greater reporting requirements than unsponsored DRs

Unsponsored

The underlying foreign company has no involvement and the depository purchases the foreign company's shares in its domestic market and then issues the receipts through brokerage firms in the depository's local market

The depository bank retains the voting rights

根据发行区域

Global depository receipt (GDR): issued outside of the company's home country and outside of the United States

American depository receipt (ADR): a US dollar-denominated security that trades like a common share on US exchanges

Four types of ADRs

Global registered shares(GRS)

定义: A common share that is traded on different stock exchanges around the world in different currencies

Currency conversions are not needed to purchase or sell shares

Basket of listed deporitory receipts(BLDR)

An exchange-traded fund (ETF) that represents a portfolio of depository receipts

The BLDR is a specific class of ETF security that consists of an underlying portfolio of DRs and is designed to track the price performance of an underlying DR index

Risk and Return Characteristics of Equity Securities

The risk is most commonly measured as the standard deviation of returns

Putable stock <Preferred stock <Common stock <Callable stock

Cumulative preferred stock< Non-cumulative preferred stock

The value of equity

Book value: shareholders' equity on a company's balance sheet

Market value: the collective and differing expectations of investors concerning the amount, timing, and uncertainty of the company's future cash flows

Return on Equity(ROE): the primary measure that equity investors use to determine whether the management of a company is effectively and efficiently using the capital they have provided to generate profits

Cost of equity:as a proxy for the investors' minimum required rate of return