导图社区 经济制度

- 126

- 1

- 0

- 举报

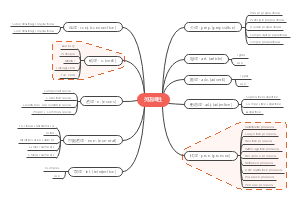

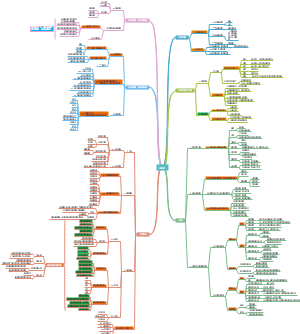

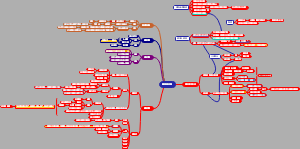

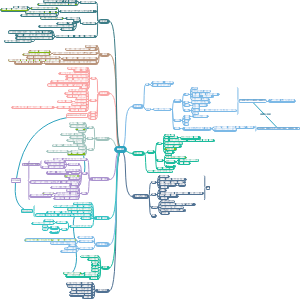

经济制度

IGCSE经济学chapter2经济制度的知识导图,介绍了市场经济体制、市场失灵等方面的内容,有需要的朋友收藏下图学习吧!

编辑于2022-04-29 20:21:20- IGCSE

- IG物理

关于IG物理的思维导图,汇总了turning effects、force and motion、electrical quantities、magnetism知识。

- IGCSE化学 Chemistry chapter3, 4, 5

IGCSE化学 Chemistry chapter3, 4, 5的思维导图,具体是quantitative chemistry、electrochemistry、bonding and structure.

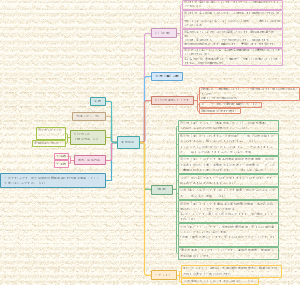

- firms

剑桥IGCSE教材经济:chapter3.5(Firms):How to classify firms?How to measure the size of the company……

经济制度

社区模板帮助中心,点此进入>>

- IG物理

关于IG物理的思维导图,汇总了turning effects、force and motion、electrical quantities、magnetism知识。

- IGCSE化学 Chemistry chapter3, 4, 5

IGCSE化学 Chemistry chapter3, 4, 5的思维导图,具体是quantitative chemistry、electrochemistry、bonding and structure.

- firms

剑桥IGCSE教材经济:chapter3.5(Firms):How to classify firms?How to measure the size of the company……

- 相似推荐

- 大纲

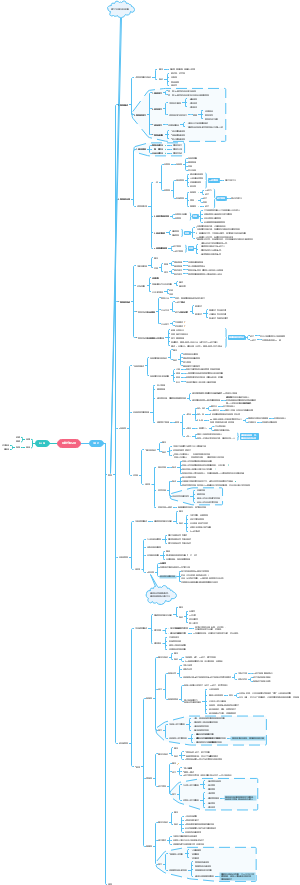

economic system

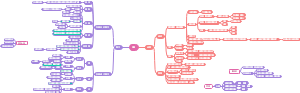

2.9 market economic system

definition of market economic system

market economic system:most decisions are taken by private sector,no government intervention.

private sector and public sector

private sector is owned by private individuals and organisation, not the government.

public sector is owned by the government.

key decision in a market economic system

what to produce?:

what consumers are able and willing to buy

how to produce?:

the way that maximizes profit (profit=total revenue-total cost)

for whom to produce?:

consumers who can afford the price

advantages of market economic system

1.Consumers will have a wide range of product to choose from. Consumer sovereignty is a key feature of market economic system.

2.Firms respond quickly to changes in consumer wants and spending patterns. Private firms will quickly move resources into production of goods and services that consumers demand.

3.There will be competition between different producers ,keeping price low and quality high

4.The profit motive(利润激励) of firms encourages them to develop new products and use the most efficient methods of production

disadvtages of market economic system

Firms will only supply products to consumers who can affod it and this may bring inequality

Firms may disregard the welfare of people ,animals and the environment since this may increase their cost

There may be examples of market failure. Such as the overproduction and overconsumption of demerit good and the underproduction and underconsumption of merit goods and the nonproduction of public goods.

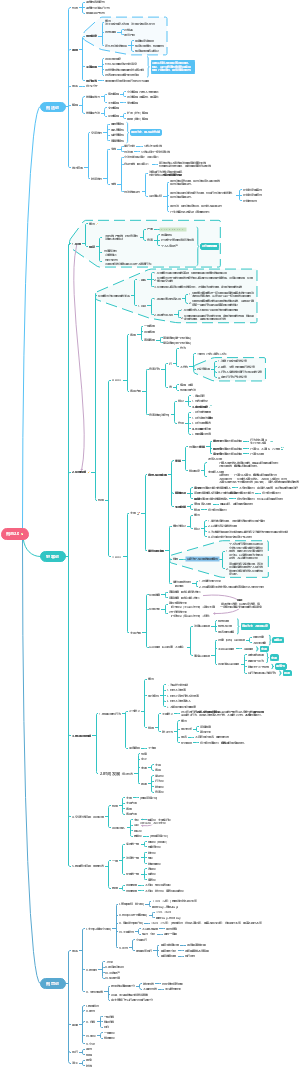

2.10 market failure(市场失灵)

market failure(市场失灵) exists when there is an inefficient allocation of resources in an economy

types of market faliure

overproduction(government disincentives necessary)e.g.:cigarette

over-consumed

over-produced

overallocation of resources

underproduction(government incentives necessary)e.g.:education

under-consumed

under-produced

underallocation of resources

causes of market failure

1.no public goods:the market is unable to provide public goods, like defence, police and street lighting. Public goods is both non-rival(非对抗性)and non-excludable(非排外性) and it is provided by goverment and financedby taxtion.

non-rival(非对抗性) means the consumption of a public good by one person does not reduse the possibility of it being consumed by another person

non- excludable(非排外性) means no one can excludable from consuming the public good

2.Overproduction and overconsumption:Demerit good, like drugs and alcohol are overproduced or overconsumed

3.Underproduction and underconsumption:The market is unable to provide sufficient(充足的)merit good, like education and health care. Merit good are underproduced and underconsimed.

4.Abuse(滥用) of monopoly(垄断):A market may fail if there is lack of competition and one firm dominate(统治)a market. The firm may abuse its monopoly power by increasing the price and reducing the quality of product.

5.Factors immobility:Factors of production are not easily moved from one area to another(geographical immobility) or from one use to another(occupational immobility)

6.Externality(外部性):Externality occur when producing or consuming a good cause an impact on third parties(第三方)

private cost is the disadvantages to an individual or to a firm resulting from resulting from an economic activity

private benbfit is the advantages to an individual or to a firm resulting from resulting from an economic activity

externality:stuff that affects other people(对其他人的影响)

external cost(a negtive externality负向外部性)is negative impact on third parties resulting from an economic activity

external benefit(a positive externality正向外部性)is positive impact on third parties resulting from an economic activity

examples of a factory

private benefit:the revenue earned by the factory

private cost:the cost of capital, labour, rent and raw material

external benefit:jobs are created reducing unemployment

external cost:the noise, air and environment pollution

social cost is the cost of economic actovity to society as a whole

social benefit is the benefit of economic actovity to society as a whole

social cost = private cost + external cost

social benefit = private benefit + external benefit

If total social benefit>total social cost(economic use of resources)

economic welfare(福利)can be improved by encouraging more production and consumpation

If total social benefit<total social cost(uneconomic use of resources)

economic welfare can be improved by reducing production and consumpation

government policies to deal with externalities

taxation:Pollution may be reduced if a tax is imposed(征收)on firms producing harmful waste. This will raise costs, increasing prices and cut demand for their product

subsidies:Subsidies may be given to those that generate(产生)postive externalities. For example, grants may be to people who install solar panels generate clean electricity

fines(罚款):Financial penalties may be given to those who damage the envirnment. For example, there may be fines for firms that pollute atomosphere

government regulation(法律法规):The EU's Emissions Trading Directive limits the amount of carbon dioxide that firms can release into the atomsphere

other measures:There are congestion(堵车)charges and international agreements to reduse global pollution. Pollution permits gives firms legal right to pollute a certain amount. If firms produce less pollution, they can sell pollution permits to other firms.

government intervention to address market faliure

Maximum and minimum price in markets

maximum price is a price established in a market below the equlibrium price .Maximum price is often set for essential item(basic necessities) like food, rents and water

Minimum price is a price established in a market above the equlibrium price. Minimum price is often set for the harmful goods, like tobacco, alcohol and other demerit goods.

Indirect taxes(间接税收)

Indirect tax is a tax on expenditure. Examples include a sales tax, a good and services tax(GST) and value added tax(VAT).

The intermediary(中介), like a firm, collects the taxes on behalf of government

Producers will pass on some of tax to consumers in the form of higher price

结论:Indirect taxes falls mainly on the inelastic side

taxes for consumers is greater than producers'

taxes for producers is greater than consumer'

subsidy(补助,补贴)

definition:Subsidy is a payment made to by a government

subsidized in dustry

agriculture

education

housing(住房)

renewable energy

domestically-produced product(国产的)

purposes of subsidies

to keep down the cost of production

to encourage the production of essential products(necessity)

to encourage the development of new products and new industries

to provide support to industries that are in decline

to protect domestic industries from foreign competition

to provide support to industries that are major employers of labour

Why do governments subsidise the production of good and services?

1.Keep down the market prices of essential goods

Subsidies can be used make certain goods(necessities )affordable to low-income consumers.

2.Raise producers' income, especially in the case of farmers

Subsidies can be used too increase revenues(and hence incomes)of producers.

3.Encourage production & consumpation of merit goods

Subsidies can be used to encourage production of goods and services that are belived to be desirable for consumers.

4.Encourage exports by making exports more competitive than imports

Subsidies be used to encourage exports of particular goods since lower export prices increase the quanlity of exports.

5.Encourage production and consumption of goods with external benefits

Subsidies can be used to increase the production of goods with external benefits.

cost of production falls------for producers

price falls/quantity rises------for consumers

regulation(管制):regulation is a variety of laws and rules that firms must obey.

privatisation(私有化):privatisation is the process of transferring the ownership of enterprises the public sector to the private sector

nationalisation(国有化):nationalisation is the process of transforring the ownership of enterprises the private sector to public sector

direct provision:direct provision is a situation where a government decides to provide a particular good or service itself(eg:public/merit good)